Crypto

The Proof Of Work Behind Proof-Of-Work — Bitcoin Mining Profitability Doesn’t Come Easy

Published

2 years agoon

Photo courtesy of Brekkie von Bitcoin.

The inspiration of this article comes from spending a weekend with Nick Foster.

Over the past few years, there has been an incredible amount of interest dedicated toward the bitcoin mining space. It is apparent that many interested parties lack the understanding of how difficult it is to be a participant in this industry, and the amount of work that goes into plugging in a machine so that it begins hashing. This lack of understanding can be attributed to a general disconnect from the complexities of the entire process, because you cannot truly understand it until you try it. What I would like to convey in this article is how much work is necessary in order to build the infrastructure needed to process a Bitcoin transaction.

To be successful in this industry, you need to have some sort of edge over the competition. One such edge is being a maniac. Just passively strolling onto the scene with a “How hard can plugging in computers be?” attitude will not cut it. Having access to capital is not a guarantee that you will make it.

This market is incredibly difficult not only from a Bitcoin-economic standpoint, but also a manpower, hardware, regulatory and logistical standpoint. Difficulties have been massively exacerbated by current supply-chain and manufacturing complexities. Mining is not for the faint of heart, and to be successful in the business you have to be relentless.

Proof Of Work

Bitcoin wants the highest possible amount of effort expended to create the most security for the network. The network needs this to counter bad actors. That being said, increasing network hash rate is a tremendous amount of work just in and of itself.

A petahash consists of about 10 S19s and an exahash is about 10,000 S19s. So, looking at a network hashrate of 200 EH, that means — translated in S19s as a measurement — that there is an equivalent of two million S19s currently plugged in. 312 S19s comes out to a megawatt, so that means that the entire network consumes roughly 6.4 terawatts of power. In reality, a large portion of ASICs currently in circulation are not nearly as efficient as the S19. That means my estimates on power consumption are extremely low.

The math done here is a massive oversimplification. An S19 has a power consumption of around 3.2 kW and has an efficiency of around 29.5 watts per terahash (W/Th). S9s in comparison are around 85 W/Th. The University of Cambridge’s Centre for Alternative Finance did a much more in-depth attempt to measure Bitcoin’s energy usage which you can check out here: Cambridge Bitcoin Electricity Consumption Index (CBECI). In comparison to global energy usage, Bitcoin mining is a rounding error, but even still it is quite impressive.

The top-10 mining pools have roughly 191 EH directed between them. They mine the majority of blocks. That means for Slushpool (9 EH), it takes the work of almost 100,000 S19s. The amount of work that goes behind a user being able to send a Bitcoin transaction is absolutely astronomical. In the rest of this article, I want to talk about the proof of work a miner has to show in setting up their machines in order to make this all possible.

There Are No Experts

The mining industry is constantly changing. When an ASIC manufacturer releases a new machine, everything changes. Even as they continue to produce the machine, things are constantly changing as they tweak it. Manufacturers are often not forthcoming with changes they make, so users have to work with trying to piece together information from equipment they have.

By the time you get a grasp on a certain topic, everything will have changed. To be successful, individuals need to constantly be on their toes, willing to experiment through trial and error. Individuals also need to have connections throughout the industry to source accurate information in order to be successful. Bitcoin mining may be the most competitive industry on Earth right now, so individuals are often not too transparent with the data they are sharing. This creates an incredibly confusing landscape to wade through.

ASIC trends seem to be moving towards increasing density of hash rate and power consumption. For example, the Antminer S9 has a power consumption of 1,400W; The Antminer S19 has a power consumption of 3,250W; The Whatsminer M53 has a power consumption of 6,554W. The massive increase in power consumption means that typical electrical infrastructure changes from generation to generation of ASIC. Infrastructure and methods that worked in the past will most likely not work in the future. It takes constant diligence and work to stay updated on trends.

Logistics

There is a big reason why Kaboomracks is not only in business but is thriving. Logistics are incredibly difficult and are only getting more difficult. Our employees for some reason really enjoy pain and are willing to run headlong into the mess which is international logistics. Even if you have been in the space for a while, the amount of effort needed to get things from point A to point B is astronomical. First, you have to find what you need. Then, you have to verify that the vendor you are working with is legitimate and is not going to scam you. Next, you have to determine how you are going to get it where you need to. All of that is a tremendous amount of work. Knowing when and why you may want to send something by air versus sea is a big decision that needs to be calculated and takes time to determine. What do you do if you do everything right but the guy with the shipping company is having a bad day and decides to run a forklift through your pallet? These are things that can only be solved through experience and an immense amount of time, research, yelling and pulling your hair out.

