Crypto

Bitcoiners Are Not Utopians

Published

2 years agoon

This is an opinion editorial by Aleks Svetski, author of “The UnCommunist Manifesto,” founder of The Bitcoin Times and Host of the “Wake Up Podcast with Svetski.”

It’s not just about freedom. It’s about Responsibility.

Bitcoin is RgU Tech, or in other words, “Responsibility go Up” technology.

To be a Bitcoiner is to be an individual who can balance freedom and responsibility, rooted in a line of consistent and congruent values that are as closely representative of natural law as possible.

This idea that Bitcoin is some magical panacea to all the ailments of the world or that it is some sort of utopian ideal is completely false.

Utopianism is a statist or collectivist ideal in which people are arrogant enough to believe the definition of perfection (a) exists, and (b) can be applied across all of society and its individual participants as if they’re just numbers on a spreadsheet, i.e., they completely ignore the differences and nuances present in all humans.

Bitcoiners, at least those worth their salt, abhor this notion of a utopia.

True Bitcoiners are realists, and I hope this short first-principles primer on their values and the concept of structuring society around responsible individuals will set the record straight.

I will draw upon an interaction on Twitter with someone in 2020 who asked some questions that I’m sure many others have too.

Let’s start with this comment about masks.

Unfortunately, our friend here is a bit confused about how Western societies work.

What actually propelled Western society was the idea that the individual is sovereign and responsible enough to make a choice on their own behalf, because he was most able to know what was best for him.

This is actually echoed in Eastern teachings such as the Tao Te Ching by Lao Tzu, which was unfortunately forced out of and censored in China thanks in large part to the more collectivist and power-oriented philosophy of the confucianists.

Gru is right in one sense: this is no longer how “Western society” works, which is a big part of why it is decaying. In fact, this decay is rooted in the rapid rise — particularly over the past 200 years — of collectivism in the form of the “public” society, alongside the erosion of private property and the individual.

What we’re seeing around the world now is the peak of this stupid experiment, where:

- Imaginary “groups” take precedence over the real individual.

- Rights and entitlements proliferate.

- Responsibilities are shrugged off or ignored.

- Socially constructed ideologies supersede biological or evolutionary facts.

So yeah, he may be right that it’s not how Western society works any longer, but it for damn sure deviates from the original premise.

Next …

I disagree with this notion of it being a theoretical idea incompatible with reality.

It’s actually the idea that’s most compatible with reality, and without it America would not have gone from a newly colonized land to the center of innovation and subsequently the greatest economic power in the world within a century — and long before the statists or federalists took over.

What made America great was the lack of central government, the frontiersman’s spirit and the laissez-faire market in which innovation, great ideas and technology drove progress forward.

The original libertarian ideas of America can still be found in the American Constitution, and the inertia they gave that part of the world has continued to give it an edge, despite all the damage done by the “democratic republic” and the collectivists over the past 200 years.

Why we deviated from that is a topic of a much larger discussion, which people like Hans-Hermann Hoppe, Murray Rothbard, Ayn Rand or William Davidson and James Dale Rees-Mogg discuss in their books.

The short version in my limited space here is that the advent of industrial technology and advantages of centralization at scale ensured the public apparatus known as “the state” was the most effective way of seizing and accruing power, especially with the threat of mass violence.

The most violent leaders were able to form monopolies, “voted in by the people,” and ever since, humanity has been living through a strange and evolutionarily deviant experiment where all systems, processes, natural environments, lifestyles, diets, information and opinions are being homogenized, standardized, sterilized and made as devoid of any variance as possible in order to cater to the lowest common denominator of bipedal humanoid.

The goal is sameness, so they’ve made everything fluid, relative and mutable. In this way, everything becomes meaningless, because when something is everything, it is nothing.

But alas (at least for the collectivists), nature is far older than humans, and life far too complex for our tiny minds to comprehend, so all of this centralization and globalization will only lead to an unraveling in the opposite direction.

Why?

