Crypto

What Psychedelics And Bitcoin Have In Common

Published

2 years agoon

This is an opinion editorial by Maxx Mannheimer, a former sales account manager with a background in training and industrial-organizational psychology.

I’ll begin by stating that I do not suggest that anyone take psychedelics. Each individual knows what is best for them and it is not my intent to challenge your free will in any way. If what I have written connects with your life experience, great. If it does not, feel free to ignore every word. But if you wish to debate about what I am presenting, I would only request that you carefully read this article in its entirety. I do not recommend participating in any activity which is illegal where you live and I do not recommend taking psychedelic substances without professional guidance. Psychedelic experiences can be profoundly liberating and inspiring, but they can also be existentially earth-shattering if used without proper preparation. As always, do your own research and use your best judgment.

I’m not the first to draw a link between psychedelics and Bitcoin. Articles about billionaire investor Christian Angermayer have highlighted at least one anecdote of psilocybe mushrooms assisting with the understanding of Bitcoin. However, I believe this won’t be the last time we see these two topics mentioned together. If my intuition is correct, we will be seeing many more articles along these lines as Bitcoin and psychedelics both enter the mainstream consciousness.

A financial revolution without a spiritual one will fail to create a better world for the majority of life on this planet. A spiritual revolution without a financial one will fail to enact lasting change due to the corruption that is built into our current monetary system. Both are needed to fix the world. It is important that we acknowledge this dynamic period in human history holistically and ecologically rather than making blanket statements about quick-fix solutions to the issues that humanity is facing.

The Bitcoin community often discusses the potential for a second renaissance. I hear much of the same talk in the psychedelics space. However, the two worlds often don’t consider the potential synergies between the two. My hope for this article is to support the ice-breaking process which has already begun. The 1960s were a time of ranging counterculture with no concrete direction. It represented a powerful lashing out against a system that doesn’t serve humanity. But after creating a cultural movement — and some excellent music — the flame was extinguished by draconian government intervention.

Not only did all use of psychedelics get pushed to the black market, but all scientific research was completely halted for about 50 years. Many psychedelics were being used recklessly at that time, but psychedelics were made illegal for political reasons, not health reasons. The loss to human progress is impossible to calculate.

In my assessment, the heavy handed prohibition is unraveling before our eyes. Various city and state governments have opted to decriminalize or legalize the use of psychedelics for therapy. Well known authors, comedians and other public figures are openly discussing psychedelics. Netflix is airing documentaries about psychedelics and many podcasters are covering the topic in a way which would have been shocking ten years ago. Publicly-traded companies are even working on psychedelic pharmaceutical development.

More conservative-minded Bitcoiners may pause before seeing this in a positive light, but the data regarding psychedelics potential for therapeutic use can’t be ignored. Therapy using MDMA — the chemical abbreviation for the drug known more commonly as ecstasy or “Molly” — seems to be the most effective way to treat post-traumatic stress disorder (PTSD) in a lasting manner. The Multidisciplinary Association for Psychedelic Studies (MAPS) is moving through U.S. Food and Drug Administration (FDA) trials to have the substance rescheduled. Their phase three trials have demonstrated 67% of PTSD patients no longer met the criteria for PTSD two months after their sessions. Even after the fiat fiasco collapses we’ll still need to support these people who were traumatized by it. Note: MAPS accepts donations in bitcoin.

The psychedelics community may have some hesitancy about the Bitcoin community as well. From my interaction with plant medicine enthusiasts, I have gathered that they’re a sensitive bunch. I genuinely mean that as a compliment, but sensitivity doesn’t always lend itself well to the self-identified “toxic” Bitcoin community. As a generalization, they are wary of anything that could be used to exclude people and deepen inequality. These concerns are valid, but are often projected onto the bitcoin life raft rather than the fiat sinking ship. As a result, there isn’t a sturdy connection between these two communities, but I am predicting that there could be for a number of reasons.

The first bridge is the one that leads towards personal and collective liberation. Psychedelics have the potential to liberate us from old systems of thought and all of their downstream effects. Bitcoin has the potential to liberate us from Modern Monetary Theory and all its downstream effects. Both are interested in reducing violence against humanity. Both are interested in reducing government control over what we decide to put in our bodies. Both carry an inherently egalitarian questioning of authority.

