Crypto

How The FTX Collapse Could Leave Blockfolio Users Exposed

Published

2 years agoon

This is an opinion editorial by Morgan Rockwell, founder of Bitcoin Kinetics.

I’m not concerned with Sam Bankman-Fried allegedly getting a loan from Alameda, which was actually FTX customer funds wired through Alameda to be credited on FTX. I’m not concerned with the moral compass of the celebrity investors who gave billions to a kid they didn’t really know or understand, yet endorsed with wealth and credibility. I’m not very concerned with the financial and market effects upon the many companies, exchanges and traders who for some reason depended on FTX in any form.

I’m most concerned with Sam Bankman-Fried getting the personal identification information of millions of customers, and using that data to do chain analysis on the Blockfolio app he purchased which was used by many Bitcoiners and cryptocurrency holders as a tracking tool of Bitcoin, Ethereum and other watch-only cryptocurrency wallets.

Source: Google Images

If you aren’t aware, Blockfolio was an app that was used by many Bitcoin holders and other cryptocurrency holders to keep track of the exchange rate or the prices of their coins held in cold storage or on wallets that they only wanted to be watching and not have actively on a hot wallet on their mobile device. Storing the wallet addresses actually were not even needed on the app. You could just put in a amount of a certain cryptocurrency that you wanted to watch and say that you had — but there was also a feature to connect to exchanges to keep track of all of your coins across all of the exchanges you had them on in one app. This was the beauty of Blockfolio as it didn’t necessarily ask for too much personal identification information other than an email to help keep track of your account so you can log in from multiple devices.

Most of us like myself became aware of Sam Bankman-Fried because of the purchase of Blockfolio by a newly formed entity called FTX. Over several weeks the Blockfolio app was rebranded as the FTX app which now had its own exchange. It also had a new set of Know Your Customer rules, Anti-Money Laundering policies, a new Terms of Service, as well as its own custodial wallet held by FTX, we assumed.

Here you can see the Terms of Service at Blockfolio from June 30, 2017:

Source: Blockfolio Privacy Policy 2017

Blockfolio avidly argued that they were not and would not ever sell user data. Blockfolio even attempted to de-identify users with a hashing mechanism for IDs to not even let themselves identify and connect user portfolios to email addresses; this apparently never happened after the purchase and transformation into FTX.

Here you can see the stark difference in the new FTX Privacy Policy:

Source: FTX Privacy Policy 2022

Here is what little is mentioned about personal identifiable information within the FTX Terms of Service, which is a different document than the Privacy Policy.

For reference, if you have never read a Terms Of Service or Privacy Policy of a company before, I strongly recommend you grab a strong beer and enjoy this word soup!

This all has brought up questions around this merger and the acquisition that happened in the cryptocurrency industry only a few years ago. I am concerned because after the fallout of this exchange, FTX going bankrupt and all of its assets potentially being put up for auction, I would like to know the state of the personal identification information that FTX had been forced to gather because of KYC and AML laws. My concern is the vast amount of information gathered including passports, phone numbers, IP addresses, home addresses, cryptocurrency wallet addresses, email addresses, passwords and government IDs. All of these could be sold at auction as customer data or customer profiles to whoever finds them valuable.

Source: FTX Privacy Policy (disclosure in the event of merger, sale, or other asset transfers)

Now the assets held by FTX whether they were actually real cryptocurrency such as bitcoin or made up tokens built on another layer one network such as ethereum are not too important in this conversation in my opinion. What is important is the data, the privacy data, the data mining operation that could have or will be done on all of this data FTX had gathered on customers either it was done by them or it will be done by whomever buys this data at auction. Even more so, the jurisdiction of that data is open to anywhere on earth.