Because life is messy. If you remove mess, you remove life. Trying to ignore entropy by creating and forcing everyone to live by an unadaptable utopian code will always fail. It’s impossible to fight entropy, you can only dance with it. It’s impossible to manage or predict complexity, you can only work with it. It’s impossible to fight reality, you must recognize it and live with it.

Moving on.

I don’t know about you, but voluntary means that you can choose to do so, or not to do so; It’s not a one-way function, so this statement is false.

Despite some paying taxes because they think it’s a good idea (not sure what drugs they’re on), it’s by definition not a voluntary act. Stop paying taxes and see what happens.

People who support taxation do so by virtue of the implicit threat and their conditioning. They must thus rationalize it in order to retain some semblance of sanity. The above is such an example.

At this point, I actually jumped into the Twitter exchange.

My reply is below, but I have added to it so it’s a little more well explained than a few tweets:

“Yes but libertarianism is not about a utopia. It’s about being realistic and knowing that violence exists and that the person who knows best for you is you, not some faceless, nameless, soulless “state” that thinks it can apply blanket rules to everyone as if they’re numbers on a spreadsheet.”

That’s not how reality works. Democracy is an experiment that’s going very wrong. It erodes personal agency over time and transforms people into blind drones who believe that some omnipresent authority knows how to best allocate resources on their and everyone else’s behalf, and what rules (i.e., laws) should blanket-apply to everybody regardless of their individual differences and preferences.

This is preposterous. There is no “one rule” for everyone. You can’t assume a few people know what’s best for everyone and that they know how to efficiently run everything. This is naive to think and is further invalidated when you inquire into how this idea can be effectively or practically implemented across large populations.

That’s why this shit doesn’t work.

Libertarianism is not a utopia, and Bitcoiners who get it don’t believe this in the slightest. They suggest that you should take care of your own stuff first, become the best version of yourself, and then come together with others who share similar values and build from there.

It all starts with taking personal responsibility for your decisions and actions, and with bitcoin being money that maps onto reality in a way that has no “rewind button,” the best course of action is the responsible one. This is therefore the basis upon which we can build a more voluntary, functional and robust “society.”

This is effectively how we evolved long before the advent of the modern “state.”

We continue …

To which I answered:

“Of course!

But there are dumb people all over the place that buy into ideas without understanding them deeply.” That’s a given. The natural corrective mechanism in life for poor judgment and understanding is generally poor results (notwithstanding the existence of the fools of randomness who got lucky).

The core values of Bitcoin not only suggest but by virtue of the chain’s immutability simply enforce that mechanism instead of passing the cost of someone’s poor judgment to everyone else in society that someone should bear themselves. And with Bitcoin, they must. Sure, someone else can choose to help them, voluntarily speaking, or they may attempt to “force” someone to give them alms, but neither of these acts are systemic forms of theft and socialization — as we have with democracy or the modern state.

This is the only way the individuals in a society can correct course and improve. The alternative is to continue eroding personal agency and the individual’s capacity to act or think for themselves.

This is the path to dependency and the welfare or communist state, where the incentive to be a productive member of society continues to diminish, while the expectation that someone else will give you something for nothing — because of your “needs” — continues to increase.

Again — this sort of society fails, and luckily (for us at least) we’ve had a chance to see evidence of this hundreds of times this century. Although unlucky for us, the morons in charge seem to think that they can run the same playbook with a different result. Madness.

In any case, this individual then sent me a strange reply:

I don’t know how he got there, but I tried to clarify:

Consequences are the natural corrective mechanism of life!

And because the individual is the atomic (and only real) constituent of a society, they cannot correct themselves if they are ignorant to the consequences of their actions, or if those consequences are borne by another individual or group.

I cannot go to the gym for you, nor should I die if you jump off a cliff!

There is no immunity to consequences in the real world!

Every action has a reaction and the only thing one can do is push the consequences of an action onto another.

Democracy is the most adept form of government in which the consequences of the actions of others are shared with everyone else.

This is a clusterfuck. If I have learned not to put my hand in the fire, or jump off a bridge, or step in front of a bus, why should I have to perpetually experience the partial consequences of others’ poor decision-making for the rest of my life?

It makes absolutely no sense. But this is what happens when the individual is disregarded and replaced with an imaginary collective.

