Crypto

Bitcoin Songsheet: Fiat Politics Suck

Published

2 years agoon

This is an opinion editorial by Jimmy Song, a Bitcoin developer, educator and entrepreneur and programmer with over 20 years of experience.

Link to audio read of the article here.

I hate politics.

It’s a weird zero-sum status game of perception where the winners get to make the rules. Everything is judged on intentions and nothing on results. It offends me as an engineer because it’s really a way of saying that reality doesn’t matter and that majority opinion can trump facts. It’s a collective delusion about how important our opinions are. When discussing politics everyone is the smug, arrogant, smart aleck teen who thinks he knows everything.

What’s worse is the fakeness of it all and the faux-intellectual arguments that hold sway. What sounds good wins over reality and only the most sociopathic seem to be able to play the game well enough to win. Propaganda trumps reality and that attitude is infiltrating everything like sand after a beach outing.

Still worse is that politics is so much more consequential because of fiat money. Effective politics now has a prize of immense value in the ability to create money out of nothing. This game of posturing, perception and propaganda kills, steals and destroys. Politics is a zombie horde eating away at civilization and multiplying its destruction through creation of even more zombies.

What I hope to show in this article is just how terrible things have gotten and how nearly everything in our current society has turned political.

The Great Financialization

We’ve seen almost everything get financialized. Fiat education, fiat healthcare, fiat real estate, fiat companies, even fiat property are all infected with fiat money. You can tell these things are getting finacialized because there are lots of loans and insurance products around them. Student loans, mortgages, health insurance, corporate bonds, car loans, unemployment insurance and even life insurance are evidence of the financialization or government manipulation of each industry. Almost everything can be leveraged for quick consumption and degenerate gambling. It’s like we’re turning the world into Las Vegas.

Loans and insurance are the gears of the fiat monetary system. Loans create new money and insurance is an outlet for all the leverage from these loans. In various ways, they tax the strong, subsidize the weak, and protect the interests of the people in power. Each financialized industry adds yet more rent-seekers, as more people leverage their way into consumption rather than earning their way. In a financialized world, everyone becomes Wimpy from the Popeye cartoons, the guy that will “gladly pay you Tuesday for a hamburger today.”

Financialization is really the process of fiat money taking over. That is, it’s the subjection of an industry to the control of the government. And the companies go along with it because it’s much easier than actually innovating. Why strive when you don’t have to? Corporate welfare is not that different from normal welfare, just much more expensive. They both remove incentives to be productive or provide value. Every financialized industry slowly debases into DMV-like inefficiency as they grow fat on fiat subsidization.

Financialization has a bigger problem than just the non-productivity of the subsidized entities. The bigger problem is that they become endorsers of the state. Once you take the king’s coin, you become the king’s man.

Messing With The Market

The main effect of financialization is that it props up companies that would otherwise go bankrupt. By loaning companies money or their customers money to buy that industry’s products, the entire industry gets subsidized. These companies become like that guy that always seems to get into trouble and gets bailed out by family. Financialization incentivizes mediocrity.

In other words, merit takes a back seat whenever fiat money gets involved. Instead of market forces creating better goods and services, worse goods and services continue to be pushed onto the market, usually at cheaper prices to compensate for their lack of quality. This is the real reason subsidized industries produce inferior goods. Subsidization leads to debasement of goods and services. If you’re wondering why products and services have gotten much worse during the pandemic, there’s your answer; it’s inflation-subsidized mediocrity.

What takes the front seat instead are political considerations. Right now in the U.S., these considerations include how diverse the executive team is, how environmentally friendly the products are and how much they support the war in Ukraine. These political considerations are called “environmental, social, and corporate governance” (ESG) and they have nothing to do with profit and everything to do with perception and propaganda. The government gets to create its own sock puppets in industry to give themselves more power.

This is nothing new. In other political regimes, industries had to align with war efforts, racial segregation, ethnic cleansing and worse. The more authoritarian a government is, the more aligned you have to be, so Nazis and Communists demanded much more political compliance than, say the 19th century U.S. government. The politicization of industry is an indicator of how authoritarian the government is getting. The past two years have shown this with vaccine mandates, Black Lives Matter support and the Ukraine war support.

