Crypto

Should Bitcoiners Support Nayib Bukele’s Attempt At Re-Election?

Published

2 years agoon

This is an opinion editorial by Jaime García, a Salvadoran-Canadian Bitcoin and co-host of Global Bitcoin Fest.

Many Bitcoiners regard El Salvador as a beacon of hope, as it’s the only country to date that has truly made bitcoin one of its official currencies. The country has provided a hospitable atmosphere for international Bitcoiners to meet, vacation and invest their stacks. Without a doubt, one of the key driving forces behind Bitcoin adoption in El Salvador has been President Nayib Bukele.

But ensuring the success of this novel project will take several more years. And many have wondered what would happen to the project if Bukele, its biggest champion, were no longer in charge. Some have wondered whether one presidential term is enough to complete the task of orange-pilling El Salvador.

That is why the potential of Bukele’s re-election would likely be welcomed by many Bitcoiners. However, equally as important is the potential that Bukele would be circumventing the Salvadoran constitution to achieve another term and perpetuate himself in the presidency — an abuse of power that would seem to contradict Bitcoin’s emphasis on rules, not rulers.

It now appears that Bukele will attempt to continue his presidency, beyond his current term. On September 15, 2022, El Salvador’s 201st Independence Day, Bukele announced that he would seek to run as a candidate for the presidency in the 2024 elections. Many Salvadorans received his announcement with excitement, enthusiasm and thunderous applause. In contrast, many of his detractors, critics and international news organizations immediately condemned his decision to run for a second term as illegal and unconstitutional. For the most part, their denunciations were based on the perception that El Salvador’s constitution limits presidential administrations to a single five-year term.

This article describes Bukele’s legal path to a second presidential term. It is not intended to promote nor detract from Bukele’s future presidential aspirations but to simply highlight the requirements for a Bukele candidacy within the current Salvadoran constitution. Understanding the nuanced aspects of the Salvadoran constitution, the events that led to Bukele’s announcement and the mood of the Salvadoran population are critical factors to assist the reader in thoroughly evaluating the situation.

The Legal Questions Around Bukele’s Second Term

Like many in El Salvador, Bukele himself had long held that presidential terms were limited to one and that re-election was impossible. Furthermore, in many interviews, he had gone on record asserting that he would not change the constitution to seek re-election.

As you might expect, changing the constitution is a long and arduous process. First, the president alone cannot alter the constitution. Second, proposed changes require at least ten Legislative Assembly Deputies signatories. Third, the Legislative Assembly of El Salvador has to approve the proposed change with a simple majority vote of 50% plus one. Finally, after a cool-off period, the next elected legislative assembly would ratify the proposal with a vote requiring three-quarters of the assembly.

It would have been impossible for Bukele, even with his party having a supermajority in the assembly, to pass a constitutional change in time for a second term re-election. Additionally, the constitution’s Article 248, explicitly prohibits changes to the section dealing with presidential terms.

From what is known, Bukele did not intend to seek re-election. So, what made it possible for him to announce that he would seek a second term as president?

A Recent Interpretation Of El Salvador’s Constitution

On February 15, 2021, the Salvadoran digital news outlet Diario El Mundo published an interview with Nancy Marichel Díaz de Martínez, a candidate running for the GANA party in the upcoming legislative assembly elections. In the interview, she was asked by the paper if she would support the re-election of Bukele, and she replied positively.

On March 22, 2021, in an attempt to get Díaz de Martínez disqualified from running in the legislative assembly elections, a well-known Bukele detractor and constitutional lawyer, Salvador Enrique Anaya Barraza, filed a lawsuit against her. The charge alleged that Díaz de Martínez was promoting the re-election of the president. Per the Salvadoran constitution, Article 75, Section 4, such activity is prohibited, and the penalty for doing so is to lose your citizen’s rights, including the ability to run for office.

The Salvadoran supreme court’s constitutional chamber allowed Díaz de Martínez to run in the election, provided that if it found her in breach of the constitution and she was successful in her bid (she was not), they would depose her of her office. At the time, Díaz de Martínez admitted to the charge.