The last comment which is relevant to this piece, and my answer to it, which I hope helps put Bitcoiner values into better context follows:

The idea that we invariably end up “where we are now” is patently false.

I replied with the following, which I’ll extrapolate on briefly below:

“The current incarnation of the ‘nation state’ is a modern experiment. The idea of public property managed by elected officials with NO skin in the game is a modern concoction and will tear itself apart because it is UNLIKE anything else in the natural world.

It worked as a method of gaining power over the last 2 centuries because of the advantages of scale and mass, in particular with respect to violence. That advantage is no longer as strong as it was, and will keep deteriorating as tech and sound money fragment centralized power.”

People who think the status quo is the “way it’s always been” or “way it will always be” generally have a time horizon that’s too short.

Centralized, homogenized and conformist institutions always fail. The speed is simply related to their degree of centralization and scale. The larger they are, the more fragile and unable to adapt to change (i.e., real world/real life) they become.

This is an axiomatic fact.

What becomes too large and centralized will tomorrow fracture and become smaller and decentralized.

In fact, small and decentralized is actually how nature has survived, evolved and adapted over billions of years. We humans just seem to be arrogant enough to think that we are separate from nature and can bend reality to our will without experiencing the consequences on the back end.

I proceeded to explain that this version of the statist experiment is only 200 years old and already falling apart. Compare that to a roughly 150,000-year timeline of Homo sapiens’ existence and you realize it is but a minor deviation.

In fact, so too is the 150,000-year history of Homo sapiens on the multiple million-year evolutionary progression that the primate has been in existence and experimenting with models and systems of social interaction.

Nature has tried much more than bureaucrats have!

For example, we know enough now and can state as a biological fact that “social order” is only found in primate groups via tyranny or territory.

And therein lies the basis of private property as a biological imperative — not a man-made social construct.

I am currently writing a much longer piece on this, but the fact of the matter is territory (private property) is nature’s balancing mechanism and is found not only among primates, but among all species who exhibit any form of social cohesion.

If it’s not territory, it’s tyranny (example: baboons).

Humans are a territorial species with natural instincts and inclinations that have evolved over hundreds of millions if not billions of years (depending how far back we want to assume our evolution started).

We managed to survive because we evolved alongside this territorial imperative, and developed more complex methods of implementing it into the societies we formed over time. We find balance and build functional hierarchies around territory in the form of private property. We do the opposite when we ignore this.

We are today, once again, experimenting with tyranny as a model for social cohesion. I suspect that once again, it’s not going to end well, not just because it’s antithetical to a “good life” but because it falls apart at scale.

In Closing

If you lengthen your time horizon, and observe the consequential nature of reality, you will come to realize that the “libertarian way” — or more aptly: “The Bushido of Bitcoin” — is actually the only practical way for human beings to organize themselves because it most resembles natural order and the careful blend of freedom and responsibility.

It is the least utopian vision because it assumes that there are morons and aggressors out there from whom you will need to protect yourself (i.e., those who want to transgress or trespass on your territory), and that it actually includes not just random thugs, but organized institutions of thuggery. As a result you are first and foremost responsible to deal with this.

In stark contrast, the idea of a democratic nation-state suggests you trust the bureaucrats, pass all agency along to them, own nothing, have no property and be obedient. It is not only ethically and morally wrong, but it is a biological aberration.

Libertarians And Bitcoiners

There’s a famous meme (below) that this is what libertarians want. And that’s fine, although the older I’ve become, the more I realize that these decisions have consequences.

The differentiator with Bitcoin is that there are consequencential feedback loops that no one can escape. Turn your brain into mush with a little too much weed, and you may just make decisions that lead to your impoverishment.

Other than that, libertarianism or anarchy is as close to compatible with Bitcoin as just about any ideology can be. In fact, Bitcoin makes these responsibility-centric modes of governance possible.

Without money outside the reach of any institution, the tendency to socialize poor decision-making, redistribute to the needy and bail out the idiots will always exist.

A Final Note On Utopias:

They always turn into dystopias.