The main tool at play is money. Financialization guarantees alignment with the people in power. Entire industries get bought and enslaved by the money printer. Needless to say, this isn’t good for the people and they carry the heavy burden of supporting all this with the debasement of their savings.

The People In Power

The incentives of the people in power are horribly misaligned with what’s actually good for the people. Because elected officials are typically not around very long, they tend to have a very short-term focus. That is, they’re generally high time-preference and politics reflects that. Every elected official is like the many millions today living paycheck-to-paycheck, covering today’s bills only, with no regard for planning for tomorrow

I first started paying attention to U.S. presidential politics in 1988. Every single presidential election I’ve observed has been called “the most important election of our lifetime.” And it’s not just one side, it’s both sides and they encourage this sort of thinking. The people that win in politics have a higher time preference than the people who win the lottery.

How many political scandals last more than a week these days? What seems so important this week is forgotten three weeks later by almost everyone. The people in power have the attention span of squirrels. What matters to people in politics is now and there’s little concern for what will happen to civilization tomorrow.

Deference To Power

Yet despite this obvious lack of prudence or wisdom on the part of our leaders, there is a significant deference to their opinions. Unsurprisingly, this means most people become likewise very high time preference, or impulsive and imprudent. You wouldn’t normally trust an impulsive person to be the designated driver, for example, yet people defer to government leaders because of the significant power they hold. To disobey would mean getting canceled. Financialization has hit everyone and noncompliance means economic death.

In that sense, every CEO of a large company is really a political officer. They have the power to dispense favors because they have the newly printed money at their disposal through loans. It’s no wonder these positions have gotten so political. Currying favor with the money printers through marketing is much more important for a CEO now than actually making good products.

Instead of deferring to the market, companies defer to power. It’s no wonder so many industries have seen little-to-no innovation for decades. Noncompliance means economic death and subsidization means stagnation. Not a great environment to thrive as a business.

And guess who gets screwed? Instead of customers, the community or society at large being the beneficiaries of the company’s goods, we get the people in power getting all the benefits. CEOs, politicians and investment bankers get to advance their agenda at our cost.

Whatever Is Convenient For The Powerful

The powerful get what they want at the expense of everyone else. In a badly aligned system like politics, this typically means destruction of value. Rent-seekers will spend other people’s money for their own benefit without providing value to anyone. This often includes creating more rent-seeking positions! The zombie horde grows.

Instead of new innovations, regulations keep out any competition for current incumbents. Nuclear power hasn’t progressed since the 70s, and neither have airlines. Gee, I wonder what happened in 1971?

This is unfortunately the normal course of business as financialization has essentially put the power of money printing into the hands of the politically connected. Becoming friends with the politically connected pays better than creating a useful good or service. It’d be like selecting a quarterback based on who’s good friends with the team owner. It’s not going to lead to much progress or prosperity.

Bitcoin And Politics

If this whole thing so far sounds depressing, that’s because it is. There’s no question that the financialization has gotten worse, the subsidization more abundant, and politics more ubiquitous. Yet there’s one thing that we’ve seen going against the tide of all this destruction of value: Bitcoin.

We saw that Bitcoin was different five years ago during the Blocksize Wars. One side was a powerful group of well-connected CEOs who made a consensus among themselves about what Bitcoin should be. They wanted to define and control Bitcoin through changes in its protocol.

On the other side were the users. They are what would be considered irrelevant in politics. In the normal course of politics, these were at best people that could easily be manipulated by propaganda and at worst, people that could be canceled.

At this point, any outside observer would have predicted that the powerful companies would win. They were the better political players and knew how to take power in any governance structure. This was a professional football team going against the JV team of a local high school. One side seemed poised to easily get what they want and use politics to get it. Whether through regulation, subsidization or cancellation, the CEOs had tools to get what they want.