On September 3, 2021, the supreme court’s constitutional chamber rendered a ruling regarding the loss of Díaz de Martínez’s citizenship rights. The report extensively explored the impact of its decision by relying on the body of jurisprudence in the matter. Essentially, it found that Díaz de Martínez did not lose her citizen’s rights because:

1. The evidence provided by Salvador Enrique Anaya Barraza lacked objectivity and credibility;

2. It’s a given that the chamber must exercise common sense in interpreting the constitution and not penalize sovereign individuals for the rigid and literal language of the document. Additionally, citizens can freely express their political desires, even if not permitted within the constitution, without fear of losing their rights. Free expression is already a guaranteed right in the constitution, and other sections, including Article 75 Section 4, cannot supersede it.

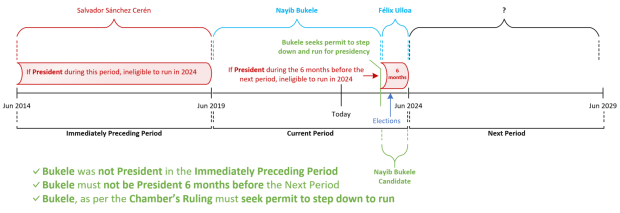

3. Further, it clarified that, although the president cannot be re-elected as an incumbent, the president may seek a second term by obtaining a permit from the legislative assembly to step down from the presidency to run as a candidate, as long as he is not president in the six months before the next term begins. This interpretation allows for citizens to promote a second term, because it is constitutionally possible.

4. The chamber provided additional clarity on Article 152, Section 1, where it reveals a path for a legal second term:

A translation of the original 1983 version of the constitution, Article 152 states:

“The following may not be candidates for President of the Republic:

Section 1 – Those who have held the Presidency of the Republic for more than six months, consecutive or not, during the immediately preceding period or within the last six months before the start of the presidential term”

The court highlighted that the immediately preceding period is not the current presidential period; therefore, the current president could choose to seek a candidacy, provided he is not the president at the time of running.

It highlighted the importance of a candidate not being the president within the last six months before the start of the presidential term because of the advantage of incumbency and using the power of the office for campaigning.

5. The ruling also addressed that if the president seeks a second term, they must request a permit to step down from the presidency to become a candidate and run.

6. The chamber interpreted the concept of alternability more than a change in president. However, that may happen due to a current president stepping down to run and the vice president assuming the role. Still, the chamber also defined “alternability” as the ability of the electorate, through freely-held elections, to have the option to choose another candidate if they wish.

7. A vital part of the chamber’s ruling was its direct instruction that pursuing a third presidential term is prohibited.

8. Finally, the chamber provided explicit instructions to the supreme electorate tribunal, which enforces the rules and administration of elections and facilitates the registration of the current president, provided that he desires to run and he meets the requirements.

Does El Salvador’s Constitution Prohibit A Second Presidential Term?

According to Arturo Mendez Azahar, who, as minister of justice and legal advisor to the presidency in 1983 served as one of the authors of the Salvadoran constitution, a second term has been legal and possible since this version was drafted.

In an interview with Bitcoin Magazine, Mendez Azahar said, “When you compare the current version of the Constitution to that of 1950 and 1962, where it specifically prohibited the president to be a candidate, you realize that a second term is an option. In the 1983 version, we took that prohibition out. Perhaps we made mistakes in drafting parts of the constitution, but this change was intentional. Constitutional lawyers of my generation have long understood that there is a way forward to seek a second presidential term.”

When asked why no one has tried to seek a second term, Mendez Azahar explained that all presidents believed they could only run for one period. He explained that imprisoned former president Tony Saca had successfully run when he was ineligible. In the 2014 election, despite Saca’s candidacy being unconstitutional, the supreme electorate tribunal allowed him to run.

Even more striking is that the last Salvadoran president, Salvador Sánchez Cerén had a candidacy that would likely be seen as unconstitutional. As former vice president under Mauricio Funes, Sánchez Cerén could not be a candidate because he had served his full term. Under the constitution, he had to seek a permit and step down six months before the next period began to have been a legal candidate. Despite the unconstitutionality of Sánchez Cerén’s candidacy, no one took notice, or perhaps it was entirely ignored, and he eventually won the election and became president of El Salvador.