Source: FTX Privacy Policy (international data transfers)

As someone who has personally worked on coin analysis concepts and technology for the United States Military, as well as consulted on this for the Department of Defense as a so called “subject matter expert,” I can personally attest that it is very easy to correlate a person to their Bitcoin wallet address using nothing more than the amounts of bitcoin held on specific addresses, as well as the device data that is keeping track of those specific amounts on specific addresses — this is simple SIGINT, MASINT or HUMINT, all of which are different forms of intelligence gathering.

If you are keeping track of any bitcoin on any wallet over any Bitcoin explorer that is looked through a browser or app on any device, phone, laptop or tablet, there is now a record that will be connected to the IP address, the MAC number, the SIM phone number, the VOIP number, credit card number, home address and any other personal identifying information that is attached in any way to this device. I know this because Edward Snowden leaked documents showing that the NSA had a program called XKEYSCORE and applications were used like OAKSTAR and its subprogram MONKEYROCKET to specifically keep track of Bitcoin users at the NSA.

Source: https://theintercept.com/2018/03/20/the-nsa-worked-to-track-down-bitcoin-users-snowden-documents-reveal/

Now what I’m getting at is this data that FTX was forced under AML and KYC law to be gathered. This is potentially one of the largest gatherings of this type of data in the cryptocurrency industry ever done in history. This data, combined with coin analysis information related to bitcoin, ethereum and other cryptocurrency amounts being tracked by the previously titled Blockfolio app has created a situation where KYC data personal identifying information can be now superimposed over Blockfolio email addresses, UTXOs and watch addresses that plenty of people used on Blockfolio without any personal information being divulged to the app.

So this means that people that used Blockfolio to keep track of the amount of cryptocurrency they had, wanted to buy or were keeping track of for whatever reason will now be able to be correlated to very detailed personal identification information. The concern I have is not whether FTX and its hundreds of subsidiaries were keeping track of this information from Blockfolio or using it in any way, but that their vast new pool of customer information and data will be binded in the future to the Blockfolio data. I don’t assume FTX was intelligent enough to do this for any purpose such as advertising, or data sharing with a hedge fund like Robinhood was caught doing, but I do assume that they may have considered selling this data to law enforcement agencies, to advertisers or to actors in the intelligence community as SBF said there was an open door to regulators and law enforcement agencies at FTX.

What we need to think about now is when the assets of FTX go up for auction, which they will, that not only the digital currencies and tokens as well as the licenses will be sold to some new party, but it will be the customers themselves, personal identifying information and the massive data mining that could have been or will be done with that data.

I was never an FTX user, I never created an account with FTX or FTX.us and I never wired any money to Alameda. Unfortunately, because of my longevity in the Bitcoin space, I used Blockfolio like many Bitcoin users before me to keep track of the amounts of Bitcoin I had in multiple locations and their total value. Now that data that I thought was private will be connected to KYC data of anyone I know, interacted with over a wire and any device they used, especially if through multiple connections it leads back to FTX in any way.

What we need to do now is ask the serious questions and not focus on the financial obligations or mishandlings of SBF and FTX. But we must ask who has this data? What has been done with this data and who will be owning this data in the future? The reality is FTT dissolving into nothing isn’t a “Force Majeure Event,” so most of the users are screwed.

Source: FTX Terms Of Service 2022

If this at all concerns you or involves you, I would suggest we all find the proper channels to protect ourselves from the worst case scenario from this fallout of data. This is the biggest problem with KYC and AML laws,because after all of this financial chaos, there is now a criminal-run exchange that is in possession of millions of people’s personal information about their devices, their homes, their financials and more, all available to the highest bidder.

Notes:

The Blockfolio TOS & Privacy Policy go to dead links on the FTX.com website, but I found a 2017 version.

You must sign in through Zendesk to view the missing Blockfolio TOS/PP as well as the new FTX TOS/PP which means I had to give an email and PPI to even see the documents.

This is a guest post by Morgan Rockwell. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Crypto

El Salvador Takes First Step To Issue Bitcoin Volcano Bonds

Published

2 years agoon

November 22, 2022

El Salvador’s Minister of the Economy Maria Luisa Hayem Brevé submitted a digital assets issuance bill to the country’s legislative assembly, paving the way for the launch of its bitcoin-backed “volcano” bonds.

