Crypto

What Does It Mean To Orange-Pill Someone?

Published

2 years agoon

This is an opinion editorial by Mark Maraia, an entrepreneur, author of “Rainmaking Made Simple” and Bitcoiner.

If you have been in bitcoin long enough or been around someone who is a strong proponent of bitcoin you will have eventually heard this phrase: “I orange-pilled my (friend/brother/mom/dad etc.).” I’ve never been very fond of the phrase, although I agree with the sentiment that it expresses. Long-term, our goal is to gather as many people on the monetary lifeboat called bitcoin. How we get there is the real issue that we don’t discuss often enough. For example, why doesn’t Bitcoin Magazine have a regular column that allows ordinary plebs to share their favorite orange-pill story? This would give readers advice on how to approach their friends and family.

As I started to reflect on what “orange-pill” means, I realized that it can mean many things to different people. This article will attempt to discuss some of the common meanings and question whether this is the best strategy for bitcoin.

Does orange-pill mean:

- Convince someone to buy bitcoin?

- Help someone see the brilliance of bitcoin?

- Create curiosity about bitcoin?

- Show someone how messed up our fiat monetary system is?

- Educate someone on bitcoin?

Or all of the above? Or none of the above?

It is obvious there are many interpretations of what it means to orange-pill someone.

What I think many in the space miss is that friends and family won’t see bitcoin as a solution if they don’t have a solid grasp of the problem. And you are well advised to assume most have no clue about the problem. The simple fact is most people are so overwhelmed and barely getting by that not only do they not have a solid grasp of the problem, they have no desire to hear you tell them about the problem!

So in many respects, if the person you are orange-pilling doesn’t understand the problem, you are highly unlikely to be successful. Does that mean you should not even try? I can’t answer that for you. It is entirely your choice for how you use your life energy. However, in a recent Bitcoin Magazine podcast, Michael Saylor explained his approach to Aleks Svetski and I think it’s worth sharing:

The world is going through an unprecedented financial crisis. The greatest of our lifetime. The financial world is in crisis. And the political world is in the greatest turmoil of our lifetime. There’s just a lot of turmoil. A lot of sound and fury. A lot of strong passion. A lot of noise and turbulence. Bitcoin is a good thing. There are a thousand issues distracting people. Most people do not see the brilliance of bitcoin as a new money or as digital energy or as a new form of property or a better ideology […] as a catalyst for good in the world. Most people do not recognize that. So you have finite minutes in your life left. When you meet a person you only have a few minutes to talk with them and convey something. What’s the highest form of good you can bring to them?

I’m of the opinion that it’s best to approach every conversation constructively and cheerfully when educating people. Removing the fear, dealing with the doubt, dealing with the uncertainty. Educating them that bitcoin is a great technology. The greatest monetary technology in the history of the world. It can improve their lives, their friends lives, their company’s lives and their fellow citizens lives. It can improve everything it touches if they grasp and understand it. I think that’s the highest, best use of time and energy.

It’s always a temptation to get drawn into other discussions and other debates. I’m not going to tell you how to spend your life, but in terms of professional focus […] the focus is to educate the world on how each person can improve their lives. When you do that you have to do it in the language they speak. You have to use the metaphors they understand. You have to appeal to the values they have and sometimes you might not even share those values. Figure out what they want, how they speak, how they communicate, how they want to be communicated to and then communicate as much insight about bitcoin as you can. That’s how we spread the entire network. That’s how we improve the world. Avoid being baited and distracted and drawn into negativity. Some people just enjoy and want conflict.

Until they have compelling requirements they will be dismissive. Tell them how bitcoin solves their problem. In sales you want to know why each person will benefit from what I have to offer? And then I explain the benefit to them in the most concise format I can. You either make the sale or you don’t. If you make the sale, great. If you don’t, thank them for their time. No point in making them angry or calling them an idiot. Make lots of friends and no enemies. You’ll learn a lot from listening.

If I’m keeping a scorecard, the scorecard is: “who did you convince to join the network?” and the way you join the network is you convert your money to a different asset into bitcoin. The more energy you attract to the network, the faster the world gets better. That’s the ultimate utility function.