The collectivists, statists and pro-democracy mafias that believe in imaginary utopian ideals are those who wind up forcing them on others. This tyranny has many faces, historic and current.

Reject these fantasies.

To be a Bitcoiner is not about utopianism. It is about contending with reality and pursuing a greater quality of problem. This is how we mature as a species.

Bitcoin is not just about freedom. It is about bearing the responsibility of existence. To play, you must pay the price that the territory (reality) demands.

This is a guest post by Aleks Svetski, author of “The UnCommunist Manifesto,” founder of The Bitcoin Times and Host of The Wake Up Podcast. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Crypto

El Salvador Takes First Step To Issue Bitcoin Volcano Bonds

Published

2 years agoon

November 22, 2022

El Salvador’s Minister of the Economy Maria Luisa Hayem Brevé submitted a digital assets issuance bill to the country’s legislative assembly, paving the way for the launch of its bitcoin-backed “volcano” bonds.

First announced one year ago today, the pioneering initiative seeks to attract capital and investors to El Salvador. It was revealed at the time the plans to issue $1 billion in bonds on the Liquid Network, a federated Bitcoin sidechain, with the proceedings of the bonds being split between a $500 million direct allocation to bitcoin and an investment of the same amount in building out energy and bitcoin mining infrastructure in the region.

A sidechain is an independent blockchain that runs parallel to another blockchain, allowing for tokens from that blockchain to be used securely in the sidechain while abiding by a different set of rules, performance requirements, and security mechanisms. Liquid is a sidechain of Bitcoin that allows bitcoin to flow between the Liquid and Bitcoin networks with a two-way peg. A representation of bitcoin used in the Liquid network is referred to as L-BTC. Its verifiably equivalent amount of BTC is managed and secured by the network’s members, called functionaries.

“Digital securities law will enable El Salvador to be the financial center of central and south America,” wrote Paolo Ardoino, CTO of cryptocurrency exchange Bitfinex, on Twitter.

Bitfinex is set to be granted a license in order to be able to process and list the bond issuance in El Salvador.

The bonds will pay a 6.5% yield and enable fast-tracked citizenship for investors. The government will share half the additional gains with investors as a Bitcoin Dividend once the original $500 million has been monetized. These dividends will be dispersed annually using Blockstream’s asset management platform.

The act of submitting the bill, which was hinted at earlier this year, kickstarts the first major milestone before the bonds can see the light of day. The next is getting it approved, which is expected to happen before Christmas, a source close to President Nayib Bukele told Bitcoin Magazine. The bill was submitted on November 17 and presented to the country’s Congress today. It is embedded in full below.

Crypto

How I’ll Talk To Family Members About Bitcoin This Thanksgiving

Published

2 years agoon

November 22, 2022

This is an opinion editorial by Joakim Book, a Research Fellow at the American Institute for Economic Research, contributor and copy editor for Bitcoin Magazine and a writer on all things money and financial history.

I don’t.

That’s it. That’s the article.

In all sincerity, that is the full message: Just don’t do it. It’s not worth it.

You’re not an excited teenager anymore, in desperate need of bragging credits or trying out your newfound wisdom. You’re not a preaching priestess with lost souls to save right before some imminent arrival of the day of reckoning. We have time.

Instead: just leave people alone. Seriously. They came to Thanksgiving dinner to relax and rejoice with family, laugh, tell stories and zone out for a day — not to be ambushed with what to them will sound like a deranged rant in some obscure topic they couldn’t care less about. Even if it’s the monetary system, which nobody understands anyway.

Get real.

If you’re not convinced of this Dale Carnegie-esque social approach, and you still naively think that your meager words in between bites can change anybody’s view on anything, here are some more serious reasons for why you don’t talk to friends and family about Bitcoin the protocol — but most certainly not bitcoin, the asset:

- Your family and friends don’t want to hear it. Move on.

- For op-sec reasons, you don’t want to draw unnecessary attention to the fact that you probably have a decent bitcoin stack. Hopefully, family and close friends should be safe enough to confide in, but people talk and that gossip can only hurt you.