But something strange happened; the JV team started to win. And the reason was because there’s no central authority in Bitcoin. There wasn’t a group to bribe. There wasn’t any governance board to appeal to. They had to deal with the market, the people, the users. They couldn’t bypass them with some authority that could change the rules for them. We found out that they weren’t a professional football team as much as they had the refs in their pocket. Bitcoin created a fair match.

And the users, the people, or the market responded. They said no. And won.

Bitcoin Is Anti-Political

There were a lot of people that were betting on the side of the corporations and the powerful. These were seasoned pros when it came to propaganda and politics and surely, they would figure out a way to defeat some plebs on Twitter? Yet they couldn’t. The corporations couldn’t change Bitcoin because Bitcoin was different. The users got to decide what was and wasn’t Bitcoin. The playing field was frustratingly fair and level, much to the detriment of the people specializing in influencing the refs.

Bitcoiners not only resisted the protocol changes, but any attempts to represent them by proxy. Erik Voorhees famously claimed that they represented them because these users were these companies’ customers. The market spoke clearly and loudly in the futures markets that this was not the case. Despite all the money and resources clearly being on one side of the debate, the plebs won. The users had a voice, not through some intermediary or trusted third party, but directly, through the market. And they spoke. It turns out that we were the professional football team all along and they were the JV team that specialized in bribing refs. The plebs won and it wasn’t particularly close.

Bitcoin is anti-political. It resists political processes because changes require consensus. Even a small minority can resist changes to the rules. There’s no bribing the ref or the rules committee. Bitcoin took politics out of the equation.

Altcoins Are Political

Contrast this to altcoins and the difference couldn’t be more stark. Altcoins operate completely at a political level, controlling the perception of the public through massive propaganda campaigns. They are in the habit of subsidizing anything and everything that makes their coin look good while spreading FUD about anything that makes their coin look bad.

They defer completely to the people in power, like the creator or foundation. They bribe influencers and give them rent-seeking positions. They rob people blind while telling them it’s good for them.

If you doubt me, think through this thought experiment. Would an altcoin have been able to resist the SegWit2x agreement from five years ago? The answer is no. The people in charge of the altcoin would have decided and that would have been it. Indeed, SegWit2x-like agreements are happening all the time in Altcoinland. They are called hard forks and show how centralized and political these coins are.

Bitcoin Is Living The U.S. Constitution’s Ideal

Interestingly, consensus-driven decision making was the original design of the U.S. Constitution. It was supposed to be very difficult for any law to get passed and for a while, even one senator could derail it. That meant every change and every law had to take into consideration everyone that it would affect. If it didn’t satisfy all those people, then it wouldn’t get passed. Unfortunately, this changed as the checks and balances kept getting debased. Changes to the rules came easier and easier even as the economy stagnated.

Unlike the U.S. government, Bitcoin fulfills this idea that every person has a say. You can’t just take stuff away from someone without their consent. Cynically, you can say that politics is the agreement by the majority to take stuff from the minority. That’s simply not possible with Bitcoin. It’s for that reason that Bitcoin is anti-political.

If you hate politics, you’ll love Bitcoin. Happy Bitcoin Independence Day.

Twelve New Altcoins Coming Soon:

- WomanCoin – Coins for women only, with the board of governors that decide what a woman is, not you because you’re not a biologist.

- Diffirand – Founded by an academic that got tired of scamming a few undergrads and decided to scam the entire public instead.

- BitcoinNakamoto – A fork of Bitcoin for those that believe a16z should own Satoshi’s coins.

- BytePecunia – Privacy-focused coin that guarantees nothing, like say, supply, future governance or even privacy.

- Methamphetamine – A coin that keeps promising to change everything based on the fanciful ideas of its teenage founder, but fails to deliver because said teenage founder can’t code nor has any interest in doing so because of the premine.

- Trinium – Founded by some Asian guy to market to a billion Asians, but nobody in the West cares because it’s only Asians that are getting hurt.

- Catastrophe – Get 18% yield until the price doesn’t go up anymore at which point it’s a -100% yield, unless you’re one of the people at the top in which case you get a 20,000% yield.

- Cripple – A coin with a blockchain/database run on a piece of paper with pencil, to be better for the environment.