The second bridge is the novelty of thought required to understand Bitcoin. As I mentioned in “The Bitcoin Customer Service Department,” Bitcoin is a complex paradigm-shifting topic. Despite the simplicity of the Bitcoin white paper, understanding all its implications requires a dramatically novel understanding of the world. In Michael Pollan’s book “How to Change Your Mind,” the following metaphor is used by Mendel Kaelen to explain the effects of psychedelics on the human psyche.

“Think of the brain as a hill covered in snow, and thoughts as sleds gliding down that hill. As one sled after another goes down the hill, a small number of main trails will appear in the snow. And every time a new sled goes down, it will be drawn into the preexisting trails, almost like a magnet. In time, it becomes more and more difficult to glide down the hill on any other path or in a different direction. Think of psychedelics as temporarily flattening the snow. The deeply worn trails disappear, and suddenly the sled can go in other directions, exploring new landscapes and, literally, creating new pathways.”

This metaphor is an excellent way to visualize what has been observed in psychedelic patient trials. Neural pathways become more flexible. New connections are created that allow for novel thought, understanding and behavior. Have you ever had a conversation with someone where they fully understood your viewpoint and agreed with everything you said just to see them revert back to their default assumptions a day or two later? That’s the snow metaphor in conversation form. The more concrete our neural connections become, the less likely we will be to understand new emergent technologies.

The third bridge relates to the counterculture which gravitates around both Bitcoin and psychedelics. Radical rejection of conventional norms seems to be inherent in the Bitcoin ethos. Bitcoiners generally don’t accept mainstream media, political corruption or dishonesty. Psychedelics enthusiasts generally don’t accept moralistic arguments, violence or inauthenticity. Both groups seek fair treatment of humanity. Both groups avoid processed foods. Both groups are opposed to mindless materialistic consumption. Psychedelics enthusiasts are proponents of meditation and if Bitcoin holders haven’t been meditating through the 2020-22 market, I wouldn’t know what else to call it.

Psychedelics pose a threat to authoritarian systems of control because they show users a deeper potential for spirituality and connection with their environment. They enable a novel view of circumstances which allows people to notice that what they are used to may not be the truth. What happened in the 1960s, exactly? A ton of young people realized that the game they were playing was making them and the rest of society miserable. They dropped out in the hopes of finding a new way to live. Most of the hippies in the 1960s were deeply distrustful of the government and of the fruitless wars politicians were creating. They knew the game was rigged and the best course of action was to opt out. What are Bitcoiners talking about today? Essentially the same thing.

I know that both of these amorphous groups may balk at the fact that I have categorized them into groups at all. They are not really groups, but rather millions of individuals who share common interests and many of whom will never meet. That’s the beauty of it. Bitcoiners and psychedelic enthusiasts seem to be under a constant centrifugal force. As soon as I begin to categorize or wrangle them into any semblance of a group identity, they sprawl out even further. They span the full scope of human backgrounds and experience.

The propaganda war against psychedelics has largely lumped them together, in the mind of the public, with dangerous addictive substances. I would recommend a more nuanced approach to understanding drugs and their uses. Every drug is a tool and each has its proper use. To simply ask for any random tool when what you really need is specifically a Phillips-head screwdriver, you’re unlikely to meet your needs. A closer inspection of each substance will clearly demonstrate that lumping all “drugs” together, simply due to legal status, is absurd.

The federal government has clearly lost its grip on “The War On Drugs.” In direct opposition to federal drug scheduling laws, Oregon has decriminalized all drugs and made psilocybe mushroom therapy legal. As Ryan McMaken points out in his recent article, 43% of Americans are currently living in states which have legalized recreational cannabis. Again, in direct opposition to federal drug scheduling laws. If there was a “War On Drugs” it is fair to say that the drugs have won. Right or wrong, this trend is likely to continue.