First announced one year ago today, the pioneering initiative seeks to attract capital and investors to El Salvador. It was revealed at the time the plans to issue $1 billion in bonds on the Liquid Network, a federated Bitcoin sidechain, with the proceedings of the bonds being split between a $500 million direct allocation to bitcoin and an investment of the same amount in building out energy and bitcoin mining infrastructure in the region.

A sidechain is an independent blockchain that runs parallel to another blockchain, allowing for tokens from that blockchain to be used securely in the sidechain while abiding by a different set of rules, performance requirements, and security mechanisms. Liquid is a sidechain of Bitcoin that allows bitcoin to flow between the Liquid and Bitcoin networks with a two-way peg. A representation of bitcoin used in the Liquid network is referred to as L-BTC. Its verifiably equivalent amount of BTC is managed and secured by the network’s members, called functionaries.

“Digital securities law will enable El Salvador to be the financial center of central and south America,” wrote Paolo Ardoino, CTO of cryptocurrency exchange Bitfinex, on Twitter.

Bitfinex is set to be granted a license in order to be able to process and list the bond issuance in El Salvador.

The bonds will pay a 6.5% yield and enable fast-tracked citizenship for investors. The government will share half the additional gains with investors as a Bitcoin Dividend once the original $500 million has been monetized. These dividends will be dispersed annually using Blockstream’s asset management platform.

The act of submitting the bill, which was hinted at earlier this year, kickstarts the first major milestone before the bonds can see the light of day. The next is getting it approved, which is expected to happen before Christmas, a source close to President Nayib Bukele told Bitcoin Magazine. The bill was submitted on November 17 and presented to the country’s Congress today. It is embedded in full below.

Crypto

How I’ll Talk To Family Members About Bitcoin This Thanksgiving

Published

2 years agoon

November 22, 2022

This is an opinion editorial by Joakim Book, a Research Fellow at the American Institute for Economic Research, contributor and copy editor for Bitcoin Magazine and a writer on all things money and financial history.

I don’t.

That’s it. That’s the article.

In all sincerity, that is the full message: Just don’t do it. It’s not worth it.

You’re not an excited teenager anymore, in desperate need of bragging credits or trying out your newfound wisdom. You’re not a preaching priestess with lost souls to save right before some imminent arrival of the day of reckoning. We have time.

Instead: just leave people alone. Seriously. They came to Thanksgiving dinner to relax and rejoice with family, laugh, tell stories and zone out for a day — not to be ambushed with what to them will sound like a deranged rant in some obscure topic they couldn’t care less about. Even if it’s the monetary system, which nobody understands anyway.

Get real.

If you’re not convinced of this Dale Carnegie-esque social approach, and you still naively think that your meager words in between bites can change anybody’s view on anything, here are some more serious reasons for why you don’t talk to friends and family about Bitcoin the protocol — but most certainly not bitcoin, the asset:

- Your family and friends don’t want to hear it. Move on.

- For op-sec reasons, you don’t want to draw unnecessary attention to the fact that you probably have a decent bitcoin stack. Hopefully, family and close friends should be safe enough to confide in, but people talk and that gossip can only hurt you.

- People find bitcoin interesting only when they’re ready to; everyone gets the price they deserve. Like Gigi says in “21 Lessons:”

“Bitcoin will be understood by you as soon as you are ready, and I also believe that the first fractions of a bitcoin will find you as soon as you are ready to receive them. In essence, everyone will get ₿itcoin at exactly the right time.”

It’s highly unlikely that your uncle or mother-in-law just happens to be at that stage, just when you’re about to sit down for dinner.

- Unless you can claim youth, old age or extreme poverty, there are very few people who genuinely haven’t heard of bitcoin. That means your evangelizing wouldn’t be preaching to lost, ignorant souls ready to be saved but the tired, huddled and jaded masses who could care less about the discovery that will change their societies more than the internal combustion engine, internet and Big Government combined. Big deal.