- Daschund – It’s got a cute logo and does nothing, but the hope is that a billionaire will someday jerk around the public with it.

- Salami – A token in a SQL database run by ex-Wall Street investment bankers to screw over the public even more.

- Sucker – Recruit 10 people to get rewarded with staking coins which can be redeemed in three years when the founder will be in prison!

- SeedOilSwap – A governance token for a platform that allows exchange of synthetic asset swaps that are enforced algorithmically through the drool coming out of your ape NFT.

This is a guest post by Jimmy Song. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Crypto

El Salvador Takes First Step To Issue Bitcoin Volcano Bonds

Published

2 years agoon

November 22, 2022

El Salvador’s Minister of the Economy Maria Luisa Hayem Brevé submitted a digital assets issuance bill to the country’s legislative assembly, paving the way for the launch of its bitcoin-backed “volcano” bonds.

First announced one year ago today, the pioneering initiative seeks to attract capital and investors to El Salvador. It was revealed at the time the plans to issue $1 billion in bonds on the Liquid Network, a federated Bitcoin sidechain, with the proceedings of the bonds being split between a $500 million direct allocation to bitcoin and an investment of the same amount in building out energy and bitcoin mining infrastructure in the region.

A sidechain is an independent blockchain that runs parallel to another blockchain, allowing for tokens from that blockchain to be used securely in the sidechain while abiding by a different set of rules, performance requirements, and security mechanisms. Liquid is a sidechain of Bitcoin that allows bitcoin to flow between the Liquid and Bitcoin networks with a two-way peg. A representation of bitcoin used in the Liquid network is referred to as L-BTC. Its verifiably equivalent amount of BTC is managed and secured by the network’s members, called functionaries.

“Digital securities law will enable El Salvador to be the financial center of central and south America,” wrote Paolo Ardoino, CTO of cryptocurrency exchange Bitfinex, on Twitter.

Bitfinex is set to be granted a license in order to be able to process and list the bond issuance in El Salvador.

The bonds will pay a 6.5% yield and enable fast-tracked citizenship for investors. The government will share half the additional gains with investors as a Bitcoin Dividend once the original $500 million has been monetized. These dividends will be dispersed annually using Blockstream’s asset management platform.

The act of submitting the bill, which was hinted at earlier this year, kickstarts the first major milestone before the bonds can see the light of day. The next is getting it approved, which is expected to happen before Christmas, a source close to President Nayib Bukele told Bitcoin Magazine. The bill was submitted on November 17 and presented to the country’s Congress today. It is embedded in full below.

Crypto

How I’ll Talk To Family Members About Bitcoin This Thanksgiving

Published

2 years agoon

November 22, 2022

This is an opinion editorial by Joakim Book, a Research Fellow at the American Institute for Economic Research, contributor and copy editor for Bitcoin Magazine and a writer on all things money and financial history.

I don’t.

That’s it. That’s the article.

In all sincerity, that is the full message: Just don’t do it. It’s not worth it.

You’re not an excited teenager anymore, in desperate need of bragging credits or trying out your newfound wisdom. You’re not a preaching priestess with lost souls to save right before some imminent arrival of the day of reckoning. We have time.

Instead: just leave people alone. Seriously. They came to Thanksgiving dinner to relax and rejoice with family, laugh, tell stories and zone out for a day — not to be ambushed with what to them will sound like a deranged rant in some obscure topic they couldn’t care less about. Even if it’s the monetary system, which nobody understands anyway.

Get real.

If you’re not convinced of this Dale Carnegie-esque social approach, and you still naively think that your meager words in between bites can change anybody’s view on anything, here are some more serious reasons for why you don’t talk to friends and family about Bitcoin the protocol — but most certainly not bitcoin, the asset:

- Your family and friends don’t want to hear it. Move on.

- For op-sec reasons, you don’t want to draw unnecessary attention to the fact that you probably have a decent bitcoin stack. Hopefully, family and close friends should be safe enough to confide in, but people talk and that gossip can only hurt you.