The continuous lack of understanding regarding drug use in America has had a devastating impact on the psyche and freedom of the country. We have the highest incarceration rate in the world and approximately half of our prisoners are locked up for non-violent offenses. Drugs and alcohol play a critical role in many of the violent offenses as well. Those incarcerations damage families for generations which ultimately increases future crime rates and use of addictive drugs. Rinse and repeat. The harder we press down on drugs, the more harmful the drugs on the street become. Opium, heroin, oxycontin, fentanyl. Overdoses have never been worse. The criminal justice system is totally broken and people are suffering. Is it possible that people are turning to these drugs because they are disenfranchised by a system which has done nothing but abuse them since the moment they were born?

Don’t worry though! Big pharma has a solution for us. They’ll use their cantillon-bucks to lobby for their interests and pay doctors to prescribe psychotropic pharmaceuticals to numb the populace. It’s helpful to keep folks docile as we push them back into the massive machine which is crushing their souls. Western medicine really shines when it comes to saving people who are in dire need of intervention, but largely falls flat when it comes to improving quality of life in a sustainable way.

In addition to treating PTSD, psychedelics have shown remarkable potential in assisting with anxiety, depression, addiction, birth trauma and fear of death. I personally have witnessed resolutions of serious physical ailments which were thought to be permanent medical conditions following ayahuasca ceremonies. Is this a result of the plant medicine or is it a result of the plant medicine’s ability to unlock human potential in self-healing? In either case, the effects could only be described as miraculous.

Due to the lengthy prohibition, empirical research in this field is just beginning and the potential benefits are much broader than most realize. As John Sanro argues in “The Mindbody Prescription,” many of the ailments which we think of as physical in nature originate in the emotional body. If used responsibly, psychedelics can create lasting emotional relief which does not require repeated use. Most psychedelics are also non-addictive. Many have said that one profound experience is enough to create a permanent positive impact in one’s life. To my knowledge there are no pharmaceuticals which can make that claim.

The understanding of self-interest in human action is a critical component for understanding society. The understanding of what constitutes the self is a critical component for understanding spirituality. At the core of every spiritual practice is the same lesson. The litigious dogma which separates religions simply distracts from that. This has been said at least since Baruch Spinoza, Sri Aurobindo and Alan Watts. Some have argued that the core spiritual message has been lost since the original teachings of Buddha, Christ and Muhammad were passed on to their followers.

As eloquently discussed by Eckhart Tolle in “A New Earth,” humanity has simply missed the mark and that is the origin of suffering. The boundary between our self-interest and the interest of every other form of life is merely a condition of our perspective on the separation. You may discover that acting exclusively in self-interest without any consideration of others gradually becomes self-destructive. Most actions taken for the exclusive benefit of others, at great personal cost, typically prove themselves fruitless as well. There is a good reason for this. In his 2001 book, “No Boundary,” Ken Wilber presents a thorough case that all separation is simply an illusion. It is my belief that we all get the chance to see through this illusion upon departing this physical realm, but if we can look through the door, before permanently crossing the threshold, the broadened perspective can be beneficial to our experience until the departure.

However, all of these words have very little consequence if they are not accompanied by first-hand experience. The metaphor I like to employ for this understanding is that of the mountain. Throughout human history the great prophets and mystics have arduously made their way up the mountain using various methods. Many have done their best to describe the sights, sounds and viewpoints from the paths that they chose. Those who reached the top have seldom had words to describe what was there and many never make the attempt to explain. That place is not describable to those who have not experienced it. This is true of every aspect of life. How can sight be described to a blind person? How can sound be described to a deaf person? Words ultimately only point to truth, they do not contain truth. Without a shared context of reality, words are empty.

What psychedelics may be able to assist with, if the seeker is prepared, is to find a temporary view of various parts of the mountain. The glimpses into those heightened states of consciousness are simply that: glimpses. They do not contain the same value as thousands of hours of meditation, years of yoga practice or pilgrimages to holy sites, but the glimpses they provide can be profoundly liberating. To hop in a helicopter and visit the top of the mountain for fifteen minutes has the potential to alter your life permanently.