ASIC Hardware

The hardware market is incredibly difficult for a variety of reasons. There are a ton of calculations you have to make in the process to ensure you are successful. There are a variety of ASIC suppliers, but which ones will actually deliver you a unit that will get you where you need to go? How many power supplies and control boards should you have on hand for inevitable failures? What amount of downtime is tolerable for you to be willing to send your machine for warranty repair? These are not simple questions to answer and vary depending on the machine and which production run they were manufactured in. These decisions also depend on where you live and what the manufacturer warranty process looks like.

For example, many people got completely turned upside down by Bitmain’s S17 and its incredibly high failure rate as a result of heat-sink issues. That was something that was impossible to know for individuals who preordered it. Knowing when and how to enter into buying ASICs is also incredibly difficult because you are having to time the bitcoin price. ASIC prices act like a lever and the bitcoin price is a fulcrum. If the bitcoin price shoots up, ASIC prices will shoot up even more. Knowing the warranty game is a challenge because things are constantly changing.

If you live in Canada, you cannot send units for warranty repair in the U.S. This is because there are tariffs preventing it from being cost-effective and there are no certified Bitmain warranty centers in Canada. They expect you to send your unit all the way to Hong Kong, which is absurdly expensive from a shipping standpoint, but also a time standpoint. In the same category, if you have a PSU go bad and you live anywhere in the world, the only certified Bitmain warranty center that will accept it is located in Hong Kong as well.

This means that you as an operator have to make a decision on the front-end on what equipment you will buy depending on expected failure rate, with almost no information. You have to have a plan on what you will do when the units fail. This being said, this is hard work and will not be solved in a day. It will be informed by data that you collect from your own experience, but also anecdotes from other individuals in the industry.

Manpower

McDonalds, Target and other major businesses are having an incredibly difficult time finding people to work for them. The mining industry is not an industry you can just throw bodies at. You need to find the right people, which is practically impossible. You may find some solid individuals with almost no experience in the field, but then you have to train them which takes time and energy that you may not have available. It’s difficult to know if in three months, an individual will be able to effectively troubleshoot a machine, deploy miner management software, tune aftermarket firmware or understand the intricacies of power consumption.

There are many disciplines an individual has to understand, which is made incredibly difficult by the fact that there is almost no documentation on these topics for you to pull from. As an operator, you have to be an expert by having gotten experience to be able to answer this. It is possible to manage with little experience if you have connections with individuals in the field you have to pull from. The moral of the story here is that this is work and you cannot just throw a random person into the fray and expect it to work out immediately.

Finding the right individual is made more difficult by the fact that mining is highly dependent on location. You cannot find cheap power everywhere. Oftentimes you have to pull from individuals in your general area which really limits those available with the skill set to accomplish what you need them to.

Having a background in Bitcoin does not guarantee that the individual is a good fit for mining. Likewise, having a background in electrical engineering or hardware is also not a guarantee that an individual will be a good fit. Individuals coming into the space must have the capacity to be constantly learning and dealing with painful headaches. That being said, to find an individual like this is a tremendous amount of work. It is also a tremendous amount of time and work to develop them right, in order for them to be successful.

Hosting:

Retail hosting and large-scale hosting are two entirely different things. Most large-scale hosts deal in megawatts and a larger number of units. That means that even to be considered as a potential client, you need a minimum of 300 new generation miners. Finding the right host, with the right power rates that will be responsive to your needs is difficult and takes knowledge of the space. Energy markets are in turmoil, which can make working with a host incredibly challenging right now. Hosts face the same risks you do in that you may build up a ton of infrastructure only to get rug pulled by regulations or your electric companies.

Hosting is definitely advantageous for the new operator, as they do not have to wade through as much unknown, as described above. Hosting gives you the ability to outsource a lot of the headaches of actually deploying and maintaining equipment, but it also gives you less control over your miners. Typically, the host will include a hosting fee in the electric rate, and you will have to determine if this makes sense for you as an operator, versus deploying your own infrastructure and hiring individuals to maintain it.

Doing the correct due diligence on the host is a tremendous amount of work. You cannot be too thorough and should not trust them just because someone said good things about them or they had good marketing. You need to be confident that your host will not get rug pulled by their power company or will be unable to service your machines and keep them online.

Estimating Profitability

If you go and plug your miner information into a mining calculator, odds are that profitability will look incredibly different a month later. This makes it difficult to determine the future profitability of your machines. When you are pricing things out, there are two factors which can turn your calculation upside down really fast.

The first one is the bitcoin price. If it plummets, you will still be mining the same amount of bitcoin, but essentially your electric rates, compared to your income, increased dramatically. You have to be prepared to watch your profits shrink incredibly quickly. If it becomes unprofitable for a lot of miners, they will have to unplug and there will be a difficulty adjustment. As difficulty drops, as a result of fewer participants, your mining rewards will increase in bitcoin terms.