- People find bitcoin interesting only when they’re ready to; everyone gets the price they deserve. Like Gigi says in “21 Lessons:”

“Bitcoin will be understood by you as soon as you are ready, and I also believe that the first fractions of a bitcoin will find you as soon as you are ready to receive them. In essence, everyone will get ₿itcoin at exactly the right time.”

It’s highly unlikely that your uncle or mother-in-law just happens to be at that stage, just when you’re about to sit down for dinner.

- Unless you can claim youth, old age or extreme poverty, there are very few people who genuinely haven’t heard of bitcoin. That means your evangelizing wouldn’t be preaching to lost, ignorant souls ready to be saved but the tired, huddled and jaded masses who could care less about the discovery that will change their societies more than the internal combustion engine, internet and Big Government combined. Big deal.

- What is the case, however, is that everyone in your prospective audience has already had a couple of touchpoints and rejected bitcoin for this or that standard FUD. It’s a scam; seems weird; it’s dead; let’s trust the central bankers, who have our best interest at heart.

No amount of FUD busting changes that impression, because nobody holds uninformed and fringe convictions for rational reasons, reasons that can be flipped by your enthusiastic arguments in-between wiping off cranberry sauce and grabbing another turkey slice. - It really is bad form to talk about money — and bitcoin is the best money there is. Be classy.

Now, I’m not saying to never ever talk about Bitcoin. We love to talk Bitcoin — that’s why we go to meetups, join Twitter Spaces, write, code, run nodes, listen to podcasts, attend conferences. People there get something about this monetary rebellion and have opted in to be part of it. Your unsuspecting family members have not; ambushing them with the wonders of multisig, the magically fast Lightning transactions or how they too really need to get on this hype train, like, yesterday, is unlikely to go down well.

However, if in the post-dinner lull on the porch someone comes to you one-on-one, whisky in hand and of an inquisitive mind, that’s a very different story. That’s personal rather than public, and it’s without the time constraints that so usually trouble us. It involves clarifying questions or doubts for somebody who is both expressively curious about the topic and available for the talk. That’s rare — cherish it, and nurture it.

Last year I wrote something about the proper role of political conversations in social settings. Since November was also election month, it’s appropriate to cite here:

“Politics, I’m starting to believe, best belongs in the closet — rebranded and brought out for the specific occasion. Or perhaps the bedroom, with those you most trust, love, and respect. Not in public, not with strangers, not with friends, and most certainly not with other people in your community. Purge it from your being as much as you possibly could, and refuse to let political issues invade the areas of our lives that we cherish; politics and political disagreements don’t belong there, and our lives are too important to let them be ruled by (mostly contrived) political disagreements.”

If anything, those words seem more true today than they even did then. And I posit to you that the same applies for bitcoin.

Everyone has some sort of impression or opinion of bitcoin — and most of them are plain wrong. But there’s nothing people love more than a savior in white armor, riding in to dispel their errors about some thing they are freshly out of fucks for. Just like politics, nobody really cares.

Leave them alone. They will find bitcoin in their own time, just like all of us did.

This is a guest post by Joakim Book. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

This is an opinion editorial by Federico Tenga, a long time contributor to Bitcoin projects with experience as start-up founder, consultant and educator.

The term “smart contracts” predates the invention of the blockchain and Bitcoin itself. Its first mention is in a 1994 article by Nick Szabo, who defined smart contracts as a “computerized transaction protocol that executes the terms of a contract.” While by this definition Bitcoin, thanks to its scripting language, supported smart contracts from the very first block, the term was popularized only later by Ethereum promoters, who twisted the original definition as “code that is redundantly executed by all nodes in a global consensus network”

While delegating code execution to a global consensus network has advantages (e.g. it is easy to deploy unowed contracts, such as the popularly automated market makers), this design has one major flaw: lack of scalability (and privacy). If every node in a network must redundantly run the same code, the amount of code that can actually be executed without excessively increasing the cost of running a node (and thus preserving decentralization) remains scarce, meaning that only a small number of contracts can be executed.