The permanency is what many people fear when they hear about psychedelics, but what if the changes that remain with us are largely beneficial to our well-being rather than harmful? What if the expansion of human consciousness is exactly what is needed to slingshot us into the next phase of human evolution? The lowering of time preference alone seems to have a spiritual component, but is it enough to shift human nature away from the darkest parts of our past? The answer will come in the form of individual choice and expression. I want to believe that the separation of money and state will benefit humanity as a whole, but I won’t be entirely convinced until I see how it happens.

What I would ask from the reader is a gentle approach to both psychedelics and to Bitcoin. You may benefit from listening for the true intent of those you are communicating with, not the intent you may have assumed they have. This speaks true not just for Bitcoin and psychedelics, but for all topics of discussion. The lack of understanding of a topic is not the same as malevolence. Assume the former even if you suspect the latter and your ability to support others in learning will improve significantly.

Have a nice trip.

This is a guest post by Maxx Mannheimer. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Crypto

El Salvador Takes First Step To Issue Bitcoin Volcano Bonds

Published

2 years agoon

November 22, 2022

El Salvador’s Minister of the Economy Maria Luisa Hayem Brevé submitted a digital assets issuance bill to the country’s legislative assembly, paving the way for the launch of its bitcoin-backed “volcano” bonds.

First announced one year ago today, the pioneering initiative seeks to attract capital and investors to El Salvador. It was revealed at the time the plans to issue $1 billion in bonds on the Liquid Network, a federated Bitcoin sidechain, with the proceedings of the bonds being split between a $500 million direct allocation to bitcoin and an investment of the same amount in building out energy and bitcoin mining infrastructure in the region.

A sidechain is an independent blockchain that runs parallel to another blockchain, allowing for tokens from that blockchain to be used securely in the sidechain while abiding by a different set of rules, performance requirements, and security mechanisms. Liquid is a sidechain of Bitcoin that allows bitcoin to flow between the Liquid and Bitcoin networks with a two-way peg. A representation of bitcoin used in the Liquid network is referred to as L-BTC. Its verifiably equivalent amount of BTC is managed and secured by the network’s members, called functionaries.

“Digital securities law will enable El Salvador to be the financial center of central and south America,” wrote Paolo Ardoino, CTO of cryptocurrency exchange Bitfinex, on Twitter.

Bitfinex is set to be granted a license in order to be able to process and list the bond issuance in El Salvador.

The bonds will pay a 6.5% yield and enable fast-tracked citizenship for investors. The government will share half the additional gains with investors as a Bitcoin Dividend once the original $500 million has been monetized. These dividends will be dispersed annually using Blockstream’s asset management platform.

The act of submitting the bill, which was hinted at earlier this year, kickstarts the first major milestone before the bonds can see the light of day. The next is getting it approved, which is expected to happen before Christmas, a source close to President Nayib Bukele told Bitcoin Magazine. The bill was submitted on November 17 and presented to the country’s Congress today. It is embedded in full below.

Crypto

How I’ll Talk To Family Members About Bitcoin This Thanksgiving

Published

2 years agoon

November 22, 2022

This is an opinion editorial by Joakim Book, a Research Fellow at the American Institute for Economic Research, contributor and copy editor for Bitcoin Magazine and a writer on all things money and financial history.

I don’t.

That’s it. That’s the article.

In all sincerity, that is the full message: Just don’t do it. It’s not worth it.

You’re not an excited teenager anymore, in desperate need of bragging credits or trying out your newfound wisdom. You’re not a preaching priestess with lost souls to save right before some imminent arrival of the day of reckoning. We have time.

Instead: just leave people alone. Seriously. They came to Thanksgiving dinner to relax and rejoice with family, laugh, tell stories and zone out for a day — not to be ambushed with what to them will sound like a deranged rant in some obscure topic they couldn’t care less about. Even if it’s the monetary system, which nobody understands anyway.

Get real.

If you’re not convinced of this Dale Carnegie-esque social approach, and you still naively think that your meager words in between bites can change anybody’s view on anything, here are some more serious reasons for why you don’t talk to friends and family about Bitcoin the protocol — but most certainly not bitcoin, the asset:

- Your family and friends don’t want to hear it. Move on.

- For op-sec reasons, you don’t want to draw unnecessary attention to the fact that you probably have a decent bitcoin stack. Hopefully, family and close friends should be safe enough to confide in, but people talk and that gossip can only hurt you.