My approach is similar to Saylor’s, only I might go a step further. My job is to educate people and do my best to understand how concerned the person I’m orange-pilling is about his or her situation. No pain points, no buy-in to the Bitcoin network. Speaking to a boomer or retiree will require an entirely different approach than a millennial who has been shut out of the real estate market. The amazing thing about bitcoin is it has many facets to it that make it appealing to many different people. It seems that many in this space use a one-size-fits-all approach to persuasion. Or worse, they assume that what they found compelling about bitcoin will be the same thing others will find compelling. At best that is naïve and at worst it shows a level of arrogance that is highly off-putting. Offensive, really. We’re not going to insult our way to success.

Our job as bitcoiners is to listen and ask questions that demonstrate that we care more about the person and have zero investment in whether they decide to buy bitcoin. Figure out a way to take that approach and adoption will shoot through the roof.

One of my favorite statements to my peers who have done well in the fiat world and enjoy considerable net worth is: “you probably don’t need bitcoin.” This disarms them and tends to make them far more curious and open. Telling them what to do might work if the person has complete trust in you and your opinion of what to do. But that is very rare.

There is no one right way to do this. More importantly, I suggest you undertake the conversation with all people in such a way that they trust you and appreciate your genuine interest in their well-being. My goal with each conversation is to educate those who seem open and listen to the problem driving them to seek out bitcoin as a solution. Ideally, you have piqued their curiosity. When the conversation is over, I’m hoping the relationship is stronger than it was before we had the conversation. What never works is dismissing them or getting angry or frustrated that they can’t see the brilliance of bitcoin or any number of other off-putting behaviors that benefit no one.

Do you care enough about your friends and neighbors to educate them patiently and slowly for as long as it takes? For some that may be years. Wonderful, that means it requires patience from you. If you are so sure you’re right, then you are well advised to shut up. During a recent bitcoin meet up I spoke with a young mom who “gets” bitcoin and she was expressing her frustration that her sister, a lawyer in a large NYC firm, doesn’t get it. I suggested she wait for her sister to show curiosity about bitcoin before attempting to orange-pill her. She had already pressed her often enough that she was getting increasingly frustrated with her sister. My advice to her was to just love and accept her sister exactly as she is, even if she never gets bitcoin. Don’t make bitcoin the reason why you feel estranged from your sister. She softened as she realized that bitcoin is patient and will wait for her sister to see its brilliance.

Everyone in the space talks about low time-preference and then gets irritated, impatient and pissed off at those they care about when they don’t get it. Low time-preference means you are taking the long view of things. Think in terms of years and decades, not minutes, hours, days or weeks. The only thing that makes us irritated, impatient and angry is our own fear or immaturity. Grow up.

What I’ve long advised clients to do when they want to become a rainmaker is to first think like a rainmaker. Same with bitcoin: start thinking like a person who has already seen the brilliance of bitcoin and knows that it has won. That doesn’t give you license to be arrogant and dismissive of those who don’t get it. I’d love nothing more than to retire from using the phrase “have fun staying poor.” Talk about arrogant and entitled and immature. To me bitcoin isn’t about poverty or wealth, it’s about freedom and liberation from the shackles of fiat. It’s about having an alternative to the U.S. dollar or other fiat currency. It’s about saying no to debt slavery and taking greater responsibility for my wealth.

There are some in the space who gladly report that bitcoin has already won. Bravo to those who take that approach!! That is not widely understood yet in our culture. Relax, many will come around when they are ready. Give Jay Powell and our rulers enough time and rope and they will hang themselves.

“Getting” bitcoin is a two-step process:

Step one: Realize the major shortcomings and unfairness of our current system. If the person you are speaking to can’t or won’t see those gaps, that is your starting point. Close that gap slowly, patiently, gently. If they are not open to admitting how unfair the current system is then your job is to “zip it” and wait for the right moment. The teachable moment.

Step two: Once they understand how unfair our current monetary system is, then — and only then — will they be interested in a solution. You don’t convince an alcoholic to give up drinking until after he admits it’s a problem.