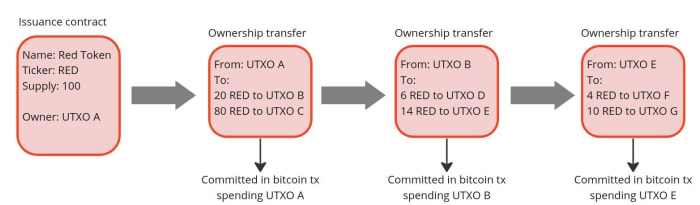

But what if we could design a system where the terms of the contract are executed and validated only by the parties involved, rather than by all members of the network? Let us imagine the example of a company that wants to issue shares. Instead of publishing the issuance contract publicly on a global ledger and using that ledger to track all future transfers of ownership, it could simply issue the shares privately and pass to the buyers the right to further transfer them. Then, the right to transfer ownership can be passed on to each new owner as if it were an amendment to the original issuance contract. In this way, each owner can independently verify that the shares he or she received are genuine by reading the original contract and validating that all the history of amendments that moved the shares conform to the rules set forth in the original contract.

This is actually nothing new, it is indeed the same mechanism that was used to transfer property before public registers became popular. In the U.K., for example, it was not compulsory to register a property when its ownership was transferred until the ‘90s. This means that still today over 15% of land in England and Wales is unregistered. If you are buying an unregistered property, instead of checking on a registry if the seller is the true owner, you would have to verify an unbroken chain of ownership going back at least 15 years (a period considered long enough to assume that the seller has sufficient title to the property). In doing so, you must ensure that any transfer of ownership has been carried out correctly and that any mortgages used for previous transactions have been paid off in full. This model has the advantage of improved privacy over ownership, and you do not have to rely on the maintainer of the public land register. On the other hand, it makes the verification of the seller’s ownership much more complicated for the buyer.

Source: Title deed of unregistered real estate propriety

How can the transfer of unregistered properties be improved? First of all, by making it a digitized process. If there is code that can be run by a computer to verify that all the history of ownership transfers is in compliance with the original contract rules, buying and selling becomes much faster and cheaper.

Secondly, to avoid the risk of the seller double-spending their asset, a system of proof of publication must be implemented. For example, we could implement a rule that every transfer of ownership must be committed on a predefined spot of a well-known newspaper (e.g. put the hash of the transfer of ownership in the upper-right corner of the first page of the New York Times). Since you cannot place the hash of a transfer in the same place twice, this prevents double-spending attempts. However, using a famous newspaper for this purpose has some disadvantages:

- You have to buy a lot of newspapers for the verification process. Not very practical.

- Each contract needs its own space in the newspaper. Not very scalable.

- The newspaper editor can easily censor or, even worse, simulate double-spending by putting a random hash in your slot, making any potential buyer of your asset think it has been sold before, and discouraging them from buying it. Not very trustless.

For these reasons, a better place to post proof of ownership transfers needs to be found. And what better option than the Bitcoin blockchain, an already established trusted public ledger with strong incentives to keep it censorship-resistant and decentralized?

If we use Bitcoin, we should not specify a fixed place in the block where the commitment to transfer ownership must occur (e.g. in the first transaction) because, just like with the editor of the New York Times, the miner could mess with it. A better approach is to place the commitment in a predefined Bitcoin transaction, more specifically in a transaction that originates from an unspent transaction output (UTXO) to which the ownership of the asset to be issued is linked. The link between an asset and a bitcoin UTXO can occur either in the contract that issues the asset or in a subsequent transfer of ownership, each time making the target UTXO the controller of the transferred asset. In this way, we have clearly defined where the obligation to transfer ownership should be (i.e in the Bitcoin transaction originating from a particular UTXO). Anyone running a Bitcoin node can independently verify the commitments and neither the miners nor any other entity are able to censor or interfere with the asset transfer in any way.

Since on the Bitcoin blockchain we only publish a commitment of an ownership transfer, not the content of the transfer itself, the seller needs a dedicated communication channel to provide the buyer with all the proofs that the ownership transfer is valid. This could be done in a number of ways, potentially even by printing out the proofs and shipping them with a carrier pigeon, which, while a bit impractical, would still do the job. But the best option to avoid the censorship and privacy violations is establish a direct peer-to-peer encrypted communication, which compared to the pigeons also has the advantage of being easy to integrate with a software to verify the proofs received from the counterparty.