- People find bitcoin interesting only when they’re ready to; everyone gets the price they deserve. Like Gigi says in “21 Lessons:”

“Bitcoin will be understood by you as soon as you are ready, and I also believe that the first fractions of a bitcoin will find you as soon as you are ready to receive them. In essence, everyone will get ₿itcoin at exactly the right time.”

It’s highly unlikely that your uncle or mother-in-law just happens to be at that stage, just when you’re about to sit down for dinner.

- Unless you can claim youth, old age or extreme poverty, there are very few people who genuinely haven’t heard of bitcoin. That means your evangelizing wouldn’t be preaching to lost, ignorant souls ready to be saved but the tired, huddled and jaded masses who could care less about the discovery that will change their societies more than the internal combustion engine, internet and Big Government combined. Big deal.

- What is the case, however, is that everyone in your prospective audience has already had a couple of touchpoints and rejected bitcoin for this or that standard FUD. It’s a scam; seems weird; it’s dead; let’s trust the central bankers, who have our best interest at heart.

No amount of FUD busting changes that impression, because nobody holds uninformed and fringe convictions for rational reasons, reasons that can be flipped by your enthusiastic arguments in-between wiping off cranberry sauce and grabbing another turkey slice. - It really is bad form to talk about money — and bitcoin is the best money there is. Be classy.

Now, I’m not saying to never ever talk about Bitcoin. We love to talk Bitcoin — that’s why we go to meetups, join Twitter Spaces, write, code, run nodes, listen to podcasts, attend conferences. People there get something about this monetary rebellion and have opted in to be part of it. Your unsuspecting family members have not; ambushing them with the wonders of multisig, the magically fast Lightning transactions or how they too really need to get on this hype train, like, yesterday, is unlikely to go down well.

However, if in the post-dinner lull on the porch someone comes to you one-on-one, whisky in hand and of an inquisitive mind, that’s a very different story. That’s personal rather than public, and it’s without the time constraints that so usually trouble us. It involves clarifying questions or doubts for somebody who is both expressively curious about the topic and available for the talk. That’s rare — cherish it, and nurture it.

Last year I wrote something about the proper role of political conversations in social settings. Since November was also election month, it’s appropriate to cite here:

“Politics, I’m starting to believe, best belongs in the closet — rebranded and brought out for the specific occasion. Or perhaps the bedroom, with those you most trust, love, and respect. Not in public, not with strangers, not with friends, and most certainly not with other people in your community. Purge it from your being as much as you possibly could, and refuse to let political issues invade the areas of our lives that we cherish; politics and political disagreements don’t belong there, and our lives are too important to let them be ruled by (mostly contrived) political disagreements.”

If anything, those words seem more true today than they even did then. And I posit to you that the same applies for bitcoin.

Everyone has some sort of impression or opinion of bitcoin — and most of them are plain wrong. But there’s nothing people love more than a savior in white armor, riding in to dispel their errors about some thing they are freshly out of fucks for. Just like politics, nobody really cares.

Leave them alone. They will find bitcoin in their own time, just like all of us did.

This is a guest post by Joakim Book. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

This is an opinion editorial by Federico Tenga, a long time contributor to Bitcoin projects with experience as start-up founder, consultant and educator.

The term “smart contracts” predates the invention of the blockchain and Bitcoin itself. Its first mention is in a 1994 article by Nick Szabo, who defined smart contracts as a “computerized transaction protocol that executes the terms of a contract.” While by this definition Bitcoin, thanks to its scripting language, supported smart contracts from the very first block, the term was popularized only later by Ethereum promoters, who twisted the original definition as “code that is redundantly executed by all nodes in a global consensus network”

While delegating code execution to a global consensus network has advantages (e.g. it is easy to deploy unowed contracts, such as the popularly automated market makers), this design has one major flaw: lack of scalability (and privacy). If every node in a network must redundantly run the same code, the amount of code that can actually be executed without excessively increasing the cost of running a node (and thus preserving decentralization) remains scarce, meaning that only a small number of contracts can be executed.