Mendez Azahar explained that “the original 1950 constitution, under auspices of the U.S. and the Salvadoran oligarchy, made sure that no one could have a second term because they were concerned about the military holding on to perpetual power, or worse, a civilian president doing a good job. But once we removed that limit in 1983, it was our intention to make it difficult to ask for a second term. Only someone like Bukele has the confidence to ask the people for an exoneration to step down from the presidency to seek a second term. Salvadorans would have laughed at any former president making such a request.”

What Path Will Bukele Take?

The most likely scenario is that Bukele will ask the legislative assembly for a permit to step down from the presidency to run as a candidate, as prescribed by the chamber’s ruling. Even with permission from the legislative assembly, the supreme electorate tribunal cannot assure Bukele that his candidacy will be accepted, as this is the same body that blocked him in 2017. One of its key members, Julio Olivo, has gone on a national television talk show suggesting there should be a coup d’état against Bukele.

So, while there is a path for Bukele, it is neither assured nor without risks.

Ironically, in an attempt to discourage Bukele from seeking a second term, his opposition has facilitated the possibility not only for him to run but almost to guarantee his presidency, given his high approval rating. And while it may seem easy to group Bukele with Latin American caudillos, it’s essential to understand El Salvador’s laws and the potential legal path he has to run for the presidency for a second time.

Some may agree, and some will disagree, but knowing all the facts is crucial for Bitcoiners in evaluating the situation in Bitcoin Country.

This is a guest post by Jaime García. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Crypto

El Salvador Takes First Step To Issue Bitcoin Volcano Bonds

Published

2 years agoon

November 22, 2022

El Salvador’s Minister of the Economy Maria Luisa Hayem Brevé submitted a digital assets issuance bill to the country’s legislative assembly, paving the way for the launch of its bitcoin-backed “volcano” bonds.

First announced one year ago today, the pioneering initiative seeks to attract capital and investors to El Salvador. It was revealed at the time the plans to issue $1 billion in bonds on the Liquid Network, a federated Bitcoin sidechain, with the proceedings of the bonds being split between a $500 million direct allocation to bitcoin and an investment of the same amount in building out energy and bitcoin mining infrastructure in the region.

A sidechain is an independent blockchain that runs parallel to another blockchain, allowing for tokens from that blockchain to be used securely in the sidechain while abiding by a different set of rules, performance requirements, and security mechanisms. Liquid is a sidechain of Bitcoin that allows bitcoin to flow between the Liquid and Bitcoin networks with a two-way peg. A representation of bitcoin used in the Liquid network is referred to as L-BTC. Its verifiably equivalent amount of BTC is managed and secured by the network’s members, called functionaries.

“Digital securities law will enable El Salvador to be the financial center of central and south America,” wrote Paolo Ardoino, CTO of cryptocurrency exchange Bitfinex, on Twitter.

Bitfinex is set to be granted a license in order to be able to process and list the bond issuance in El Salvador.

The bonds will pay a 6.5% yield and enable fast-tracked citizenship for investors. The government will share half the additional gains with investors as a Bitcoin Dividend once the original $500 million has been monetized. These dividends will be dispersed annually using Blockstream’s asset management platform.

The act of submitting the bill, which was hinted at earlier this year, kickstarts the first major milestone before the bonds can see the light of day. The next is getting it approved, which is expected to happen before Christmas, a source close to President Nayib Bukele told Bitcoin Magazine. The bill was submitted on November 17 and presented to the country’s Congress today. It is embedded in full below.

Crypto

How I’ll Talk To Family Members About Bitcoin This Thanksgiving

Published

2 years agoon

November 22, 2022

This is an opinion editorial by Joakim Book, a Research Fellow at the American Institute for Economic Research, contributor and copy editor for Bitcoin Magazine and a writer on all things money and financial history.

I don’t.

That’s it. That’s the article.

In all sincerity, that is the full message: Just don’t do it. It’s not worth it.

You’re not an excited teenager anymore, in desperate need of bragging credits or trying out your newfound wisdom. You’re not a preaching priestess with lost souls to save right before some imminent arrival of the day of reckoning. We have time.

Instead: just leave people alone. Seriously. They came to Thanksgiving dinner to relax and rejoice with family, laugh, tell stories and zone out for a day — not to be ambushed with what to them will sound like a deranged rant in some obscure topic they couldn’t care less about. Even if it’s the monetary system, which nobody understands anyway.

Get real.