- People find bitcoin interesting only when they’re ready to; everyone gets the price they deserve. Like Gigi says in “21 Lessons:”

“Bitcoin will be understood by you as soon as you are ready, and I also believe that the first fractions of a bitcoin will find you as soon as you are ready to receive them. In essence, everyone will get ₿itcoin at exactly the right time.”

It’s highly unlikely that your uncle or mother-in-law just happens to be at that stage, just when you’re about to sit down for dinner.

- Unless you can claim youth, old age or extreme poverty, there are very few people who genuinely haven’t heard of bitcoin. That means your evangelizing wouldn’t be preaching to lost, ignorant souls ready to be saved but the tired, huddled and jaded masses who could care less about the discovery that will change their societies more than the internal combustion engine, internet and Big Government combined. Big deal.

- What is the case, however, is that everyone in your prospective audience has already had a couple of touchpoints and rejected bitcoin for this or that standard FUD. It’s a scam; seems weird; it’s dead; let’s trust the central bankers, who have our best interest at heart.

No amount of FUD busting changes that impression, because nobody holds uninformed and fringe convictions for rational reasons, reasons that can be flipped by your enthusiastic arguments in-between wiping off cranberry sauce and grabbing another turkey slice. - It really is bad form to talk about money — and bitcoin is the best money there is. Be classy.

Now, I’m not saying to never ever talk about Bitcoin. We love to talk Bitcoin — that’s why we go to meetups, join Twitter Spaces, write, code, run nodes, listen to podcasts, attend conferences. People there get something about this monetary rebellion and have opted in to be part of it. Your unsuspecting family members have not; ambushing them with the wonders of multisig, the magically fast Lightning transactions or how they too really need to get on this hype train, like, yesterday, is unlikely to go down well.

However, if in the post-dinner lull on the porch someone comes to you one-on-one, whisky in hand and of an inquisitive mind, that’s a very different story. That’s personal rather than public, and it’s without the time constraints that so usually trouble us. It involves clarifying questions or doubts for somebody who is both expressively curious about the topic and available for the talk. That’s rare — cherish it, and nurture it.

Last year I wrote something about the proper role of political conversations in social settings. Since November was also election month, it’s appropriate to cite here:

“Politics, I’m starting to believe, best belongs in the closet — rebranded and brought out for the specific occasion. Or perhaps the bedroom, with those you most trust, love, and respect. Not in public, not with strangers, not with friends, and most certainly not with other people in your community. Purge it from your being as much as you possibly could, and refuse to let political issues invade the areas of our lives that we cherish; politics and political disagreements don’t belong there, and our lives are too important to let them be ruled by (mostly contrived) political disagreements.”

If anything, those words seem more true today than they even did then. And I posit to you that the same applies for bitcoin.

Everyone has some sort of impression or opinion of bitcoin — and most of them are plain wrong. But there’s nothing people love more than a savior in white armor, riding in to dispel their errors about some thing they are freshly out of fucks for. Just like politics, nobody really cares.

Leave them alone. They will find bitcoin in their own time, just like all of us did.

This is a guest post by Joakim Book. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

This is an opinion editorial by Federico Tenga, a long time contributor to Bitcoin projects with experience as start-up founder, consultant and educator.

The term “smart contracts” predates the invention of the blockchain and Bitcoin itself. Its first mention is in a 1994 article by Nick Szabo, who defined smart contracts as a “computerized transaction protocol that executes the terms of a contract.” While by this definition Bitcoin, thanks to its scripting language, supported smart contracts from the very first block, the term was popularized only later by Ethereum promoters, who twisted the original definition as “code that is redundantly executed by all nodes in a global consensus network”

While delegating code execution to a global consensus network has advantages (e.g. it is easy to deploy unowed contracts, such as the popularly automated market makers), this design has one major flaw: lack of scalability (and privacy). If every node in a network must redundantly run the same code, the amount of code that can actually be executed without excessively increasing the cost of running a node (and thus preserving decentralization) remains scarce, meaning that only a small number of contracts can be executed.