The second factor that can impact your profitability is difficulty increasing. On average, hash rate has doubled every year. As hash rate increases, the amount of bitcoin you mine will go down. This typically is okay because the dollar price goes up over time, but in times where price is down and hash rate is climbing, it can become incredibly painful for you. One circumstance that leads to this happening is the release of a new generation of hardware.

Keeping these things in mind, it is important to really weigh the up-front costs you are willing to pay, as it will add to your return-on-investment (ROI) time. Most people get into mining when times are good and are unaware of how ugly things can get when times are rough. Doing research and talking with people who have been in the space can definitely save you from heartache.

Power Generation And Procurement

There are multiple ways for an operator to acquire their power. By far, most individuals acquire it by buying it from the grid. A smaller, hard-core group of masochists choose to generate their own power by setting up generators on oil and natural gas wells. Either way, there is a tremendous amount of energy that needs to be expended to be able to find inexpensive energy.

A lot of people are concerned with renewables. As a miner, you have to decide what energy sources are reliable and consistent, rather than what is the fad. This takes real, hard math to determine. There are definitely different models in regard to types of power. Some people find it attractive to control their power production, and others prefer to just buy it from a producer.

Energy markets are tough, and it is not easy to just go to your local power company and negotiate favorable prices. Oftentimes, you have to do some digging to find a location next to a substation and try to determine how much excess power there is. There are firms that you can hire to find power for you. Another option is to hang around substations and pass out $100 bills and beer to the workers servicing it to try and get some inside information.

One of the best ways to find excess electrical capacity is to look for industrial places where a lot of large power consumption businesses have moved from or shut down. Whichever direction you go, it will take time and effort to figure this out before you break ground on your site.

Electrical Infrastructure

Lead times on transformers are absurd right now; The lead times on just about anything is horrible right now. First you have to get the equipment you need, then you need to find an electrician to install it. Finding an electrician is not just as simple as calling one up. You need to find someone who is competent enough to do the job correctly, but also is available to do it in a timely manner. In a time when everyone is understaffed — and booked up — this can be quite the task.

When you take shortcuts, you will most likely run into issues. Timelines are incredibly difficult to stick to or formulate because there are so many moving pieces that can disrupt your goals. All this being said, this is more work.

Plugging in ASICs and installing infrastructure is dangerous. It is a completely different business than traditional server hosting or what you would do in a data center. Oftentimes, operators have to improvise and develop the products they need for themselves with the manufacturer. Having a smart power distribution unit (PDU) that collects power consumption data is incredibly useful, but having it made for the type of power consumption that ASICs need is a whole different story. Learning that this process is constantly evolving is a lot of work.

Aftermarket Firmware

Aftermarket firmware is another discussion to have as it can increase your hash rate/power consumption, without up-front equipment costs. If you are doing immersion, it is almost a must to run firmware for overclocking. Firmware adds a whole new world of possibilities but also headaches.

There are some challenges that aftermarket firmware creates. It adds complexity to your operation and can increase machine downtime as a result. Also, if you are not aware of the specs on your equipment, you may damage your electrical infrastructure from increasing the power consumption, or even damage the ASICs themselves. Some firmware is not compatible with all control boards. If you do decide to implement it, it may mean swapping a bunch of control boards. To get the most out of overclocking, it will mean potentially swapping all the PSUs on the machines.

Another challenge is learning how to properly use the firmware. Tuning specifications will be different between machine models: Some models are better for overclocking than others. You can outsource this or take the time and energy to have someone trained in-house.

All in all, some find pursuing aftermarket firmware incredibly fruitful, but there are still a lot of scenarios you have to consider before using it. Again, something as simple as installing a program to run on your machines is a ton of work to implement and can have a bunch of consequences.

Immersion

Immersion opens up the door to a lot of possibilities. It is advantageous, especially in hotter climates, and will extend the life cycle of your machines. You can dramatically increase the overclocking using firmware. Immersion adds a massive increase to your up-front cost, but you may find it worth pursuing. There are many advantages to using it — but once again, it adds a lot of complexity to your operation.

Machines will run substantially more efficiently in immersion, which makes a massive difference at scale. Sourcing the proper equipment for immersion adds to the cluster, which is dealing with long lead times and logistics. There are a lot of people making tanks out there, which makes it difficult to determine what is good quality.

Another difficulty that immersion creates is making servicing machines more challenging. If a power supply unit (PSU) or a control board goes bad, there is a lot more work needed to pull the machine out of the oil and replace the part. Even prepping machines for immersion in the first place can be a lot of work.

Mining Pools

Payout structures are different from pool to pool. Also, your potential income will be different from pool to pool depending on how many blocks that pool mines. Sometimes, mining pools have bugs and make mistakes, so it is good practice to closely monitor your payouts. Monitoring software like Foreman offers the ability to do this, but costs money.

