Business

How the Fed’s rate hikes could affect your finances

Published

2 years agoon

NEW YORK (AP) — The Federal Reserve’s move Wednesday to raise its key rate by a half-point brought it to a range of 4.25% to 4.5%, the highest level in 14 years.

The Fed’s latest increase — its seventh rate hike this year — will make it even costlier for consumers and businesses to borrow for homes, autos and other purchases. If, on the other hand, you have money to save, you’ll earn a bit more interest on it.

Wednesday’s rate hike, part of the Fed’s drive to curb high inflation, was smaller than its previous four straight three-quarter-point increases. The downshift reflects, in part, the easing of inflation and the cooling of the economy.

As interest rates increase, many economists say they fear that a recession remains inevitable — and with it, job losses that could cause hardship for households already badly hurt by inflation.

Here’s what to know:

WHAT’S PROMPTING THE RATE INCREASES?

The short answer: Inflation. Over the past year, consumer inflation in the United States has clocked in at 7.1% — the fifth straight monthly drop but still a painfully high level.

The Fed’s goal is to slow consumer spending, thereby reducing demand for homes, cars and other goods and services, eventually cooling the economy and lowering prices.

Fed Chair Jerome Powell has acknowledged that aggressively raising interest rates would bring “some pain” for households but that doing so is necessary to crush high inflation.

WHICH CONSUMERS ARE MOST AFFECTED?

Anyone borrowing money to make a large purchase, such as a home, car or large appliance, will take a hit, according to Scott Hoyt, an analyst with Moody’s Analytics.

“The new rate pretty dramatically increases your monthly payments and your cost,” he said. “It also affects consumers who have a lot of credit card debt — that will hit right away.”

That said, Hoyt noted that household debt payments, as a proportion of income, remain relatively low, though they have risen lately. So even as borrowing rates steadily rise, many households might not feel a much heavier debt burden immediately.

“I’m not sure interest rates are top of mind for most consumers right now,” Hoyt said. “They seem more worried about groceries and what’s going on at the gas pump. Rates can be something tricky for consumers to wrap their minds around.”

HOW WILL THIS AFFECT CREDIT CARD RATES?

Even before the Fed’s latest move, credit card borrowing rates had reached their highest level since 1996, according to Bankrate.com, and these will likely continue to rise.

And with prices still surging, there are signs that Americans are increasingly relying on credit cards to help maintain their spending. Total credit card balances have topped $900 billion, according to the Fed, a record high, though that amount isn’t adjusted for inflation.

John Leer, chief economist at Morning Consult, a survey research firm, said its polling suggests that more Americans are spending down the savings they accumulated during the pandemic and are using credit instead. Eventually, rising rates could make it harder for those households to pay off their debts.

Those who don’t qualify for low-rate credit cards because of weak credit scores are already paying significantly higher interest on their balances, and they’ll continue to.

As rates have risen, zero percent loans marketed as “Buy Now, Pay Later” have also become popular with consumers. But longer-term loans of more than four payments that these companies offer are subject to the same increased borrowing rates as credit cards.

For people who have home equity lines of credit or other variable-interest debt, rates will increase by roughly the same amount as the Fed hike, usually within one or two billing cycles. That’s because those rates are based in part on banks’ prime rate, which follows the Fed’s.

HOW ARE SAVERS AFFECTED?

The rising returns on high-yield savings accounts and certificates of deposit (CDs) have put them at levels not seen since 2009, which means that households may want to boost savings if possible. You can also now earn more on bonds and other fixed-income investments.

Though savings, CDs, and money market accounts don’t typically track the Fed’s changes, online banks and others that offer high-yield savings accounts can be exceptions. These institutions typically compete aggressively for depositors. (The catch: They sometimes require significantly high deposits.)

In general, banks tend to capitalize on a higher-rate environment to boost their profits by imposing higher rates on borrowers, without necessarily offering juicer rates to savers.

WILL THIS AFFECT HOME OWNERSHIP?

Last week, mortgage buyer Freddie Mac reported that the average rate on the benchmark 30-year mortgage dipped to 6.33%. That means the rate on a typical home loan is still about twice as expensive as it was a year ago.

Mortgage rates don’t always move in tandem with the Fed’s benchmark rate. They instead tend to track the yield on the 10-year Treasury note.

Sales of existing homes have declined for nine straight months as borrowing costs have become too high a hurdle for many Americans who are already paying much more for food, gas and other necessities.