One of the things that I so enjoy about the bitcoin community is they have a much deeper grasp of the problems and shortcomings in our current system. These problems are very hard to miss if you’re looking for them, but most aren’t looking for them! Most people are a product of their education and upbringing and have learned nothing about our monetary system. It’s not taught in school. Or worse, they have bought the propaganda fed to them their entire lives which reduces the likelihood of them ever seeing the problem. That said, the last thing we need are true believers who are only too eager to tell you you’re dumb as crap and, unless you take full possession of your private keys, you’re a tool of the state.

So my call to action to the reader is this: Educate others, don’t attack them as ignorant or evil. Don’t waste your precious time on Twitter if you’re after wider adoption. Most of the people who need to learn about money and bitcoin aren’t on Twitter or Telegram. And most importantly, set a goal for yourself on the number of people you will help get off zero each year and do your best to achieve that number. Bitcoin has infinite patience. Start thinking and acting as if that is true. And when one of your friends or family asks you about the latest altcoin, say, as Nik Bhatia says, “that is not an investment class I put any money or energy into.”

This is a guest post by Mark Maraia. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.

Crypto

El Salvador Takes First Step To Issue Bitcoin Volcano Bonds

Published

2 years agoon

November 22, 2022

El Salvador’s Minister of the Economy Maria Luisa Hayem Brevé submitted a digital assets issuance bill to the country’s legislative assembly, paving the way for the launch of its bitcoin-backed “volcano” bonds.

First announced one year ago today, the pioneering initiative seeks to attract capital and investors to El Salvador. It was revealed at the time the plans to issue $1 billion in bonds on the Liquid Network, a federated Bitcoin sidechain, with the proceedings of the bonds being split between a $500 million direct allocation to bitcoin and an investment of the same amount in building out energy and bitcoin mining infrastructure in the region.

A sidechain is an independent blockchain that runs parallel to another blockchain, allowing for tokens from that blockchain to be used securely in the sidechain while abiding by a different set of rules, performance requirements, and security mechanisms. Liquid is a sidechain of Bitcoin that allows bitcoin to flow between the Liquid and Bitcoin networks with a two-way peg. A representation of bitcoin used in the Liquid network is referred to as L-BTC. Its verifiably equivalent amount of BTC is managed and secured by the network’s members, called functionaries.

“Digital securities law will enable El Salvador to be the financial center of central and south America,” wrote Paolo Ardoino, CTO of cryptocurrency exchange Bitfinex, on Twitter.

Bitfinex is set to be granted a license in order to be able to process and list the bond issuance in El Salvador.

The bonds will pay a 6.5% yield and enable fast-tracked citizenship for investors. The government will share half the additional gains with investors as a Bitcoin Dividend once the original $500 million has been monetized. These dividends will be dispersed annually using Blockstream’s asset management platform.

The act of submitting the bill, which was hinted at earlier this year, kickstarts the first major milestone before the bonds can see the light of day. The next is getting it approved, which is expected to happen before Christmas, a source close to President Nayib Bukele told Bitcoin Magazine. The bill was submitted on November 17 and presented to the country’s Congress today. It is embedded in full below.

Crypto

How I’ll Talk To Family Members About Bitcoin This Thanksgiving

Published

2 years agoon

November 22, 2022

This is an opinion editorial by Joakim Book, a Research Fellow at the American Institute for Economic Research, contributor and copy editor for Bitcoin Magazine and a writer on all things money and financial history.

I don’t.

That’s it. That’s the article.

In all sincerity, that is the full message: Just don’t do it. It’s not worth it.

You’re not an excited teenager anymore, in desperate need of bragging credits or trying out your newfound wisdom. You’re not a preaching priestess with lost souls to save right before some imminent arrival of the day of reckoning. We have time.

Instead: just leave people alone. Seriously. They came to Thanksgiving dinner to relax and rejoice with family, laugh, tell stories and zone out for a day — not to be ambushed with what to them will sound like a deranged rant in some obscure topic they couldn’t care less about. Even if it’s the monetary system, which nobody understands anyway.

Get real.

If you’re not convinced of this Dale Carnegie-esque social approach, and you still naively think that your meager words in between bites can change anybody’s view on anything, here are some more serious reasons for why you don’t talk to friends and family about Bitcoin the protocol — but most certainly not bitcoin, the asset:

- Your family and friends don’t want to hear it. Move on.