It is difficult to gather data on this topic because things are constantly changing in regard to pool hash rate and pool infrastructure. What many miners do is set a portion of their hash rate to different pools and gather data. It is good practice to be prepared to switch pools if they have any downtime.

Miner costs are consistent, so miners benefit from having their rewards be consistent. Luck-based rewards systems make much more sense for small miners that want to roll the dice than they do for operations with six-figure electric bills. Understanding payout structures, pool performance and monitoring if your payouts are correct is hard work.

Networking

Networking in and of itself is a tremendous task to take on. Having multiple options of ISPs (internet service providers) is important to minimize downtime. It is not usually as simple as setting up with multiple internet providers, as oftentimes they will piggyback off each other and will not be transparent with you about this. This means that if one goes down, several might at the same time.

The physical topology of networking is an in-depth conversation in and of itself. If you yourself are not knowledgeable, it is another thing that can be contracted out. Having control over and being knowledgeable over your network, versus being reliant on outside contractors, is definitely a major advantage. Networking has a tremendously steep learning curve and either way is a tremendous amount of work. Networking for a Bitcoin mine is a lot different than setting up a home router.

Though ASICs do not take up a tremendous amount of bandwidth, they need a good connection with the pool 24/7. Proper networking can help an operator minimize their downtime and improper networking will create a mess. Nothing is simple about this process.

Home Miners

Thanks to Matt Odell’s podcast, Citadel Dispatch, there has been a tremendous amount of interest in mining at home. I shouldn’t give Odell all the credit, as other Twitter personalities such as Diverter_NoKYC, Econoalchemist and Roninminer have been influential as well. That being said, people have proven that you can mine at home and it can make sense.

Once again, the process of setting up ASICs in your home is quite the process. These machines are industrial grade and not made for your home. This is not a flaw in their design, but just how it is. The ASIC market compared to general electronics is tiny, and the home mining market is even smaller. The infrastructure to run multiple machines generally is not there before modifications. For most people, there are only two outlets that can deliver enough power for a S19 or M30s to run: the dryer and oven outlets.

An individual will have to figure out how much power is expendable to them, the rates at which they are charged and how to mitigate the temperature and noise. Doing this properly is important because most individuals do not want to burn down their houses. The biggest challenge for an individual is figuring out how to not burn their house down with limited documentation. All in all, the process of mining at home takes work.

Regulatory Risk

As seen by the most recent China ban, regulatory risk is real. A local or national government oftentimes has no issue with rug pulling an operation. There have been many examples of this and there will be many more going forward. This is a really difficult thing to build a threat model for in our politically volatile environment.

Something to consider on this topic is building out in multiple jurisdictions, versus just one. Having multiple locations allows you to potentially move and build out more if needed, but also means that you need more manpower to manage your sites. It is not easy to just pick up and move, as it is almost starting over from scratch.

Another approach is lobbying local politicians and working really hard to get the buy-in from the local community. Riot has been very effective at this with their Whinstone site in Rockdale, Texas. They are consistently engaging with Bitcoin conferences, media and their local community to get their buy-in. You can often get away with flying under the radar if you are small. When you get bigger, there will be a lot more scrutiny on you. One approach that has been taken is actually setting up local governments with the ability to mine themselves.

Bitcoin mining is ultimately a net benefit to any community, and it is advantageous to teach people about this. Staying in the good graces of the community is probably worth pursuing because it is a shield to protect you but is also worthwhile because it aligns with Bitcoin’s mission of empowering the individual. It is a major opportunity to help strengthen and give back to the community you are operating in. Giving back to the local community is always a good business practice. That being said, all of this is more work added to your plate.

Geopolitical Risk

Cheap power does not always mean a safe environment to run a stable mining operation, as seen by Ukraine, Russia and Kazakhstan. When you are choosing the location of your operation, potential geopolitical risks have to be weighed seriously. If a government has shown to be hostile towards mining in the past, they should be taken seriously.

Cross-border sanctions can play a major role. If you are setting up an operation outside of the U.S., something to consider is having your business located outside of the U.S. as well to potentially limit the impact of sanctions. There has been a tremendous amount of growth in U.S.-based mining, but it remains to be seen if the U.S. is truly a safe spot to have a long-term operation.

Virtually all ASICs are produced in China, and the companies producing them are based in China. They have been working around sanctions against China by shipping and moving parts of production out of China. Geopolitical tensions between the U.S. and China may make it far more difficult to source equipment in the future despite this, which may or may not make it advantageous to be outside the U.S. That being said, there is a lot of work needed in order to think through and prepare for a lot of potential scenarios that could have major impacts on your operation.

Are You Built For This?