WILL IT BE EASIER TO FIND A HOUSE IF I’M STILL LOOKING TO BUY?

If you’re financially able to proceed with a home purchase, you’re likely to have more options than at any time in the past year.

WHAT IF I WANT TO BUY A CAR?

Since the Fed began increasing rates in March, the average new vehicle loan has jumped more than 2 percentage points, from 4.5% to 6.6% in November, according to the Edmunds.com auto site. Used vehicle loans are up 2.1 percentage points to 10.2%. Loan durations for new vehicles average just under 70 months, and they’ve passed 70 months for used vehicles.

Most important, though, is the monthly payment, on which most people base their auto purchases. Edmunds says that since March, it’s up by an average of $61 to $718 for new vehicles. The average payment for used vehicles is up $22 per month to $565.

Ivan Drury, Edmunds’ director of insights, says financing the average new vehicle with a price of $47,000 now costs $8,436 in interest. That’s enough to chase many out of the auto market.

“I think we’re actually starting to see that these interest rates, they’re doing what the Fed wants,” Drury said. “They’re taking away the buying power so that you can’t buy a vehicle anymore. There’s going to be fewer people that can afford it.”

Any rate increase by the Fed will likely be passed through to auto borrowers, though it will be slightly offset by subsidized rates from manufacturers. Drury predicts that new-vehicle prices will start to ease next year as demand wanes a little.

HOW HAVE THE RATE HIKES INFLUENCED CRYPTO?

Cryptocurrencies like bitcoin have dropped in value since the Fed began raising rates. So have many previously high-valued technology stocks.

Higher rates mean that safe assets like Treasuries have become more attractive to investors because their yields have increased. That makes risky assets like technology stocks and cryptocurrencies less attractive.

Still, bitcoin continues to suffer from problems separate from economic policy. Three major crypto firms have failed, most recently the high-profile FTX exchange, shaking the confidence of crypto investors.

WHAT ABOUT MY JOB?

Some economists argue that layoffs could be necessary to slow rising prices. One argument is that a tight labor market fuels wage growth and higher inflation. But the nation’s employers kept hiring briskly in November.

“Job openings continue to exceed job hires, indicating employers are still struggling to fill vacancies,” said Odeta Kushi, an economist with First American.

WILL THIS AFFECT STUDENT LOANS?

Borrowers who take out new private student loans should prepare to pay more as as rates increase. The current range for federal loans is between about 5% and 7.5%.

That said, payments on federal student loans are suspended with zero interest until summer 2023 as part of an emergency measure put in place early in the pandemic. President Joe Biden has also announced some loan forgiveness, of up to $10,000 for most borrowers, and up to $20,000 for Pell Grant recipients — a policy that’s now being challenged in the courts.

IS THERE A CHANCE THE RATE HIKES WILL BE REVERSED?

It looks increasingly unlikely that rates will come down anytime soon. On Wednesday, the Fed signaled that it will raise its rate as high as roughly 5.1% early next year — and keep it there for the rest of 2023.

___

AP Business Writers Christopher Rugaber in Washington, Tom Krisher in Detroit and Damian Troise and Ken Sweet in New York contributed to this report.

___

The Associated Press receives support from Charles Schwab Foundation for educational and explanatory reporting to improve financial literacy. The independent foundation is separate from Charles Schwab and Co. Inc. The AP is solely responsible for its journalism.

Business

Uber and Lyft agree to pay drivers $32.50 per hour in Massachusetts settlement

Published

1 week agoon

June 27, 2024

BOSTON (AP) — Drivers for Uber and Lyft will earn a minimum pay standard of $32.50 per hour under a settlement announced Thursday by Massachusetts Attorney General Andrea Campbell, in a deal that also includes a suite of benefits and protections.

The two companies will also be required to pay a combined $175 million to the state to resolve allegations that the companies violated Massachusetts wage and hour laws, a substantial majority of which will be distributed to current and former drivers.

Campbell said the settlement resolves her office’s yearslong litigation against the two companies and stops the threat of their attempt to rewrite state employment law by a proposed 2024 ballot initiative.

That question would have resulted in drivers receiving inadequate protections and an earnings standard that would not guarantee minimum wage, she said.

“For years, these companies have underpaid their drivers and denied them basic benefits,” Campbell said in a written statement. “Today’s agreement holds Uber and Lyft accountable, and provides their drivers, for the very first time in Massachusetts, guaranteed minimum pay, paid sick leave, occupational accident insurance, and health care stipends.”