- For op-sec reasons, you don’t want to draw unnecessary attention to the fact that you probably have a decent bitcoin stack. Hopefully, family and close friends should be safe enough to confide in, but people talk and that gossip can only hurt you.

- People find bitcoin interesting only when they’re ready to; everyone gets the price they deserve. Like Gigi says in “21 Lessons:”

“Bitcoin will be understood by you as soon as you are ready, and I also believe that the first fractions of a bitcoin will find you as soon as you are ready to receive them. In essence, everyone will get ₿itcoin at exactly the right time.”

It’s highly unlikely that your uncle or mother-in-law just happens to be at that stage, just when you’re about to sit down for dinner.

- Unless you can claim youth, old age or extreme poverty, there are very few people who genuinely haven’t heard of bitcoin. That means your evangelizing wouldn’t be preaching to lost, ignorant souls ready to be saved but the tired, huddled and jaded masses who could care less about the discovery that will change their societies more than the internal combustion engine, internet and Big Government combined. Big deal.

- What is the case, however, is that everyone in your prospective audience has already had a couple of touchpoints and rejected bitcoin for this or that standard FUD. It’s a scam; seems weird; it’s dead; let’s trust the central bankers, who have our best interest at heart.

No amount of FUD busting changes that impression, because nobody holds uninformed and fringe convictions for rational reasons, reasons that can be flipped by your enthusiastic arguments in-between wiping off cranberry sauce and grabbing another turkey slice. - It really is bad form to talk about money — and bitcoin is the best money there is. Be classy.

Now, I’m not saying to never ever talk about Bitcoin. We love to talk Bitcoin — that’s why we go to meetups, join Twitter Spaces, write, code, run nodes, listen to podcasts, attend conferences. People there get something about this monetary rebellion and have opted in to be part of it. Your unsuspecting family members have not; ambushing them with the wonders of multisig, the magically fast Lightning transactions or how they too really need to get on this hype train, like, yesterday, is unlikely to go down well.

However, if in the post-dinner lull on the porch someone comes to you one-on-one, whisky in hand and of an inquisitive mind, that’s a very different story. That’s personal rather than public, and it’s without the time constraints that so usually trouble us. It involves clarifying questions or doubts for somebody who is both expressively curious about the topic and available for the talk. That’s rare — cherish it, and nurture it.

Last year I wrote something about the proper role of political conversations in social settings. Since November was also election month, it’s appropriate to cite here:

“Politics, I’m starting to believe, best belongs in the closet — rebranded and brought out for the specific occasion. Or perhaps the bedroom, with those you most trust, love, and respect. Not in public, not with strangers, not with friends, and most certainly not with other people in your community. Purge it from your being as much as you possibly could, and refuse to let political issues invade the areas of our lives that we cherish; politics and political disagreements don’t belong there, and our lives are too important to let them be ruled by (mostly contrived) political disagreements.”

If anything, those words seem more true today than they even did then. And I posit to you that the same applies for bitcoin.

Everyone has some sort of impression or opinion of bitcoin — and most of them are plain wrong. But there’s nothing people love more than a savior in white armor, riding in to dispel their errors about some thing they are freshly out of fucks for. Just like politics, nobody really cares.

Leave them alone. They will find bitcoin in their own time, just like all of us did.

This is a guest post by Joakim Book. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

This is an opinion editorial by Federico Tenga, a long time contributor to Bitcoin projects with experience as start-up founder, consultant and educator.

The term “smart contracts” predates the invention of the blockchain and Bitcoin itself. Its first mention is in a 1994 article by Nick Szabo, who defined smart contracts as a “computerized transaction protocol that executes the terms of a contract.” While by this definition Bitcoin, thanks to its scripting language, supported smart contracts from the very first block, the term was popularized only later by Ethereum promoters, who twisted the original definition as “code that is redundantly executed by all nodes in a global consensus network”

While delegating code execution to a global consensus network has advantages (e.g. it is easy to deploy unowed contracts, such as the popularly automated market makers), this design has one major flaw: lack of scalability (and privacy). If every node in a network must redundantly run the same code, the amount of code that can actually be executed without excessively increasing the cost of running a node (and thus preserving decentralization) remains scarce, meaning that only a small number of contracts can be executed.