The oil and gas world is a perfect fit for the mining space, because they are already exposed to and fully understand the pain that is involved with a similar industry. They are also predisposed to understanding energy markets like no one else is. If you are an individual who likes to sit in a nice, air-conditioned office, but does not like to get your hands dirty, mining is not for you.

For some individuals, the industry is too difficult, and they will quickly give up when it does not work. For others, mining is an addiction that you can’t let go of. It consumes your life until all your fingers are bleeding from being cut on fans or pulling out ribbon wires. It is an industry like no other, but it sure as hell is a fun industry to be a part of.

Security For Users

All the effort that goes into proof-of-work makes the network extremely secure. Say for instance, a government or large powerful entity wants to take control of the network. They would have to deploy a monumental amount of equipment. The equipment needed to take over the network just isn’t there and neither are the incentives. The Bitcoin network is backed by thousands of insane masochists chasing a profit to the ends of the Earth.

The media, which represents the incumbent system that Bitcoin is displacing, decries Bitcoin’s energy use. If anything, the complexity and industriousness of this industry should be celebrated. We are building the most secure and best monetary network ever created, which is moving humanity forwards in so many ways. Crazy masochists allow Bitcoin users to move large amounts of money, inexpensively, anywhere in the world without reliance on third parties.

The amount of effort that goes into mining Bitcoin takes an astounding amount of emotional energy. This emotional energy is just as powerful, if not more so, as the financial capital put into setting up an operation. Miners literally bleed going through the process of setting up their mines. Miners will continue to mine, innovate and put pressure on forces trying to attack the network.

Final Thoughts

There is nothing simple about Bitcoin, and there is absolutely nothing simple about mining bitcoin. The complexity of sourcing and setting up infrastructure is a force that inevitably distributes network hash rate. The average Bitcoin user will never understand the heartache that goes into mining Bitcoin but will still experience the benefits from it.

The competitive and constantly changing nature of the market means that there will be a constant flow of participants entering and exiting. The name of the game is survival. Operators have to be prepared for the worst-case scenario and have to be willing to adjust in accordance with it. There is not an easy path to take in this industry.

To survive, you have to work countless hours in order to make sure that things work. You will hit roadblocks, get massive headaches and wake up in the morning feeling hungover without having taken a single drink. For some strange reason, thousands of us find this kind of work incredibly fulfilling. All of this effort is what it takes to mine bitcoin and is the proof of work behind proof-of-work.

This is a guest post by Kaboomracks Alex. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.

Crypto

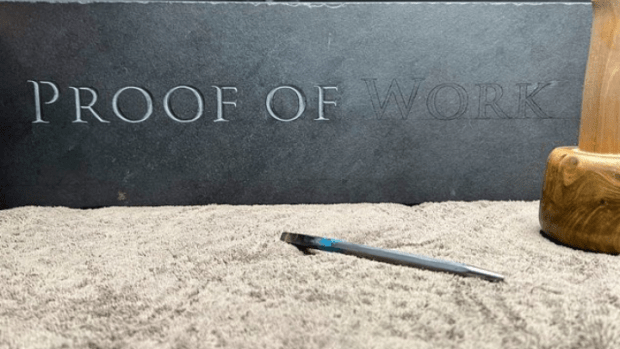

El Salvador Takes First Step To Issue Bitcoin Volcano Bonds

Published

2 years agoon

November 22, 2022

El Salvador’s Minister of the Economy Maria Luisa Hayem Brevé submitted a digital assets issuance bill to the country’s legislative assembly, paving the way for the launch of its bitcoin-backed “volcano” bonds.

First announced one year ago today, the pioneering initiative seeks to attract capital and investors to El Salvador. It was revealed at the time the plans to issue $1 billion in bonds on the Liquid Network, a federated Bitcoin sidechain, with the proceedings of the bonds being split between a $500 million direct allocation to bitcoin and an investment of the same amount in building out energy and bitcoin mining infrastructure in the region.

A sidechain is an independent blockchain that runs parallel to another blockchain, allowing for tokens from that blockchain to be used securely in the sidechain while abiding by a different set of rules, performance requirements, and security mechanisms. Liquid is a sidechain of Bitcoin that allows bitcoin to flow between the Liquid and Bitcoin networks with a two-way peg. A representation of bitcoin used in the Liquid network is referred to as L-BTC. Its verifiably equivalent amount of BTC is managed and secured by the network’s members, called functionaries.

“Digital securities law will enable El Salvador to be the financial center of central and south America,” wrote Paolo Ardoino, CTO of cryptocurrency exchange Bitfinex, on Twitter.

Bitfinex is set to be granted a license in order to be able to process and list the bond issuance in El Salvador.