If you’re not convinced of this Dale Carnegie-esque social approach, and you still naively think that your meager words in between bites can change anybody’s view on anything, here are some more serious reasons for why you don’t talk to friends and family about Bitcoin the protocol — but most certainly not bitcoin, the asset:

- Your family and friends don’t want to hear it. Move on.

- For op-sec reasons, you don’t want to draw unnecessary attention to the fact that you probably have a decent bitcoin stack. Hopefully, family and close friends should be safe enough to confide in, but people talk and that gossip can only hurt you.

- People find bitcoin interesting only when they’re ready to; everyone gets the price they deserve. Like Gigi says in “21 Lessons:”

“Bitcoin will be understood by you as soon as you are ready, and I also believe that the first fractions of a bitcoin will find you as soon as you are ready to receive them. In essence, everyone will get ₿itcoin at exactly the right time.”

It’s highly unlikely that your uncle or mother-in-law just happens to be at that stage, just when you’re about to sit down for dinner.

- Unless you can claim youth, old age or extreme poverty, there are very few people who genuinely haven’t heard of bitcoin. That means your evangelizing wouldn’t be preaching to lost, ignorant souls ready to be saved but the tired, huddled and jaded masses who could care less about the discovery that will change their societies more than the internal combustion engine, internet and Big Government combined. Big deal.

- What is the case, however, is that everyone in your prospective audience has already had a couple of touchpoints and rejected bitcoin for this or that standard FUD. It’s a scam; seems weird; it’s dead; let’s trust the central bankers, who have our best interest at heart.

No amount of FUD busting changes that impression, because nobody holds uninformed and fringe convictions for rational reasons, reasons that can be flipped by your enthusiastic arguments in-between wiping off cranberry sauce and grabbing another turkey slice. - It really is bad form to talk about money — and bitcoin is the best money there is. Be classy.

Now, I’m not saying to never ever talk about Bitcoin. We love to talk Bitcoin — that’s why we go to meetups, join Twitter Spaces, write, code, run nodes, listen to podcasts, attend conferences. People there get something about this monetary rebellion and have opted in to be part of it. Your unsuspecting family members have not; ambushing them with the wonders of multisig, the magically fast Lightning transactions or how they too really need to get on this hype train, like, yesterday, is unlikely to go down well.

However, if in the post-dinner lull on the porch someone comes to you one-on-one, whisky in hand and of an inquisitive mind, that’s a very different story. That’s personal rather than public, and it’s without the time constraints that so usually trouble us. It involves clarifying questions or doubts for somebody who is both expressively curious about the topic and available for the talk. That’s rare — cherish it, and nurture it.

Last year I wrote something about the proper role of political conversations in social settings. Since November was also election month, it’s appropriate to cite here:

“Politics, I’m starting to believe, best belongs in the closet — rebranded and brought out for the specific occasion. Or perhaps the bedroom, with those you most trust, love, and respect. Not in public, not with strangers, not with friends, and most certainly not with other people in your community. Purge it from your being as much as you possibly could, and refuse to let political issues invade the areas of our lives that we cherish; politics and political disagreements don’t belong there, and our lives are too important to let them be ruled by (mostly contrived) political disagreements.”

If anything, those words seem more true today than they even did then. And I posit to you that the same applies for bitcoin.

Everyone has some sort of impression or opinion of bitcoin — and most of them are plain wrong. But there’s nothing people love more than a savior in white armor, riding in to dispel their errors about some thing they are freshly out of fucks for. Just like politics, nobody really cares.

Leave them alone. They will find bitcoin in their own time, just like all of us did.

This is a guest post by Joakim Book. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

This is an opinion editorial by Federico Tenga, a long time contributor to Bitcoin projects with experience as start-up founder, consultant and educator.

The term “smart contracts” predates the invention of the blockchain and Bitcoin itself. Its first mention is in a 1994 article by Nick Szabo, who defined smart contracts as a “computerized transaction protocol that executes the terms of a contract.” While by this definition Bitcoin, thanks to its scripting language, supported smart contracts from the very first block, the term was popularized only later by Ethereum promoters, who twisted the original definition as “code that is redundantly executed by all nodes in a global consensus network”

While delegating code execution to a global consensus network has advantages (e.g. it is easy to deploy unowed contracts, such as the popularly automated market makers), this design has one major flaw: lack of scalability (and privacy). If every node in a network must redundantly run the same code, the amount of code that can actually be executed without excessively increasing the cost of running a node (and thus preserving decentralization) remains scarce, meaning that only a small number of contracts can be executed.