Democratic Gov. Maura Healey said the settlement delivers “historic wages and benefits to right the wrongs of the past and ensure drivers are paid fairly going forward.”

In a statement Lyft said the agreement resolves a lawsuit that recently went to trial, and avoids the need for the ballot initiative campaign this November.

“More importantly, it is a major victory in a multiyear campaign by Bay State drivers to secure their right to remain independent, while gaining access to new benefits,” the company said.

Uber also released a statement calling the agreement “an example of what independent, flexible work with dignity should look like in the 21st century.”

“In taking this opportunity, we’ve resolved historical liabilities by constructing a new operating model that balances both flexibility and benefits,” the company said. “This allows both Uber and Massachusetts to move forward in a way that reflects what drivers want and demonstrates to other states what’s possible to achieve.”

The companies were pushing a ballot question that would classify drivers as independent contractors eligible for some benefits, but Campbell said the settlement stops the threat of the ballot question. A competing ballot question seeks to give drivers the right to unionize in Massachusetts.

Drivers will now earn one hour of sick day pay for every 30 hours worked, up to a maximum of 40 hours per year. As part of the agreement, Uber and Lyft must update their driver applications so drivers are able to view and claim their sick leave directly in the app. Drivers will also receive a stipend to buy into the state’s paid family and medical leave program.

Under the deal, Uber and Lyft will also allow drivers to pool together their hours driving for the two companies to obtain access to a health insurance stipend. Anyone who drives for more than 15 hours per week — for either or both companies — will be able to earn a health insurance stipend to pay for a plan on the Massachusetts Health Connector.

Drivers will be eligible for occupational accident insurance paid by the companies for up to $1 million in coverage for work-related injuries.

The agreement also requires the companies to provide drivers with key information — about the length of a trip, the destination and expected earnings — before they are expected to accept a ride.

The companies are barred from discriminating against drivers based on race, religion, national origin, sex, sexual orientation, gender identity, disability or other protected identities — and can’t retaliate against drivers who have filed a complaint about the companies with the Attorney General’s Office.

The deal also requires the companies to provide drivers in-app chat support with a live person in English, Spanish, Portuguese and French and must provide drivers with information about why they have been deactivated and create an appeals process.

Business

Michigan farmworker diagnosed with bird flu, becoming 2nd US case tied to dairy cows