The bonds will pay a 6.5% yield and enable fast-tracked citizenship for investors. The government will share half the additional gains with investors as a Bitcoin Dividend once the original $500 million has been monetized. These dividends will be dispersed annually using Blockstream’s asset management platform.

The act of submitting the bill, which was hinted at earlier this year, kickstarts the first major milestone before the bonds can see the light of day. The next is getting it approved, which is expected to happen before Christmas, a source close to President Nayib Bukele told Bitcoin Magazine. The bill was submitted on November 17 and presented to the country’s Congress today. It is embedded in full below.

Crypto

How I’ll Talk To Family Members About Bitcoin This Thanksgiving

Published

2 years agoon

November 22, 2022

This is an opinion editorial by Joakim Book, a Research Fellow at the American Institute for Economic Research, contributor and copy editor for Bitcoin Magazine and a writer on all things money and financial history.

I don’t.

That’s it. That’s the article.

In all sincerity, that is the full message: Just don’t do it. It’s not worth it.

You’re not an excited teenager anymore, in desperate need of bragging credits or trying out your newfound wisdom. You’re not a preaching priestess with lost souls to save right before some imminent arrival of the day of reckoning. We have time.

Instead: just leave people alone. Seriously. They came to Thanksgiving dinner to relax and rejoice with family, laugh, tell stories and zone out for a day — not to be ambushed with what to them will sound like a deranged rant in some obscure topic they couldn’t care less about. Even if it’s the monetary system, which nobody understands anyway.

Get real.

If you’re not convinced of this Dale Carnegie-esque social approach, and you still naively think that your meager words in between bites can change anybody’s view on anything, here are some more serious reasons for why you don’t talk to friends and family about Bitcoin the protocol — but most certainly not bitcoin, the asset:

- Your family and friends don’t want to hear it. Move on.

- For op-sec reasons, you don’t want to draw unnecessary attention to the fact that you probably have a decent bitcoin stack. Hopefully, family and close friends should be safe enough to confide in, but people talk and that gossip can only hurt you.

- People find bitcoin interesting only when they’re ready to; everyone gets the price they deserve. Like Gigi says in “21 Lessons:”

“Bitcoin will be understood by you as soon as you are ready, and I also believe that the first fractions of a bitcoin will find you as soon as you are ready to receive them. In essence, everyone will get ₿itcoin at exactly the right time.”

It’s highly unlikely that your uncle or mother-in-law just happens to be at that stage, just when you’re about to sit down for dinner.

- Unless you can claim youth, old age or extreme poverty, there are very few people who genuinely haven’t heard of bitcoin. That means your evangelizing wouldn’t be preaching to lost, ignorant souls ready to be saved but the tired, huddled and jaded masses who could care less about the discovery that will change their societies more than the internal combustion engine, internet and Big Government combined. Big deal.

- What is the case, however, is that everyone in your prospective audience has already had a couple of touchpoints and rejected bitcoin for this or that standard FUD. It’s a scam; seems weird; it’s dead; let’s trust the central bankers, who have our best interest at heart.

No amount of FUD busting changes that impression, because nobody holds uninformed and fringe convictions for rational reasons, reasons that can be flipped by your enthusiastic arguments in-between wiping off cranberry sauce and grabbing another turkey slice. - It really is bad form to talk about money — and bitcoin is the best money there is. Be classy.

Now, I’m not saying to never ever talk about Bitcoin. We love to talk Bitcoin — that’s why we go to meetups, join Twitter Spaces, write, code, run nodes, listen to podcasts, attend conferences. People there get something about this monetary rebellion and have opted in to be part of it. Your unsuspecting family members have not; ambushing them with the wonders of multisig, the magically fast Lightning transactions or how they too really need to get on this hype train, like, yesterday, is unlikely to go down well.

However, if in the post-dinner lull on the porch someone comes to you one-on-one, whisky in hand and of an inquisitive mind, that’s a very different story. That’s personal rather than public, and it’s without the time constraints that so usually trouble us. It involves clarifying questions or doubts for somebody who is both expressively curious about the topic and available for the talk. That’s rare — cherish it, and nurture it.

Last year I wrote something about the proper role of political conversations in social settings. Since November was also election month, it’s appropriate to cite here:

“Politics, I’m starting to believe, best belongs in the closet — rebranded and brought out for the specific occasion. Or perhaps the bedroom, with those you most trust, love, and respect. Not in public, not with strangers, not with friends, and most certainly not with other people in your community. Purge it from your being as much as you possibly could, and refuse to let political issues invade the areas of our lives that we cherish; politics and political disagreements don’t belong there, and our lives are too important to let them be ruled by (mostly contrived) political disagreements.”

If anything, those words seem more true today than they even did then. And I posit to you that the same applies for bitcoin.