- What is the case, however, is that everyone in your prospective audience has already had a couple of touchpoints and rejected bitcoin for this or that standard FUD. It’s a scam; seems weird; it’s dead; let’s trust the central bankers, who have our best interest at heart.

No amount of FUD busting changes that impression, because nobody holds uninformed and fringe convictions for rational reasons, reasons that can be flipped by your enthusiastic arguments in-between wiping off cranberry sauce and grabbing another turkey slice. - It really is bad form to talk about money — and bitcoin is the best money there is. Be classy.

Now, I’m not saying to never ever talk about Bitcoin. We love to talk Bitcoin — that’s why we go to meetups, join Twitter Spaces, write, code, run nodes, listen to podcasts, attend conferences. People there get something about this monetary rebellion and have opted in to be part of it. Your unsuspecting family members have not; ambushing them with the wonders of multisig, the magically fast Lightning transactions or how they too really need to get on this hype train, like, yesterday, is unlikely to go down well.

However, if in the post-dinner lull on the porch someone comes to you one-on-one, whisky in hand and of an inquisitive mind, that’s a very different story. That’s personal rather than public, and it’s without the time constraints that so usually trouble us. It involves clarifying questions or doubts for somebody who is both expressively curious about the topic and available for the talk. That’s rare — cherish it, and nurture it.

Last year I wrote something about the proper role of political conversations in social settings. Since November was also election month, it’s appropriate to cite here:

“Politics, I’m starting to believe, best belongs in the closet — rebranded and brought out for the specific occasion. Or perhaps the bedroom, with those you most trust, love, and respect. Not in public, not with strangers, not with friends, and most certainly not with other people in your community. Purge it from your being as much as you possibly could, and refuse to let political issues invade the areas of our lives that we cherish; politics and political disagreements don’t belong there, and our lives are too important to let them be ruled by (mostly contrived) political disagreements.”

If anything, those words seem more true today than they even did then. And I posit to you that the same applies for bitcoin.

Everyone has some sort of impression or opinion of bitcoin — and most of them are plain wrong. But there’s nothing people love more than a savior in white armor, riding in to dispel their errors about some thing they are freshly out of fucks for. Just like politics, nobody really cares.

Leave them alone. They will find bitcoin in their own time, just like all of us did.

This is a guest post by Joakim Book. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

This is an opinion editorial by Federico Tenga, a long time contributor to Bitcoin projects with experience as start-up founder, consultant and educator.

The term “smart contracts” predates the invention of the blockchain and Bitcoin itself. Its first mention is in a 1994 article by Nick Szabo, who defined smart contracts as a “computerized transaction protocol that executes the terms of a contract.” While by this definition Bitcoin, thanks to its scripting language, supported smart contracts from the very first block, the term was popularized only later by Ethereum promoters, who twisted the original definition as “code that is redundantly executed by all nodes in a global consensus network”

While delegating code execution to a global consensus network has advantages (e.g. it is easy to deploy unowed contracts, such as the popularly automated market makers), this design has one major flaw: lack of scalability (and privacy). If every node in a network must redundantly run the same code, the amount of code that can actually be executed without excessively increasing the cost of running a node (and thus preserving decentralization) remains scarce, meaning that only a small number of contracts can be executed.