Published

2 months agoon

May 22, 2024

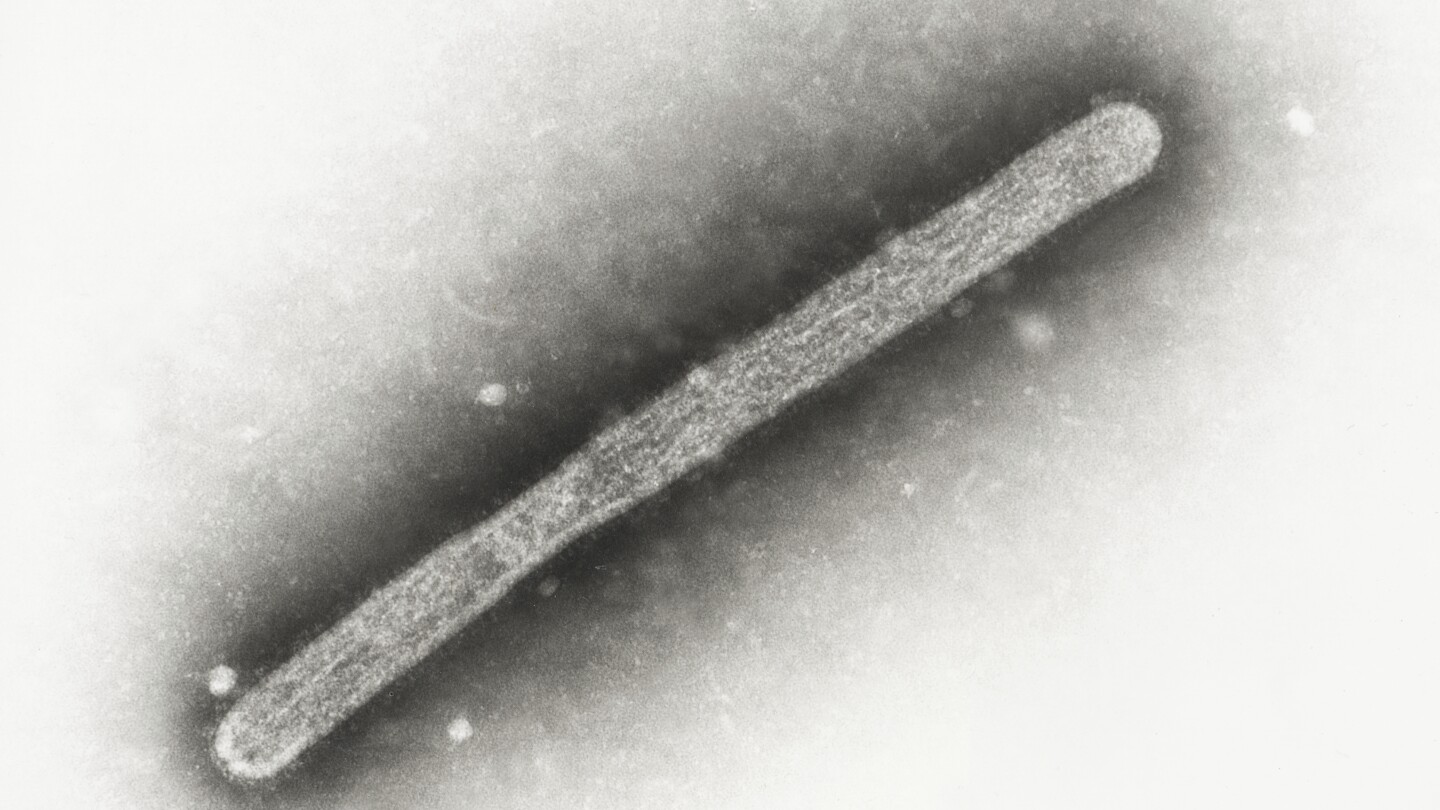

A Michigan dairy worker has been diagnosed with bird flu — the second human case associated with an outbreak in U.S. dairy cows.

The male worker had been in contact with cows at a farm with infected animals. He experienced mild eye symptoms and has recovered, U.S. and Michigan health officials said in announcing the case Wednesday.

A nasal swab from the person tested negative for the virus, but an eye swab tested Tuesday was positive for bird flu, “indicating an eye infection,” U.S. Centers for Disease Control and Prevention officials said.

The worker developed a “gritty feeling” in his eye earlier this month but it was a “very mild case,” said Dr. Natasha Bagdasarian, Michigan’s chief medical executive. He was not treated with oseltamivir, a medication advised for treating bird flu, she said.

The risk to the public remains low, but farmworkers exposed to infected animals are at higher risk, health officials said. They said those workers should be offered protective equipment, especially for their eyes.

Health officials say they do not know if the Michigan farmworker was wearing protective eyewear, but an investigation is continuing.

In late March, a farmworker in Texas was diagnosed in what officials called the first known instance globally of a person catching this version of bird flu from a mammal. That patient reported only eye inflammation and recovered.

Since 2020, a bird flu virus has been spreading among more animal species — including dogs, cats, skunks, bears and even seals and porpoises — in scores of countries.

The detection in U.S. livestock earlier this year was an unexpected twist that sparked questions about food safety and whether it would start spreading among humans.

That hasn’t happened, although there’s been a steady increase of reported infections in cows. As of Wednesday, the virus had been confirmed in 51 dairy herds in nine states, according to the U.S. Agriculture Department. Fifteen of the herds were in Michigan.

The CDC’s Dr. Nirav Shah said the case was “not unexpected” and it’s possible more infections could be diagnosed in people who work around infected cows.

U.S. officials said they had tested 40 people since the first cow cases were discovered in late March. Michigan has tested 35 of them, Bagdasarian told The Associated Press in an interview.

Shah praised Michigan officials for actively monitoring farmworkers. He said health officials there have been sending daily text messages to workers exposed to infected cows asking about possible symptoms, and that the effort helped officials catch this infection. He said no other workers had reported symptoms.

That’s encouraging news, said Michael Osterholm, a University of Minnesota epidemiologist who has studied bird flu for decades. There’s no sign to date that the virus is causing flu-like illness or that it is spreading among people.

“If we had four or five people seriously ill with respiratory illness, we would be picking that up,” he said.

The virus has been found in high levels in the raw milk of infected cows, but government officials say pasteurized products sold in grocery stores are safe because heat treatment has been confirmed to kill the virus.

The new case marks the third time a person in the United States has been diagnosed with what’s known as Type A H5N1 virus. In 2022, a prison inmate in a work program picked it up while killing infected birds at a poultry farm in Montrose County, Colorado. His only symptom was fatigue, and he recovered. That predated the virus’s appearance in cows.