Everyone has some sort of impression or opinion of bitcoin — and most of them are plain wrong. But there’s nothing people love more than a savior in white armor, riding in to dispel their errors about some thing they are freshly out of fucks for. Just like politics, nobody really cares.

Leave them alone. They will find bitcoin in their own time, just like all of us did.

This is a guest post by Joakim Book. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

This is an opinion editorial by Federico Tenga, a long time contributor to Bitcoin projects with experience as start-up founder, consultant and educator.

The term “smart contracts” predates the invention of the blockchain and Bitcoin itself. Its first mention is in a 1994 article by Nick Szabo, who defined smart contracts as a “computerized transaction protocol that executes the terms of a contract.” While by this definition Bitcoin, thanks to its scripting language, supported smart contracts from the very first block, the term was popularized only later by Ethereum promoters, who twisted the original definition as “code that is redundantly executed by all nodes in a global consensus network”

While delegating code execution to a global consensus network has advantages (e.g. it is easy to deploy unowed contracts, such as the popularly automated market makers), this design has one major flaw: lack of scalability (and privacy). If every node in a network must redundantly run the same code, the amount of code that can actually be executed without excessively increasing the cost of running a node (and thus preserving decentralization) remains scarce, meaning that only a small number of contracts can be executed.

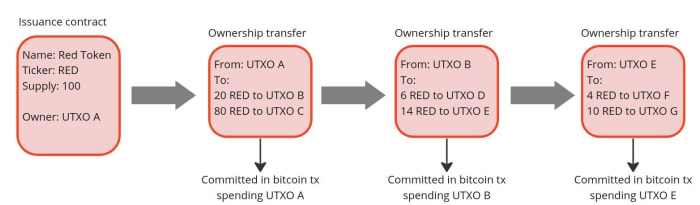

But what if we could design a system where the terms of the contract are executed and validated only by the parties involved, rather than by all members of the network? Let us imagine the example of a company that wants to issue shares. Instead of publishing the issuance contract publicly on a global ledger and using that ledger to track all future transfers of ownership, it could simply issue the shares privately and pass to the buyers the right to further transfer them. Then, the right to transfer ownership can be passed on to each new owner as if it were an amendment to the original issuance contract. In this way, each owner can independently verify that the shares he or she received are genuine by reading the original contract and validating that all the history of amendments that moved the shares conform to the rules set forth in the original contract.

This is actually nothing new, it is indeed the same mechanism that was used to transfer property before public registers became popular. In the U.K., for example, it was not compulsory to register a property when its ownership was transferred until the ‘90s. This means that still today over 15% of land in England and Wales is unregistered. If you are buying an unregistered property, instead of checking on a registry if the seller is the true owner, you would have to verify an unbroken chain of ownership going back at least 15 years (a period considered long enough to assume that the seller has sufficient title to the property). In doing so, you must ensure that any transfer of ownership has been carried out correctly and that any mortgages used for previous transactions have been paid off in full. This model has the advantage of improved privacy over ownership, and you do not have to rely on the maintainer of the public land register. On the other hand, it makes the verification of the seller’s ownership much more complicated for the buyer.

Source: Title deed of unregistered real estate propriety

How can the transfer of unregistered properties be improved? First of all, by making it a digitized process. If there is code that can be run by a computer to verify that all the history of ownership transfers is in compliance with the original contract rules, buying and selling becomes much faster and cheaper.

Secondly, to avoid the risk of the seller double-spending their asset, a system of proof of publication must be implemented. For example, we could implement a rule that every transfer of ownership must be committed on a predefined spot of a well-known newspaper (e.g. put the hash of the transfer of ownership in the upper-right corner of the first page of the New York Times). Since you cannot place the hash of a transfer in the same place twice, this prevents double-spending attempts. However, using a famous newspaper for this purpose has some disadvantages:

- You have to buy a lot of newspapers for the verification process. Not very practical.

- Each contract needs its own space in the newspaper. Not very scalable.

- The newspaper editor can easily censor or, even worse, simulate double-spending by putting a random hash in your slot, making any potential buyer of your asset think it has been sold before, and discouraging them from buying it. Not very trustless.

For these reasons, a better place to post proof of ownership transfers needs to be found. And what better option than the Bitcoin blockchain, an already established trusted public ledger with strong incentives to keep it censorship-resistant and decentralized?

If we use Bitcoin, we should not specify a fixed place in the block where the commitment to transfer ownership must occur (e.g. in the first transaction) because, just like with the editor of the New York Times, the miner could mess with it. A better approach is to place the commitment in a predefined Bitcoin transaction, more specifically in a transaction that originates from an unspent transaction output (UTXO) to which the ownership of the asset to be issued is linked. The link between an asset and a bitcoin UTXO can occur either in the contract that issues the asset or in a subsequent transfer of ownership, each time making the target UTXO the controller of the transferred asset. In this way, we have clearly defined where the obligation to transfer ownership should be (i.e in the Bitcoin transaction originating from a particular UTXO). Anyone running a Bitcoin node can independently verify the commitments and neither the miners nor any other entity are able to censor or interfere with the asset transfer in any way.