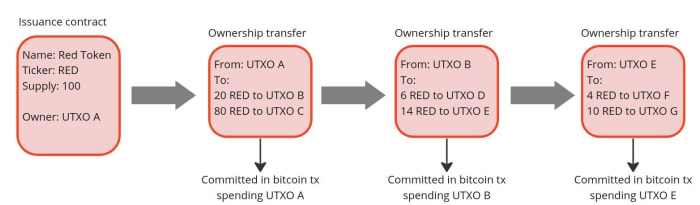

But what if we could design a system where the terms of the contract are executed and validated only by the parties involved, rather than by all members of the network? Let us imagine the example of a company that wants to issue shares. Instead of publishing the issuance contract publicly on a global ledger and using that ledger to track all future transfers of ownership, it could simply issue the shares privately and pass to the buyers the right to further transfer them. Then, the right to transfer ownership can be passed on to each new owner as if it were an amendment to the original issuance contract. In this way, each owner can independently verify that the shares he or she received are genuine by reading the original contract and validating that all the history of amendments that moved the shares conform to the rules set forth in the original contract.

This is actually nothing new, it is indeed the same mechanism that was used to transfer property before public registers became popular. In the U.K., for example, it was not compulsory to register a property when its ownership was transferred until the ‘90s. This means that still today over 15% of land in England and Wales is unregistered. If you are buying an unregistered property, instead of checking on a registry if the seller is the true owner, you would have to verify an unbroken chain of ownership going back at least 15 years (a period considered long enough to assume that the seller has sufficient title to the property). In doing so, you must ensure that any transfer of ownership has been carried out correctly and that any mortgages used for previous transactions have been paid off in full. This model has the advantage of improved privacy over ownership, and you do not have to rely on the maintainer of the public land register. On the other hand, it makes the verification of the seller’s ownership much more complicated for the buyer.

Source: Title deed of unregistered real estate propriety

How can the transfer of unregistered properties be improved? First of all, by making it a digitized process. If there is code that can be run by a computer to verify that all the history of ownership transfers is in compliance with the original contract rules, buying and selling becomes much faster and cheaper.

Secondly, to avoid the risk of the seller double-spending their asset, a system of proof of publication must be implemented. For example, we could implement a rule that every transfer of ownership must be committed on a predefined spot of a well-known newspaper (e.g. put the hash of the transfer of ownership in the upper-right corner of the first page of the New York Times). Since you cannot place the hash of a transfer in the same place twice, this prevents double-spending attempts. However, using a famous newspaper for this purpose has some disadvantages:

- You have to buy a lot of newspapers for the verification process. Not very practical.

- Each contract needs its own space in the newspaper. Not very scalable.

- The newspaper editor can easily censor or, even worse, simulate double-spending by putting a random hash in your slot, making any potential buyer of your asset think it has been sold before, and discouraging them from buying it. Not very trustless.

For these reasons, a better place to post proof of ownership transfers needs to be found. And what better option than the Bitcoin blockchain, an already established trusted public ledger with strong incentives to keep it censorship-resistant and decentralized?

If we use Bitcoin, we should not specify a fixed place in the block where the commitment to transfer ownership must occur (e.g. in the first transaction) because, just like with the editor of the New York Times, the miner could mess with it. A better approach is to place the commitment in a predefined Bitcoin transaction, more specifically in a transaction that originates from an unspent transaction output (UTXO) to which the ownership of the asset to be issued is linked. The link between an asset and a bitcoin UTXO can occur either in the contract that issues the asset or in a subsequent transfer of ownership, each time making the target UTXO the controller of the transferred asset. In this way, we have clearly defined where the obligation to transfer ownership should be (i.e in the Bitcoin transaction originating from a particular UTXO). Anyone running a Bitcoin node can independently verify the commitments and neither the miners nor any other entity are able to censor or interfere with the asset transfer in any way.

Since on the Bitcoin blockchain we only publish a commitment of an ownership transfer, not the content of the transfer itself, the seller needs a dedicated communication channel to provide the buyer with all the proofs that the ownership transfer is valid. This could be done in a number of ways, potentially even by printing out the proofs and shipping them with a carrier pigeon, which, while a bit impractical, would still do the job. But the best option to avoid the censorship and privacy violations is establish a direct peer-to-peer encrypted communication, which compared to the pigeons also has the advantage of being easy to integrate with a software to verify the proofs received from the counterparty.