This model just described for client-side validated contracts and ownership transfers is exactly what has been implemented with the RGB protocol. With RGB, it is possible to create a contract that defines rights, assigns them to one or more existing bitcoin UTXO and specifies how their ownership can be transferred. The contract can be created starting from a template, called a “schema,” in which the creator of the contract only adjusts the parameters and ownership rights, as is done with traditional legal contracts. Currently, there are two types of schemas in RGB: one for issuing fungible tokens (RGB20) and a second for issuing collectibles (RGB21), but in the future, more schemas can be developed by anyone in a permissionless fashion without requiring changes at the protocol level.

To use a more practical example, an issuer of fungible assets (e.g. company shares, stablecoins, etc.) can use the RGB20 schema template and create a contract defining how many tokens it will issue, the name of the asset and some additional metadata associated with it. It can then define which bitcoin UTXO has the right to transfer ownership of the created tokens and assign other rights to other UTXOs, such as the right to make a secondary issuance or to renominate the asset. Each client receiving tokens created by this contract will be able to verify the content of the Genesis contract and validate that any transfer of ownership in the history of the token received has complied with the rules set out therein.

So what can we do with RGB in practice today? First and foremost, it enables the issuance and the transfer of tokenized assets with better scalability and privacy compared to any existing alternative. On the privacy side, RGB benefits from the fact that all transfer-related data is kept client-side, so a blockchain observer cannot extract any information about the user’s financial activities (it is not even possible to distinguish a bitcoin transaction containing an RGB commitment from a regular one), moreover, the receiver shares with the sender only blinded UTXO (i. e. the hash of the concatenation between the UTXO in which she wish to receive the assets and a random number) instead of the UTXO itself, so it is not possible for the payer to monitor future activities of the receiver. To further increase the privacy of users, RGB also adopts the bulletproof cryptographic mechanism to hide the amounts in the history of asset transfers, so that even future owners of assets have an obfuscated view of the financial behavior of previous holders.

In terms of scalability, RGB offers some advantages as well. First of all, most of the data is kept off-chain, as the blockchain is only used as a commitment layer, reducing the fees that need to be paid and meaning that each client only validates the transfers it is interested in instead of all the activity of a global network. Since an RGB transfer still requires a Bitcoin transaction, the fee saving may seem minimal, but when you start introducing transaction batching they can quickly become massive. Indeed, it is possible to transfer all the tokens (or, more generally, “rights”) associated with a UTXO towards an arbitrary amount of recipients with a single commitment in a single bitcoin transaction. Let’s assume you are a service provider making payouts to several users at once. With RGB, you can commit in a single Bitcoin transaction thousands of transfers to thousands of users requesting different types of assets, making the marginal cost of each single payout absolutely negligible.

Another fee-saving mechanism for issuers of low value assets is that in RGB the issuance of an asset does not require paying fees. This happens because the creation of an issuance contract does not need to be committed on the blockchain. A contract simply defines to which already existing UTXO the newly issued assets will be allocated to. So if you are an artist interested in creating collectible tokens, you can issue as many as you want for free and then only pay the bitcoin transaction fee when a buyer shows up and requests the token to be assigned to their UTXO.

Furthermore, because RGB is built on top of bitcoin transactions, it is also compatible with the Lightning Network. While it is not yet implemented at the time of writing, it will be possible to create asset-specific Lightning channels and route payments through them, similar to how it works with normal Lightning transactions.

Conclusion

RGB is a groundbreaking innovation that opens up to new use cases using a completely new paradigm, but which tools are available to use it? If you want to experiment with the core of the technology itself, you should directly try out the RGB node. If you want to build applications on top of RGB without having to deep dive into the complexity of the protocol, you can use the rgb-lib library, which provides a simple interface for developers. If you just want to try to issue and transfer assets, you can play with Iris Wallet for Android, whose code is also open source on GitHub. If you just want to learn more about RGB you can check out this list of resources.

This is a guest post by Federico Tenga. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.