Since on the Bitcoin blockchain we only publish a commitment of an ownership transfer, not the content of the transfer itself, the seller needs a dedicated communication channel to provide the buyer with all the proofs that the ownership transfer is valid. This could be done in a number of ways, potentially even by printing out the proofs and shipping them with a carrier pigeon, which, while a bit impractical, would still do the job. But the best option to avoid the censorship and privacy violations is establish a direct peer-to-peer encrypted communication, which compared to the pigeons also has the advantage of being easy to integrate with a software to verify the proofs received from the counterparty.

This model just described for client-side validated contracts and ownership transfers is exactly what has been implemented with the RGB protocol. With RGB, it is possible to create a contract that defines rights, assigns them to one or more existing bitcoin UTXO and specifies how their ownership can be transferred. The contract can be created starting from a template, called a “schema,” in which the creator of the contract only adjusts the parameters and ownership rights, as is done with traditional legal contracts. Currently, there are two types of schemas in RGB: one for issuing fungible tokens (RGB20) and a second for issuing collectibles (RGB21), but in the future, more schemas can be developed by anyone in a permissionless fashion without requiring changes at the protocol level.

To use a more practical example, an issuer of fungible assets (e.g. company shares, stablecoins, etc.) can use the RGB20 schema template and create a contract defining how many tokens it will issue, the name of the asset and some additional metadata associated with it. It can then define which bitcoin UTXO has the right to transfer ownership of the created tokens and assign other rights to other UTXOs, such as the right to make a secondary issuance or to renominate the asset. Each client receiving tokens created by this contract will be able to verify the content of the Genesis contract and validate that any transfer of ownership in the history of the token received has complied with the rules set out therein.

So what can we do with RGB in practice today? First and foremost, it enables the issuance and the transfer of tokenized assets with better scalability and privacy compared to any existing alternative. On the privacy side, RGB benefits from the fact that all transfer-related data is kept client-side, so a blockchain observer cannot extract any information about the user’s financial activities (it is not even possible to distinguish a bitcoin transaction containing an RGB commitment from a regular one), moreover, the receiver shares with the sender only blinded UTXO (i. e. the hash of the concatenation between the UTXO in which she wish to receive the assets and a random number) instead of the UTXO itself, so it is not possible for the payer to monitor future activities of the receiver. To further increase the privacy of users, RGB also adopts the bulletproof cryptographic mechanism to hide the amounts in the history of asset transfers, so that even future owners of assets have an obfuscated view of the financial behavior of previous holders.

In terms of scalability, RGB offers some advantages as well. First of all, most of the data is kept off-chain, as the blockchain is only used as a commitment layer, reducing the fees that need to be paid and meaning that each client only validates the transfers it is interested in instead of all the activity of a global network. Since an RGB transfer still requires a Bitcoin transaction, the fee saving may seem minimal, but when you start introducing transaction batching they can quickly become massive. Indeed, it is possible to transfer all the tokens (or, more generally, “rights”) associated with a UTXO towards an arbitrary amount of recipients with a single commitment in a single bitcoin transaction. Let’s assume you are a service provider making payouts to several users at once. With RGB, you can commit in a single Bitcoin transaction thousands of transfers to thousands of users requesting different types of assets, making the marginal cost of each single payout absolutely negligible.

Another fee-saving mechanism for issuers of low value assets is that in RGB the issuance of an asset does not require paying fees. This happens because the creation of an issuance contract does not need to be committed on the blockchain. A contract simply defines to which already existing UTXO the newly issued assets will be allocated to. So if you are an artist interested in creating collectible tokens, you can issue as many as you want for free and then only pay the bitcoin transaction fee when a buyer shows up and requests the token to be assigned to their UTXO.

Furthermore, because RGB is built on top of bitcoin transactions, it is also compatible with the Lightning Network. While it is not yet implemented at the time of writing, it will be possible to create asset-specific Lightning channels and route payments through them, similar to how it works with normal Lightning transactions.

Conclusion

RGB is a groundbreaking innovation that opens up to new use cases using a completely new paradigm, but which tools are available to use it? If you want to experiment with the core of the technology itself, you should directly try out the RGB node. If you want to build applications on top of RGB without having to deep dive into the complexity of the protocol, you can use the rgb-lib library, which provides a simple interface for developers. If you just want to try to issue and transfer assets, you can play with Iris Wallet for Android, whose code is also open source on GitHub. If you just want to learn more about RGB you can check out this list of resources.

This is a guest post by Federico Tenga. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.