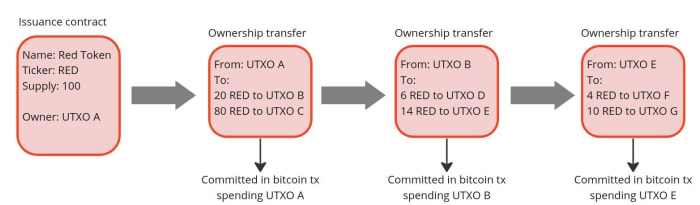

But what if we could design a system where the terms of the contract are executed and validated only by the parties involved, rather than by all members of the network? Let us imagine the example of a company that wants to issue shares. Instead of publishing the issuance contract publicly on a global ledger and using that ledger to track all future transfers of ownership, it could simply issue the shares privately and pass to the buyers the right to further transfer them. Then, the right to transfer ownership can be passed on to each new owner as if it were an amendment to the original issuance contract. In this way, each owner can independently verify that the shares he or she received are genuine by reading the original contract and validating that all the history of amendments that moved the shares conform to the rules set forth in the original contract.

This is actually nothing new, it is indeed the same mechanism that was used to transfer property before public registers became popular. In the U.K., for example, it was not compulsory to register a property when its ownership was transferred until the ‘90s. This means that still today over 15% of land in England and Wales is unregistered. If you are buying an unregistered property, instead of checking on a registry if the seller is the true owner, you would have to verify an unbroken chain of ownership going back at least 15 years (a period considered long enough to assume that the seller has sufficient title to the property). In doing so, you must ensure that any transfer of ownership has been carried out correctly and that any mortgages used for previous transactions have been paid off in full. This model has the advantage of improved privacy over ownership, and you do not have to rely on the maintainer of the public land register. On the other hand, it makes the verification of the seller’s ownership much more complicated for the buyer.

Source: Title deed of unregistered real estate propriety

How can the transfer of unregistered properties be improved? First of all, by making it a digitized process. If there is code that can be run by a computer to verify that all the history of ownership transfers is in compliance with the original contract rules, buying and selling becomes much faster and cheaper.

Secondly, to avoid the risk of the seller double-spending their asset, a system of proof of publication must be implemented. For example, we could implement a rule that every transfer of ownership must be committed on a predefined spot of a well-known newspaper (e.g. put the hash of the transfer of ownership in the upper-right corner of the first page of the New York Times). Since you cannot place the hash of a transfer in the same place twice, this prevents double-spending attempts. However, using a famous newspaper for this purpose has some disadvantages:

- You have to buy a lot of newspapers for the verification process. Not very practical.

- Each contract needs its own space in the newspaper. Not very scalable.

- The newspaper editor can easily censor or, even worse, simulate double-spending by putting a random hash in your slot, making any potential buyer of your asset think it has been sold before, and discouraging them from buying it. Not very trustless.

For these reasons, a better place to post proof of ownership transfers needs to be found. And what better option than the Bitcoin blockchain, an already established trusted public ledger with strong incentives to keep it censorship-resistant and decentralized?

If we use Bitcoin, we should not specify a fixed place in the block where the commitment to transfer ownership must occur (e.g. in the first transaction) because, just like with the editor of the New York Times, the miner could mess with it. A better approach is to place the commitment in a predefined Bitcoin transaction, more specifically in a transaction that originates from an unspent transaction output (UTXO) to which the ownership of the asset to be issued is linked. The link between an asset and a bitcoin UTXO can occur either in the contract that issues the asset or in a subsequent transfer of ownership, each time making the target UTXO the controller of the transferred asset. In this way, we have clearly defined where the obligation to transfer ownership should be (i.e in the Bitcoin transaction originating from a particular UTXO). Anyone running a Bitcoin node can independently verify the commitments and neither the miners nor any other entity are able to censor or interfere with the asset transfer in any way.

Since on the Bitcoin blockchain we only publish a commitment of an ownership transfer, not the content of the transfer itself, the seller needs a dedicated communication channel to provide the buyer with all the proofs that the ownership transfer is valid. This could be done in a number of ways, potentially even by printing out the proofs and shipping them with a carrier pigeon, which, while a bit impractical, would still do the job. But the best option to avoid the censorship and privacy violations is establish a direct peer-to-peer encrypted communication, which compared to the pigeons also has the advantage of being easy to integrate with a software to verify the proofs received from the counterparty.