___

The Associated Press Health and Science Department receives support from the Howard Hughes Medical Institute’s Science and Educational Media Group. The AP is solely responsible for all content.

Business

At collapsed Baltimore bridge, focus shifts to the weighty job of removing the massive structure

Published

3 months agoon

March 29, 2024

BALTIMORE (AP) — Teams of engineers worked Saturday on the intricate process of cutting and lifting the first section of twisted steel from the collapsed Francis Scott Key Bridge, which crumpled into the Patapsco River this week after a massive cargo ship crashed into one of its supports.

Sparks could be seen flying from a section of bent and crumpled steel in the afternoon, and video released by officials in the evening showed demolition crews using a cutting torch to slice through the thick beams. The joint incident command said in a statement that the work was being done on the top of the north side of the collapsed structure.

Crews were carefully measuring and cutting the steel from the broken bridge before attaching straps so it can be lifted onto a barge and floated away, Coast Guard Rear Adm. Shannon Gilreath said.

Seven floating cranes — including a massive one capable of lifting 1,000 tons — 10 tugboats, nine barges, eight salvage vessels and five Coast Guard boats were on site in the water southeast of Baltimore.

Each movement affects what happens next and ultimately how long it will take to remove all the debris and reopen the ship channel and the blocked Port of Baltimore, Maryland Gov. Wes Moore said.

“I cannot stress enough how important today and the first movement of this bridge and of the wreckage is. This is going to be a remarkably complicated process,” Moore said.

Undeterred by the chilly morning weather, longtime Baltimore resident Randy Lichtenberg and others took cellphone photos or just quietly looked at the broken pieces of the bridge, which including its steel trusses weigh as much as 4,000 tons.

“I wouldn’t want to be in that water. It’s got to be cold. It’s a tough job,” Lichtenberg said from a spot on the river called Sparrows Point.

The shock of waking up Tuesday morning to video of what he called an iconic part of the Baltimore skyline falling into the water has given way to sadness.

“It never hits you that quickly. It’s just unbelievable,” Lichtenberg said.

WHAT HAPPENS NEXT

One of the first goals for crews on the water is to get a smaller auxiliary ship channel open so tugboats and other small barges can move freely. Crews also want to stabilize the site so divers can resume searching for four missing workers who are presumed dead.

Two other workers were rescued from the water in the hours following the bridge collapse, and the bodies of two more were recovered from a pickup truck that fell and was submerged in the river. They had been filling potholes on the bridge and while police were able to stop vehicle traffic after the ship called in a mayday, they could not get to the construction workers, who were from Mexico, Guatemala, Honduras and El Salvador.

The crew of the cargo ship Dali, which is managed by Synergy Marine Group, remained on board with the debris from the bridge around it, and were safe and were being interviewed. They are keeping the ship running as they will be needed to get it out of the channel once more debris has been removed.

The vessel is owned by Grace Ocean Private Ltd. and was chartered by Danish shipping giant Maersk.

The collision and collapse appeared to be an accident that came after the ship lost power. Federal and state investigators are still trying to determine why.

Assuaging concern about possible pollution from the crash, Adam Ortiz, the Environmental Protection Agency’s mid-Atlantic Regional Administrator, said there was no indication in the water of active releases from the ship or materials hazardous to human health.

REBUILDING

Officials are also trying to figure out how to handle the economic impact of a closed port and the severing of a major highway link. The bridge was completed in 1977 and carried Interstate 695 around southeast Baltimore.

Maryland transportation officials are planning to rebuild the bridge, promising to consider innovative designs or building materials to hopefully shorten a project that could take years.

President Joe Biden’s administration has approved $60 million in immediate aid and promised the federal government will pay the full cost to rebuild.

Ship traffic at the Port of Baltimore remains suspended, but the Maryland Port Administration said trucks were still being processed at marine terminals.

The loss of a road that carried 30,000 vehicles a day and the port disruption will affect not only thousands of dockworkers and commuters, but also U.S. consumers, who are likely to feel the impact of shipping delays. The port handles more cars and more farm equipment than any other U.S. facility.

___

Collins reported from Columbia, South Carolina. Associated Press writers Sarah Brumfield in Washington, D.C.; Kristin M. Hall in Nashville, Tennessee; Adrian Sainz in Memphis, Tennessee; and Lisa Baumann in Bellingham, Washington, contributed.