But what if we could design a system where the terms of the contract are executed and validated only by the parties involved, rather than by all members of the network? Let us imagine the example of a company that wants to issue shares. Instead of publishing the issuance contract publicly on a global ledger and using that ledger to track all future transfers of ownership, it could simply issue the shares privately and pass to the buyers the right to further transfer them. Then, the right to transfer ownership can be passed on to each new owner as if it were an amendment to the original issuance contract. In this way, each owner can independently verify that the shares he or she received are genuine by reading the original contract and validating that all the history of amendments that moved the shares conform to the rules set forth in the original contract.

This is actually nothing new, it is indeed the same mechanism that was used to transfer property before public registers became popular. In the U.K., for example, it was not compulsory to register a property when its ownership was transferred until the ‘90s. This means that still today over 15% of land in England and Wales is unregistered. If you are buying an unregistered property, instead of checking on a registry if the seller is the true owner, you would have to verify an unbroken chain of ownership going back at least 15 years (a period considered long enough to assume that the seller has sufficient title to the property). In doing so, you must ensure that any transfer of ownership has been carried out correctly and that any mortgages used for previous transactions have been paid off in full. This model has the advantage of improved privacy over ownership, and you do not have to rely on the maintainer of the public land register. On the other hand, it makes the verification of the seller’s ownership much more complicated for the buyer.

Source: Title deed of unregistered real estate propriety

How can the transfer of unregistered properties be improved? First of all, by making it a digitized process. If there is code that can be run by a computer to verify that all the history of ownership transfers is in compliance with the original contract rules, buying and selling becomes much faster and cheaper.

Secondly, to avoid the risk of the seller double-spending their asset, a system of proof of publication must be implemented. For example, we could implement a rule that every transfer of ownership must be committed on a predefined spot of a well-known newspaper (e.g. put the hash of the transfer of ownership in the upper-right corner of the first page of the New York Times). Since you cannot place the hash of a transfer in the same place twice, this prevents double-spending attempts. However, using a famous newspaper for this purpose has some disadvantages:

- You have to buy a lot of newspapers for the verification process. Not very practical.

- Each contract needs its own space in the newspaper. Not very scalable.

- The newspaper editor can easily censor or, even worse, simulate double-spending by putting a random hash in your slot, making any potential buyer of your asset think it has been sold before, and discouraging them from buying it. Not very trustless.

For these reasons, a better place to post proof of ownership transfers needs to be found. And what better option than the Bitcoin blockchain, an already established trusted public ledger with strong incentives to keep it censorship-resistant and decentralized?

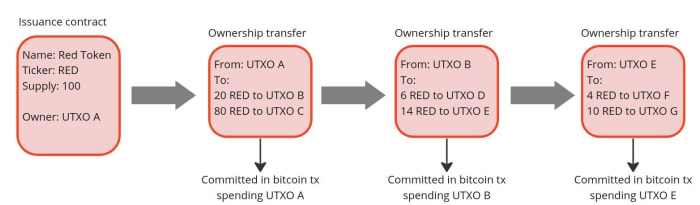

If we use Bitcoin, we should not specify a fixed place in the block where the commitment to transfer ownership must occur (e.g. in the first transaction) because, just like with the editor of the New York Times, the miner could mess with it. A better approach is to place the commitment in a predefined Bitcoin transaction, more specifically in a transaction that originates from an unspent transaction output (UTXO) to which the ownership of the asset to be issued is linked. The link between an asset and a bitcoin UTXO can occur either in the contract that issues the asset or in a subsequent transfer of ownership, each time making the target UTXO the controller of the transferred asset. In this way, we have clearly defined where the obligation to transfer ownership should be (i.e in the Bitcoin transaction originating from a particular UTXO). Anyone running a Bitcoin node can independently verify the commitments and neither the miners nor any other entity are able to censor or interfere with the asset transfer in any way.

Since on the Bitcoin blockchain we only publish a commitment of an ownership transfer, not the content of the transfer itself, the seller needs a dedicated communication channel to provide the buyer with all the proofs that the ownership transfer is valid. This could be done in a number of ways, potentially even by printing out the proofs and shipping them with a carrier pigeon, which, while a bit impractical, would still do the job. But the best option to avoid the censorship and privacy violations is establish a direct peer-to-peer encrypted communication, which compared to the pigeons also has the advantage of being easy to integrate with a software to verify the proofs received from the counterparty.