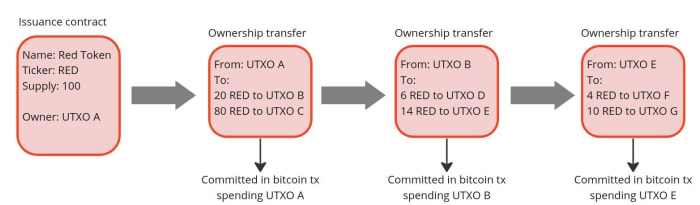

But what if we could design a system where the terms of the contract are executed and validated only by the parties involved, rather than by all members of the network? Let us imagine the example of a company that wants to issue shares. Instead of publishing the issuance contract publicly on a global ledger and using that ledger to track all future transfers of ownership, it could simply issue the shares privately and pass to the buyers the right to further transfer them. Then, the right to transfer ownership can be passed on to each new owner as if it were an amendment to the original issuance contract. In this way, each owner can independently verify that the shares he or she received are genuine by reading the original contract and validating that all the history of amendments that moved the shares conform to the rules set forth in the original contract.

This is actually nothing new, it is indeed the same mechanism that was used to transfer property before public registers became popular. In the U.K., for example, it was not compulsory to register a property when its ownership was transferred until the ‘90s. This means that still today over 15% of land in England and Wales is unregistered. If you are buying an unregistered property, instead of checking on a registry if the seller is the true owner, you would have to verify an unbroken chain of ownership going back at least 15 years (a period considered long enough to assume that the seller has sufficient title to the property). In doing so, you must ensure that any transfer of ownership has been carried out correctly and that any mortgages used for previous transactions have been paid off in full. This model has the advantage of improved privacy over ownership, and you do not have to rely on the maintainer of the public land register. On the other hand, it makes the verification of the seller’s ownership much more complicated for the buyer.

Source: Title deed of unregistered real estate propriety

How can the transfer of unregistered properties be improved? First of all, by making it a digitized process. If there is code that can be run by a computer to verify that all the history of ownership transfers is in compliance with the original contract rules, buying and selling becomes much faster and cheaper.

Secondly, to avoid the risk of the seller double-spending their asset, a system of proof of publication must be implemented. For example, we could implement a rule that every transfer of ownership must be committed on a predefined spot of a well-known newspaper (e.g. put the hash of the transfer of ownership in the upper-right corner of the first page of the New York Times). Since you cannot place the hash of a transfer in the same place twice, this prevents double-spending attempts. However, using a famous newspaper for this purpose has some disadvantages:

- You have to buy a lot of newspapers for the verification process. Not very practical.

- Each contract needs its own space in the newspaper. Not very scalable.

- The newspaper editor can easily censor or, even worse, simulate double-spending by putting a random hash in your slot, making any potential buyer of your asset think it has been sold before, and discouraging them from buying it. Not very trustless.

For these reasons, a better place to post proof of ownership transfers needs to be found. And what better option than the Bitcoin blockchain, an already established trusted public ledger with strong incentives to keep it censorship-resistant and decentralized?

If we use Bitcoin, we should not specify a fixed place in the block where the commitment to transfer ownership must occur (e.g. in the first transaction) because, just like with the editor of the New York Times, the miner could mess with it. A better approach is to place the commitment in a predefined Bitcoin transaction, more specifically in a transaction that originates from an unspent transaction output (UTXO) to which the ownership of the asset to be issued is linked. The link between an asset and a bitcoin UTXO can occur either in the contract that issues the asset or in a subsequent transfer of ownership, each time making the target UTXO the controller of the transferred asset. In this way, we have clearly defined where the obligation to transfer ownership should be (i.e in the Bitcoin transaction originating from a particular UTXO). Anyone running a Bitcoin node can independently verify the commitments and neither the miners nor any other entity are able to censor or interfere with the asset transfer in any way.