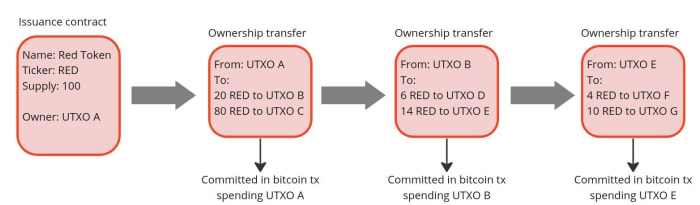

But what if we could design a system where the terms of the contract are executed and validated only by the parties involved, rather than by all members of the network? Let us imagine the example of a company that wants to issue shares. Instead of publishing the issuance contract publicly on a global ledger and using that ledger to track all future transfers of ownership, it could simply issue the shares privately and pass to the buyers the right to further transfer them. Then, the right to transfer ownership can be passed on to each new owner as if it were an amendment to the original issuance contract. In this way, each owner can independently verify that the shares he or she received are genuine by reading the original contract and validating that all the history of amendments that moved the shares conform to the rules set forth in the original contract.

This is actually nothing new, it is indeed the same mechanism that was used to transfer property before public registers became popular. In the U.K., for example, it was not compulsory to register a property when its ownership was transferred until the ‘90s. This means that still today over 15% of land in England and Wales is unregistered. If you are buying an unregistered property, instead of checking on a registry if the seller is the true owner, you would have to verify an unbroken chain of ownership going back at least 15 years (a period considered long enough to assume that the seller has sufficient title to the property). In doing so, you must ensure that any transfer of ownership has been carried out correctly and that any mortgages used for previous transactions have been paid off in full. This model has the advantage of improved privacy over ownership, and you do not have to rely on the maintainer of the public land register. On the other hand, it makes the verification of the seller’s ownership much more complicated for the buyer.

Source: Title deed of unregistered real estate propriety

How can the transfer of unregistered properties be improved? First of all, by making it a digitized process. If there is code that can be run by a computer to verify that all the history of ownership transfers is in compliance with the original contract rules, buying and selling becomes much faster and cheaper.

Secondly, to avoid the risk of the seller double-spending their asset, a system of proof of publication must be implemented. For example, we could implement a rule that every transfer of ownership must be committed on a predefined spot of a well-known newspaper (e.g. put the hash of the transfer of ownership in the upper-right corner of the first page of the New York Times). Since you cannot place the hash of a transfer in the same place twice, this prevents double-spending attempts. However, using a famous newspaper for this purpose has some disadvantages:

- You have to buy a lot of newspapers for the verification process. Not very practical.

- Each contract needs its own space in the newspaper. Not very scalable.

- The newspaper editor can easily censor or, even worse, simulate double-spending by putting a random hash in your slot, making any potential buyer of your asset think it has been sold before, and discouraging them from buying it. Not very trustless.

For these reasons, a better place to post proof of ownership transfers needs to be found. And what better option than the Bitcoin blockchain, an already established trusted public ledger with strong incentives to keep it censorship-resistant and decentralized?

If we use Bitcoin, we should not specify a fixed place in the block where the commitment to transfer ownership must occur (e.g. in the first transaction) because, just like with the editor of the New York Times, the miner could mess with it. A better approach is to place the commitment in a predefined Bitcoin transaction, more specifically in a transaction that originates from an unspent transaction output (UTXO) to which the ownership of the asset to be issued is linked. The link between an asset and a bitcoin UTXO can occur either in the contract that issues the asset or in a subsequent transfer of ownership, each time making the target UTXO the controller of the transferred asset. In this way, we have clearly defined where the obligation to transfer ownership should be (i.e in the Bitcoin transaction originating from a particular UTXO). Anyone running a Bitcoin node can independently verify the commitments and neither the miners nor any other entity are able to censor or interfere with the asset transfer in any way.

Since on the Bitcoin blockchain we only publish a commitment of an ownership transfer, not the content of the transfer itself, the seller needs a dedicated communication channel to provide the buyer with all the proofs that the ownership transfer is valid. This could be done in a number of ways, potentially even by printing out the proofs and shipping them with a carrier pigeon, which, while a bit impractical, would still do the job. But the best option to avoid the censorship and privacy violations is establish a direct peer-to-peer encrypted communication, which compared to the pigeons also has the advantage of being easy to integrate with a software to verify the proofs received from the counterparty.