This model just described for client-side validated contracts and ownership transfers is exactly what has been implemented with the RGB protocol. With RGB, it is possible to create a contract that defines rights, assigns them to one or more existing bitcoin UTXO and specifies how their ownership can be transferred. The contract can be created starting from a template, called a “schema,” in which the creator of the contract only adjusts the parameters and ownership rights, as is done with traditional legal contracts. Currently, there are two types of schemas in RGB: one for issuing fungible tokens (RGB20) and a second for issuing collectibles (RGB21), but in the future, more schemas can be developed by anyone in a permissionless fashion without requiring changes at the protocol level.

To use a more practical example, an issuer of fungible assets (e.g. company shares, stablecoins, etc.) can use the RGB20 schema template and create a contract defining how many tokens it will issue, the name of the asset and some additional metadata associated with it. It can then define which bitcoin UTXO has the right to transfer ownership of the created tokens and assign other rights to other UTXOs, such as the right to make a secondary issuance or to renominate the asset. Each client receiving tokens created by this contract will be able to verify the content of the Genesis contract and validate that any transfer of ownership in the history of the token received has complied with the rules set out therein.

So what can we do with RGB in practice today? First and foremost, it enables the issuance and the transfer of tokenized assets with better scalability and privacy compared to any existing alternative. On the privacy side, RGB benefits from the fact that all transfer-related data is kept client-side, so a blockchain observer cannot extract any information about the user’s financial activities (it is not even possible to distinguish a bitcoin transaction containing an RGB commitment from a regular one), moreover, the receiver shares with the sender only blinded UTXO (i. e. the hash of the concatenation between the UTXO in which she wish to receive the assets and a random number) instead of the UTXO itself, so it is not possible for the payer to monitor future activities of the receiver. To further increase the privacy of users, RGB also adopts the bulletproof cryptographic mechanism to hide the amounts in the history of asset transfers, so that even future owners of assets have an obfuscated view of the financial behavior of previous holders.

In terms of scalability, RGB offers some advantages as well. First of all, most of the data is kept off-chain, as the blockchain is only used as a commitment layer, reducing the fees that need to be paid and meaning that each client only validates the transfers it is interested in instead of all the activity of a global network. Since an RGB transfer still requires a Bitcoin transaction, the fee saving may seem minimal, but when you start introducing transaction batching they can quickly become massive. Indeed, it is possible to transfer all the tokens (or, more generally, “rights”) associated with a UTXO towards an arbitrary amount of recipients with a single commitment in a single bitcoin transaction. Let’s assume you are a service provider making payouts to several users at once. With RGB, you can commit in a single Bitcoin transaction thousands of transfers to thousands of users requesting different types of assets, making the marginal cost of each single payout absolutely negligible.

Another fee-saving mechanism for issuers of low value assets is that in RGB the issuance of an asset does not require paying fees. This happens because the creation of an issuance contract does not need to be committed on the blockchain. A contract simply defines to which already existing UTXO the newly issued assets will be allocated to. So if you are an artist interested in creating collectible tokens, you can issue as many as you want for free and then only pay the bitcoin transaction fee when a buyer shows up and requests the token to be assigned to their UTXO.

Furthermore, because RGB is built on top of bitcoin transactions, it is also compatible with the Lightning Network. While it is not yet implemented at the time of writing, it will be possible to create asset-specific Lightning channels and route payments through them, similar to how it works with normal Lightning transactions.

Conclusion

RGB is a groundbreaking innovation that opens up to new use cases using a completely new paradigm, but which tools are available to use it? If you want to experiment with the core of the technology itself, you should directly try out the RGB node. If you want to build applications on top of RGB without having to deep dive into the complexity of the protocol, you can use the rgb-lib library, which provides a simple interface for developers. If you just want to try to issue and transfer assets, you can play with Iris Wallet for Android, whose code is also open source on GitHub. If you just want to learn more about RGB you can check out this list of resources.

This is a guest post by Federico Tenga. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.