Since on the Bitcoin blockchain we only publish a commitment of an ownership transfer, not the content of the transfer itself, the seller needs a dedicated communication channel to provide the buyer with all the proofs that the ownership transfer is valid. This could be done in a number of ways, potentially even by printing out the proofs and shipping them with a carrier pigeon, which, while a bit impractical, would still do the job. But the best option to avoid the censorship and privacy violations is establish a direct peer-to-peer encrypted communication, which compared to the pigeons also has the advantage of being easy to integrate with a software to verify the proofs received from the counterparty.

This model just described for client-side validated contracts and ownership transfers is exactly what has been implemented with the RGB protocol. With RGB, it is possible to create a contract that defines rights, assigns them to one or more existing bitcoin UTXO and specifies how their ownership can be transferred. The contract can be created starting from a template, called a “schema,” in which the creator of the contract only adjusts the parameters and ownership rights, as is done with traditional legal contracts. Currently, there are two types of schemas in RGB: one for issuing fungible tokens (RGB20) and a second for issuing collectibles (RGB21), but in the future, more schemas can be developed by anyone in a permissionless fashion without requiring changes at the protocol level.

To use a more practical example, an issuer of fungible assets (e.g. company shares, stablecoins, etc.) can use the RGB20 schema template and create a contract defining how many tokens it will issue, the name of the asset and some additional metadata associated with it. It can then define which bitcoin UTXO has the right to transfer ownership of the created tokens and assign other rights to other UTXOs, such as the right to make a secondary issuance or to renominate the asset. Each client receiving tokens created by this contract will be able to verify the content of the Genesis contract and validate that any transfer of ownership in the history of the token received has complied with the rules set out therein.

So what can we do with RGB in practice today? First and foremost, it enables the issuance and the transfer of tokenized assets with better scalability and privacy compared to any existing alternative. On the privacy side, RGB benefits from the fact that all transfer-related data is kept client-side, so a blockchain observer cannot extract any information about the user’s financial activities (it is not even possible to distinguish a bitcoin transaction containing an RGB commitment from a regular one), moreover, the receiver shares with the sender only blinded UTXO (i. e. the hash of the concatenation between the UTXO in which she wish to receive the assets and a random number) instead of the UTXO itself, so it is not possible for the payer to monitor future activities of the receiver. To further increase the privacy of users, RGB also adopts the bulletproof cryptographic mechanism to hide the amounts in the history of asset transfers, so that even future owners of assets have an obfuscated view of the financial behavior of previous holders.

In terms of scalability, RGB offers some advantages as well. First of all, most of the data is kept off-chain, as the blockchain is only used as a commitment layer, reducing the fees that need to be paid and meaning that each client only validates the transfers it is interested in instead of all the activity of a global network. Since an RGB transfer still requires a Bitcoin transaction, the fee saving may seem minimal, but when you start introducing transaction batching they can quickly become massive. Indeed, it is possible to transfer all the tokens (or, more generally, “rights”) associated with a UTXO towards an arbitrary amount of recipients with a single commitment in a single bitcoin transaction. Let’s assume you are a service provider making payouts to several users at once. With RGB, you can commit in a single Bitcoin transaction thousands of transfers to thousands of users requesting different types of assets, making the marginal cost of each single payout absolutely negligible.

Another fee-saving mechanism for issuers of low value assets is that in RGB the issuance of an asset does not require paying fees. This happens because the creation of an issuance contract does not need to be committed on the blockchain. A contract simply defines to which already existing UTXO the newly issued assets will be allocated to. So if you are an artist interested in creating collectible tokens, you can issue as many as you want for free and then only pay the bitcoin transaction fee when a buyer shows up and requests the token to be assigned to their UTXO.

Furthermore, because RGB is built on top of bitcoin transactions, it is also compatible with the Lightning Network. While it is not yet implemented at the time of writing, it will be possible to create asset-specific Lightning channels and route payments through them, similar to how it works with normal Lightning transactions.

Conclusion

RGB is a groundbreaking innovation that opens up to new use cases using a completely new paradigm, but which tools are available to use it? If you want to experiment with the core of the technology itself, you should directly try out the RGB node. If you want to build applications on top of RGB without having to deep dive into the complexity of the protocol, you can use the rgb-lib library, which provides a simple interface for developers. If you just want to try to issue and transfer assets, you can play with Iris Wallet for Android, whose code is also open source on GitHub. If you just want to learn more about RGB you can check out this list of resources.

This is a guest post by Federico Tenga. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.