This model just described for client-side validated contracts and ownership transfers is exactly what has been implemented with the RGB protocol. With RGB, it is possible to create a contract that defines rights, assigns them to one or more existing bitcoin UTXO and specifies how their ownership can be transferred. The contract can be created starting from a template, called a “schema,” in which the creator of the contract only adjusts the parameters and ownership rights, as is done with traditional legal contracts. Currently, there are two types of schemas in RGB: one for issuing fungible tokens (RGB20) and a second for issuing collectibles (RGB21), but in the future, more schemas can be developed by anyone in a permissionless fashion without requiring changes at the protocol level.

To use a more practical example, an issuer of fungible assets (e.g. company shares, stablecoins, etc.) can use the RGB20 schema template and create a contract defining how many tokens it will issue, the name of the asset and some additional metadata associated with it. It can then define which bitcoin UTXO has the right to transfer ownership of the created tokens and assign other rights to other UTXOs, such as the right to make a secondary issuance or to renominate the asset. Each client receiving tokens created by this contract will be able to verify the content of the Genesis contract and validate that any transfer of ownership in the history of the token received has complied with the rules set out therein.

So what can we do with RGB in practice today? First and foremost, it enables the issuance and the transfer of tokenized assets with better scalability and privacy compared to any existing alternative. On the privacy side, RGB benefits from the fact that all transfer-related data is kept client-side, so a blockchain observer cannot extract any information about the user’s financial activities (it is not even possible to distinguish a bitcoin transaction containing an RGB commitment from a regular one), moreover, the receiver shares with the sender only blinded UTXO (i. e. the hash of the concatenation between the UTXO in which she wish to receive the assets and a random number) instead of the UTXO itself, so it is not possible for the payer to monitor future activities of the receiver. To further increase the privacy of users, RGB also adopts the bulletproof cryptographic mechanism to hide the amounts in the history of asset transfers, so that even future owners of assets have an obfuscated view of the financial behavior of previous holders.

In terms of scalability, RGB offers some advantages as well. First of all, most of the data is kept off-chain, as the blockchain is only used as a commitment layer, reducing the fees that need to be paid and meaning that each client only validates the transfers it is interested in instead of all the activity of a global network. Since an RGB transfer still requires a Bitcoin transaction, the fee saving may seem minimal, but when you start introducing transaction batching they can quickly become massive. Indeed, it is possible to transfer all the tokens (or, more generally, “rights”) associated with a UTXO towards an arbitrary amount of recipients with a single commitment in a single bitcoin transaction. Let’s assume you are a service provider making payouts to several users at once. With RGB, you can commit in a single Bitcoin transaction thousands of transfers to thousands of users requesting different types of assets, making the marginal cost of each single payout absolutely negligible.

Another fee-saving mechanism for issuers of low value assets is that in RGB the issuance of an asset does not require paying fees. This happens because the creation of an issuance contract does not need to be committed on the blockchain. A contract simply defines to which already existing UTXO the newly issued assets will be allocated to. So if you are an artist interested in creating collectible tokens, you can issue as many as you want for free and then only pay the bitcoin transaction fee when a buyer shows up and requests the token to be assigned to their UTXO.

Furthermore, because RGB is built on top of bitcoin transactions, it is also compatible with the Lightning Network. While it is not yet implemented at the time of writing, it will be possible to create asset-specific Lightning channels and route payments through them, similar to how it works with normal Lightning transactions.

Conclusion

RGB is a groundbreaking innovation that opens up to new use cases using a completely new paradigm, but which tools are available to use it? If you want to experiment with the core of the technology itself, you should directly try out the RGB node. If you want to build applications on top of RGB without having to deep dive into the complexity of the protocol, you can use the rgb-lib library, which provides a simple interface for developers. If you just want to try to issue and transfer assets, you can play with Iris Wallet for Android, whose code is also open source on GitHub. If you just want to learn more about RGB you can check out this list of resources.

This is a guest post by Federico Tenga. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.