This model just described for client-side validated contracts and ownership transfers is exactly what has been implemented with the RGB protocol. With RGB, it is possible to create a contract that defines rights, assigns them to one or more existing bitcoin UTXO and specifies how their ownership can be transferred. The contract can be created starting from a template, called a “schema,” in which the creator of the contract only adjusts the parameters and ownership rights, as is done with traditional legal contracts. Currently, there are two types of schemas in RGB: one for issuing fungible tokens (RGB20) and a second for issuing collectibles (RGB21), but in the future, more schemas can be developed by anyone in a permissionless fashion without requiring changes at the protocol level.

To use a more practical example, an issuer of fungible assets (e.g. company shares, stablecoins, etc.) can use the RGB20 schema template and create a contract defining how many tokens it will issue, the name of the asset and some additional metadata associated with it. It can then define which bitcoin UTXO has the right to transfer ownership of the created tokens and assign other rights to other UTXOs, such as the right to make a secondary issuance or to renominate the asset. Each client receiving tokens created by this contract will be able to verify the content of the Genesis contract and validate that any transfer of ownership in the history of the token received has complied with the rules set out therein.

So what can we do with RGB in practice today? First and foremost, it enables the issuance and the transfer of tokenized assets with better scalability and privacy compared to any existing alternative. On the privacy side, RGB benefits from the fact that all transfer-related data is kept client-side, so a blockchain observer cannot extract any information about the user’s financial activities (it is not even possible to distinguish a bitcoin transaction containing an RGB commitment from a regular one), moreover, the receiver shares with the sender only blinded UTXO (i. e. the hash of the concatenation between the UTXO in which she wish to receive the assets and a random number) instead of the UTXO itself, so it is not possible for the payer to monitor future activities of the receiver. To further increase the privacy of users, RGB also adopts the bulletproof cryptographic mechanism to hide the amounts in the history of asset transfers, so that even future owners of assets have an obfuscated view of the financial behavior of previous holders.

In terms of scalability, RGB offers some advantages as well. First of all, most of the data is kept off-chain, as the blockchain is only used as a commitment layer, reducing the fees that need to be paid and meaning that each client only validates the transfers it is interested in instead of all the activity of a global network. Since an RGB transfer still requires a Bitcoin transaction, the fee saving may seem minimal, but when you start introducing transaction batching they can quickly become massive. Indeed, it is possible to transfer all the tokens (or, more generally, “rights”) associated with a UTXO towards an arbitrary amount of recipients with a single commitment in a single bitcoin transaction. Let’s assume you are a service provider making payouts to several users at once. With RGB, you can commit in a single Bitcoin transaction thousands of transfers to thousands of users requesting different types of assets, making the marginal cost of each single payout absolutely negligible.

Another fee-saving mechanism for issuers of low value assets is that in RGB the issuance of an asset does not require paying fees. This happens because the creation of an issuance contract does not need to be committed on the blockchain. A contract simply defines to which already existing UTXO the newly issued assets will be allocated to. So if you are an artist interested in creating collectible tokens, you can issue as many as you want for free and then only pay the bitcoin transaction fee when a buyer shows up and requests the token to be assigned to their UTXO.

Furthermore, because RGB is built on top of bitcoin transactions, it is also compatible with the Lightning Network. While it is not yet implemented at the time of writing, it will be possible to create asset-specific Lightning channels and route payments through them, similar to how it works with normal Lightning transactions.

Conclusion

RGB is a groundbreaking innovation that opens up to new use cases using a completely new paradigm, but which tools are available to use it? If you want to experiment with the core of the technology itself, you should directly try out the RGB node. If you want to build applications on top of RGB without having to deep dive into the complexity of the protocol, you can use the rgb-lib library, which provides a simple interface for developers. If you just want to try to issue and transfer assets, you can play with Iris Wallet for Android, whose code is also open source on GitHub. If you just want to learn more about RGB you can check out this list of resources.

This is a guest post by Federico Tenga. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.