This model just described for client-side validated contracts and ownership transfers is exactly what has been implemented with the RGB protocol. With RGB, it is possible to create a contract that defines rights, assigns them to one or more existing bitcoin UTXO and specifies how their ownership can be transferred. The contract can be created starting from a template, called a “schema,” in which the creator of the contract only adjusts the parameters and ownership rights, as is done with traditional legal contracts. Currently, there are two types of schemas in RGB: one for issuing fungible tokens (RGB20) and a second for issuing collectibles (RGB21), but in the future, more schemas can be developed by anyone in a permissionless fashion without requiring changes at the protocol level.

To use a more practical example, an issuer of fungible assets (e.g. company shares, stablecoins, etc.) can use the RGB20 schema template and create a contract defining how many tokens it will issue, the name of the asset and some additional metadata associated with it. It can then define which bitcoin UTXO has the right to transfer ownership of the created tokens and assign other rights to other UTXOs, such as the right to make a secondary issuance or to renominate the asset. Each client receiving tokens created by this contract will be able to verify the content of the Genesis contract and validate that any transfer of ownership in the history of the token received has complied with the rules set out therein.

So what can we do with RGB in practice today? First and foremost, it enables the issuance and the transfer of tokenized assets with better scalability and privacy compared to any existing alternative. On the privacy side, RGB benefits from the fact that all transfer-related data is kept client-side, so a blockchain observer cannot extract any information about the user’s financial activities (it is not even possible to distinguish a bitcoin transaction containing an RGB commitment from a regular one), moreover, the receiver shares with the sender only blinded UTXO (i. e. the hash of the concatenation between the UTXO in which she wish to receive the assets and a random number) instead of the UTXO itself, so it is not possible for the payer to monitor future activities of the receiver. To further increase the privacy of users, RGB also adopts the bulletproof cryptographic mechanism to hide the amounts in the history of asset transfers, so that even future owners of assets have an obfuscated view of the financial behavior of previous holders.

In terms of scalability, RGB offers some advantages as well. First of all, most of the data is kept off-chain, as the blockchain is only used as a commitment layer, reducing the fees that need to be paid and meaning that each client only validates the transfers it is interested in instead of all the activity of a global network. Since an RGB transfer still requires a Bitcoin transaction, the fee saving may seem minimal, but when you start introducing transaction batching they can quickly become massive. Indeed, it is possible to transfer all the tokens (or, more generally, “rights”) associated with a UTXO towards an arbitrary amount of recipients with a single commitment in a single bitcoin transaction. Let’s assume you are a service provider making payouts to several users at once. With RGB, you can commit in a single Bitcoin transaction thousands of transfers to thousands of users requesting different types of assets, making the marginal cost of each single payout absolutely negligible.

Another fee-saving mechanism for issuers of low value assets is that in RGB the issuance of an asset does not require paying fees. This happens because the creation of an issuance contract does not need to be committed on the blockchain. A contract simply defines to which already existing UTXO the newly issued assets will be allocated to. So if you are an artist interested in creating collectible tokens, you can issue as many as you want for free and then only pay the bitcoin transaction fee when a buyer shows up and requests the token to be assigned to their UTXO.

Furthermore, because RGB is built on top of bitcoin transactions, it is also compatible with the Lightning Network. While it is not yet implemented at the time of writing, it will be possible to create asset-specific Lightning channels and route payments through them, similar to how it works with normal Lightning transactions.

Conclusion

RGB is a groundbreaking innovation that opens up to new use cases using a completely new paradigm, but which tools are available to use it? If you want to experiment with the core of the technology itself, you should directly try out the RGB node. If you want to build applications on top of RGB without having to deep dive into the complexity of the protocol, you can use the rgb-lib library, which provides a simple interface for developers. If you just want to try to issue and transfer assets, you can play with Iris Wallet for Android, whose code is also open source on GitHub. If you just want to learn more about RGB you can check out this list of resources.

This is a guest post by Federico Tenga. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.